Applying Retail Metrics

Scenario One

Stock Turnover Calculation

| Opening stock | 230,000 |

| Net Sales | 85,000 |

| Closing Stock | 430,000 |

Average stock = (Opening+ Closing)/2

- = (230,000+430,000)/2

- = 330,000

Stock turnover = Net sales/Average Stock

- = (85,000/330,000)*100

- = 25.75%

Factors Affecting Stock Turnover

Sales prices and sales volume influence the stock turnover because they directly impact net sales. When considered at the purchase price of inventory, prices will also play a factor. The higher the stock price, the less the net sales, and the lower the stock price, the higher the net sales. Also, the lead time of inventory would have influenced the stock turnover.

Scenario Two

Opening inventory = 57,000

Sell-thru % = 28%

28% = Amount sold/opening stock value

Net sales = 57,000* 28%

- = 15,960

The sell-thru performance can be considered as being unhealthy. Notably, a sell-thru performance of between 60% and 80% is deemed to be ideal.

Scenario Three

| Annual Sales | 11,390,000 |

| Average stock | 2,149,000 |

Stock Turnover = Net Sales/ Average stock

- = 11,390,000/2,149,000

- = 5.3

The store manager can ascertain whether this stock turnover is good or not by considering a stock turnover ranging between 4 and 6 as being good. Although a stock turnover considered good may vary from one business to another, the 5.3 stock turnover calculated above is good.

Scenario Four

| Opening stock | 15 |

| Safety stock | 9 |

| 1-week average sales | 9 |

| Closing stock | 6 |

| Daily average sales | 1.3 |

| Lead time | 7 days |

Reorder quantity = (Daily Average Sales* Lead time) + safety stock – stock

= (1.3*7) +9 -6

=12 units

The shortage in big-screen TVs could be due to a price reduction, which, in turn, increased demand for the TV; hence, the lead time for the delivery of the ordered stock would have increased. Thus, an increase in demand for big TV screens is the overall factor for the subject case. Colorado can address the shortage in stock by evaluating trends in customer demand due to changes in prices. Also, they should review lead time effectively.

Scenario Five

| Opening stock | 90 |

| Stock in transit | 340 |

| 1-week average sales | 120 |

| Lead time | 6 weeks |

| Lead time demand (6*120) | 720 |

| Safety Stock | 420 |

Reorder quantity point = Lead time demand+ safety stock –(stock in transit+ stock in hand)

- = 720+ 40 – (340+90)

- = 330 tires

Reorder level value

- Cost per tire = $43

- Mark-up @ 57% on Sales Price= 43/ (100-57) %

- = $100 per tire

- Total retail value of tires to be ordered = 100*330 = $33,000

ORDER A PLAGIARISM-FREE PAPER HERE

We’ll write everything from scratch

Question

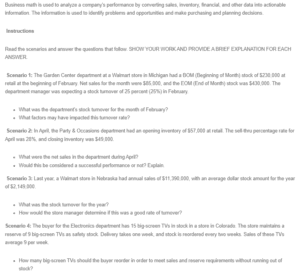

Business math is used to analyze a company’s performance by converting sales, inventory, financial, and other data into actionable information. The information is used to identify problems and opportunities and make purchasing and planning decisions.

Applying Retail Metrics

Instructions

Read the scenarios and answer the questions that follow. SHOW YOUR WORK AND PROVIDE A BRIEF EXPLANATION FOR EACH ANSWER.

Scenario 1: The Garden Center department at a Walmart store in Michigan had a BOM (Beginning of Month) stock of $230,000 at retail at the beginning of February. Net sales for the month were $85,000, and the EOM (End of Month) stock was $430,000. The department manager was expecting a stock turnover of 25 percent (25%) in February.

- What was the department’s stock turnover for the month of February?

- What factors may have impacted this turnover rate?

Scenario 2: In April, the Party & Occasions department had an opening inventory of $57,000 at retail. The sell-thru percentage rate for April was 28%, and closing inventory was $49,000.

- What were the net sales in the department during April?

- Would this be considered a successful performance or not? Explain.

Scenario 3: Last year, a Walmart store in Nebraska had annual sales of $11,390,000, with an average dollar stock amount for the year of $2,149,000.

- What was the stock turnover for the year?

- How would the store manager determine if this was a good rate of turnover?

Scenario 4: The buyer for the Electronics department has 15 big-screen TVs in stock in a store in Colorado. The store maintains a reserve of 9 big-screen TVs as safety stock. Delivery takes one week, and stock is reordered every two weeks. Sales of these TVs average 9 per week.

- How many big-screen TVs should the buyer reorder in order to meet sales and reserve requirements without running out of stock?

- The store does not appear to have enough big-screen TVs on hand to meet the average weekly demand before the new TVs arrive in three (3) weeks. What could have led to this situation and what can the buyer do in the future to avoid this from happening again?

Scenario 5: It takes six weeks for a tire order to be delivered to the Auto & Tire Center in the Walmart Supercenter in Wisconsin. Tires are ordered every five weeks. Currently, there are 90 tires on hand and another 340 on order. Sales are expected to use 120 tires per week and the department maintains a reserve of 40 tires. It’s time to reorder tires.

- How many tires is the department open to receive?

- If the tires that are ordered cost the company $43 per tire, and the retail price of the tires is determined by marking up the cost by 57%, what is the total retail value of the tires being ordered?