Enterprise Risk Management- Integration with Organizational Strategy and Strategic Implications

Enterprise Risk Management (ERM) allows organizations to identify the risks that exist within their line of business and environments. Besides risk identification, ERM facilities the process of managing these risks appropriately to avoid adverse effects on the company’s ability to meet its goals. Various factors motivate the entities to conduct enterprise risk management. These include financial distress, poor performance that reflects low earnings, opportunities for growth, and board independence (Anton & Nucu, 2020). Of greatest importance is the ability to use ERM to improve an organization’s competitive advantage. Need help with your assignment ? Reach out to us. We offer excellent services.

Risk in Business Environments

Risk is an ever-present aspect of the natural environment. Whenever an individual or organization decides to pursue a certain objective, there are risks involved. The process of dealing with these risks through ERM involves numerous decisions to make certain trade-offs. The act of considering the various risks while making business decisions creates opportunities to optimize the results towards a desired angle. The assimilation of ERM has grown significantly in the past decade. The dynamic business environment affects the business owners and stakeholders alike. Current challenges have a significant impact on trust, reliability, and relevance. More stakeholders are actively engaged in business matters as they seek to increase accountability and transparency. Just as the possibility of failure places immense pressure on businesses, the achievement of success similarly introduces the risk of failing to fulfill the new demand, which can result in a greater loss of revenue and clients (COSO, 2017). Thus, organizations need to continuously adapt to the changes that occur in the business environments.

Framework

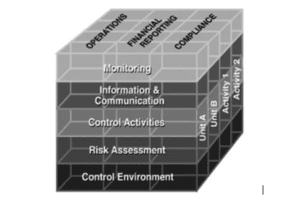

The Committee of Sponsoring Organizations of the Treadway Commission (COSO) is one of the frameworks that an organization can use to implement ERM. It is a systematic framework and ideal for organizational benchmarking. While using the COSO framework, it is possible to improve financial reporting, which leads to greater trust from investors.

The COSO framework (Salleh, Sakawi, & Jamaludin, 2020)

The COSO framework directly facilitates the quality of financial reports. Through internal controls, the management can come up with reliable reports. As a result, the system of management improves significantly (Salleh, Sakawi, & Jamaludin, 2020).

Determining factors

Various factors determine the implementation of ERM. There is a greater likelihood for large firms to engage in ERM implementation due to the capability to involve numerous business units. Organizations with strong financial muscles may fare better than those with fewer resources. ERM requires significant financial resources favoring well-to-do organizations. However, organizations that lack such resources may still choose ERM implementation to improve the process of risk assessment (Anton & Nucu, 2020). This adoption offers an opportunity to reduce debt costs and increase financial power. In a merger and acquisition setting, the adoption of ERM is difficult due to the higher likelihood of insufficient resources as other business elements take priority. Business diversification is an enabling factor with regard to ERM implementation. The desire to enhance performance among all geographic units and reduce the risk encourages international players to adopt ERM. The sectors in which a business operates are more likely to determine the likelihood of ERM adoption. The regulations may require players in certain sectors, such as banking, energy, and insurance, to adopt ERM (Salleh, Sakawi, & Jamaludin, 2020). When competition and uncertainty in an industry increase, the players are more likely to adopt ERM.

Issues

Integration of ERM into business operations encounters various issues. Firstly, the non-value add perception is encountered when the management is overconfident regarding the knowledge of the external and internal environments. As a result, they do not find ERM important to the business activities. Such attitudes are likely to result in conflict within an entity as managers fail to support the ERM team. To eliminate the issue, it is necessary to ensure that any duplication within the organization is eliminated. In addition, redundant processes should be scrapped as well (COSO, 2017). The involvement of business unit leaders is important in ensuring that they realize the value of the risk assessment and management process.

Secondly, the need to change leadership, especially in organizations that have high turnover within the management, may present significant challenges. The ERM team should ensure that the current leadership is aligned with ERM principles. If the leadership is not enabling, it is impossible for the organization to reap the benefits. These benefits include the creation of resilient strategies, identification of risks, finding solutions to long-term issues that plague other players in the industry, better performance, and stronger competitive advantage (Deloitte Development LLC., 2017). With these advantages, an organization is better positioned to achieve its goals and objectives more efficiently than it would in the presence of identified risks.

ERM as a business strategy

ERM and the organization’s strategic plan interact at three major points. The first point of engagement involves understanding the business environment. Understanding the environment includes the external and internal business spaces. This understanding allows an entity to draw its objectives clearly. The risks that play a critical role in informing the entire strategic plan are critical to this process. Secondly, the development of the plan follows and is guided by the risks that present hindrances towards goal achievement. For instance, the lack of specific skills may interfere with the process of achieving certain goals in an entity. Thirdly, plan execution follows while still considering the identified risks. The necessity for these steps is evident in the fact that most organizations avoid facing or dealing with certain risks and challenges within the external and internal environments, impeding their ability to achieve goals (Deloitte Development LLC., 2017). At times, an organization may not identify a certain risk that repeatedly affects the achievement of certain goals.

ERM is a potential business strategy because it not only highlights risks, but also identifies opportunities that are unfulfilled. At the same time, it increases the occurrence of positive outcomes and reduces the negative surprises significantly. Such surprises include financial loss, loss of business, and increasing costs, among others. In addition, the organizations that utilize ERM can reduce the variability of their performance. This aspect is characterized by a performance that exceeds expectations and beats schedules (COSO, 2017). The improved resource deployment allows the organization to utilize the scarce resources based on need and return. Overall, the resilience of an organization is improved, and it is better able to handle the challenges in its environment.

Conclusion

ERM adoption is increasingly gaining popularity as most entities find it important. The availability of resources and leadership to support ERM implementation. Lack of support from management can paralyze the adoption process. The businesses that adopt ERM stand to gain increased resilience, reduction of variability in performance, better deployment of resources, and increased opportunity identification. The process of adapting ERM should be guided by the needs of an organization as it seeks to improve its ability to achieve goals. Therefore, it improves the competitive advantage of an organization.

References

Anton, S. G., & Nucu, A. E. (2020). Enterprise Risk Management: A Literature Review and Agenda for Future Research. J. Risk Financial Manag., 13(281). doi:10.3390/jrfm13110281

COSO. (2017). Enterprise Risk Management Integrating with Strategy and Performance.

Deloitte Development LLC. (2017). Integrating Enterprise Risk Management (ERM) with strategic. Retrieved from https://www2.deloitte.com/content/dam/Deloitte/us/Documents/public-sector/us-fed-integrating-erm-with-strategic-planning.pdf

Salleh, F., Sakawi, M. S., & Jamaludin, N. H. (2020). What Affects The Adoption Of Enterprise Risk Management Framework For Public Listed Companies? Journal of Critical Reviews, 7(11).

ORDER A PLAGIARISM-FREE PAPER HERE

We’ll write everything from scratch

Question

The reading this week discusses strategy and how ERM can be integrated with an organization’s overall strategy. Prepare a research paper on some of the various issues, protocols, methods, and frameworks you found and discuss how – if possible – organizations can use ERM as a strategy. It is perfectly acceptable if you deem ERM cannot be used as a strategy; just back up your claim with scholarly research and justifications.

Enterprise Risk Management- Integration with Organizational Strategy and Strategic Implications

Your paper should meet these requirements:

Be approximately FOUR to SIX pages in length, not including the required cover page and reference page.

Follow APA 7 guidelines. Your paper should include an introduction, a body with fully developed content, and a conclusion.

Support your answers WITH THE READINGS (Attached), and at least TWO SCHOLARLY JOURNAL ARTICLES to support your positions, claims, and observations, in addition to your textbook.

Be clearly and well-written, concise, and logical, using excellent grammar and style techniques.