Comparing the Financial Stress of Two Families with Children

| ASSIGNMENT TABLE | Single Parent, Christine Chapelle,

Advanced Practice Psychiatric Nurse |

Married Parent, Juan Ramirez,

Psychiatric Technician |

Married Parent, Cecilia Ramirez,

Correctional Officer / Jailer |

| Yearly Salary in your state | $77,600 in California | $36,570 in California | $47,920 in California |

| Total family income yearly | $77,600 | Add David and Bella’s income: $84,490

|

|

| Using the IRS Tax and Earned Income Credit Tables (https://www.irs.gov/pub/irs-pdf/i1040tt.pdf ), Identify how much each family owes in taxes. | Filing as Single: $12,695

|

Married Filing Jointly:

$9,819 |

|

| Yearly income after taxes | $64,905 | $74,671 | |

| Monthly income (Post Tax Yearly income divided by 12) | $5,408.75 | $6,222.58 | |

| Monthly Student Loan Payment | ($600.00 for 20 years)

$600.00 |

($300 × 2 for 10 years)

$600.00 |

|

| Monthly Grocery Bill | $300 | $450 | |

| Monthly Utility Bill | $200 | $200 | |

| Monthly Vehicle Costs (Payment, Gas, Insurance) | $250 | $250 | |

| Monthly Housing Cost (Rent/Mortgage) in your area | $1,568 | $1,895 | |

| Monthly Childcare Costs in your area for 2 children | $1,700 | $1,700 | |

| Total Income-Expenditures each month (Post-tax income minus all listed expenditures) | $790.75 | $1,127.58 | |

| Percentage of Monthly income spent on childcare

(Childcare costs divided by post-tax income, multiplied by 100) |

31.43% | 27.32% |

Questions:

-

Compare the budgets of the Chapel and Ramirez families. What are some specific challenges that each family will face?

As highlighted in the table above, Chapel and Ramirez’s families have enough income to cover basic needs. However, the Chapel family has to incur higher taxes due to a single-status setting. Notably, this can also be reflected as a budgeting challenge because of dependency on a single income. In case of contract termination from the current employment, the family will be affected adversely. On the other hand, the Ramirez family has an advantage in tax liability, whereby filing tax as jointly married has a lower tax liability. Overall, the family of Ramirez has a higher disposable income than the Chapels. Hire our assignment writing services if your assignment is devastating you.

Each family faces various challenges based on the income statistics indicated in the table. On the part of the Chapel family, there would be a challenge if another child was born. Notably, this is so because the current disposable income is insufficient to cover another child’s childcare. Additionally, the Chapel family will likely face a shutdown and irredeemable financial distress if the current job ends. From the table above, there are no payments made to insurance plans to help the family sustain any unexpected financial crises such as illness and accidents. On the other hand, Ramirez’s family has lighter challenges than the Chapels. One challenge that the family is likely to face is financial difficulties when a new child is born. Notably, this is so because the current disposable income is less than the monthly budget for childcare. The family has no insurance payments to cover accidents and illness in the expenses section of the table above. Thus, the family will likely suffer financial distress if illness or accident halts one partner’s ability to work.

-

Consider how much money the families have to spend on childcare. Are there any options that can reduce that cost? Do these alternatives come with a different kind of cost?

Chapel family spends $1,700 on childcare each month. It is the same case for the Ramirez family. There are various options that the two families can consider to reduce this cost. First, they can consider working from home sometimes. The current work environment offers opportunities for workers to work remotely. For instance, if one of the partners in the Ramirez family is accorded this opportunity, they can take care of the children while at home, reducing the costs. Second, they should look for inexpensive daycares or nannies for the children’s support and care. One way of doing this is looking for the services early and bargaining for better charges. Notably, this will help reduce the costs that are currently being incurred. Third, the two families should consider joining cooperatives that will plan for children’s care. Such cooperatives entail families from a local place coming together to arrange for common cost-sharing for babysitting services, which is a cheaper option than hiring one babysitter for each family. The suggested alternatives can help in reducing childcare costs. However, they come with new expenses requiring the families to do good mathematics to arrive at the better option and the costs to be saved. For instance, joining a cooperative may come with monthly contributions to the cooperative. However, the costs may be cheap when many parents participate in the cooperative and, thus, cheaper than hiring a personal babysitter.

-

What sort of challenges will each of the families experience balancing work, childcare, self-care, and other relationships? Which families appear to have advantages or disadvantages and why?

Both families are likely to face challenges related to balancing work, catering for childcare, and self-care. However, each of the family will face challenges at different levels. Due to a single-status nature, the Chapel family will likely juggle work and childcare responsibilities. The family will likely encounter heavier financial strain in finding time and resources for self-care and maintaining relationships outside the family. On the other hand, the Ramirez family is better placed to cater for childcare and household responsibilities because two adults will be available. However, this nature of family can face challenges related to the division of labor and communication. Conflicts between the partners can arise and strain their relationships, leading to the challenge of balancing work and personal responsibilities.

Comparing the two families, the Ramirez family is in an advantageous position because of the higher income. The family is better positioned to hire housekeepers or babysitters to help handle household jobs and childcare activities. Conversely, the Chapel family has fewer financial resources and may be required to rely on extended family members, public programs, or community support to help with household responsibilities and childcare.

-

Reviewing the data above provides two reasons why the transition from being childless to having children can be particularly stressful for new parents.

For two reasons, transitioning from being childless to having children can be particularly stressful for new parents. First, the transition comes with additional expenses. Bearing a child comes with childcare costs that have to be borne by the new parent(s). In the case of insufficient financial resources, such a parent will be stressed. Second, transitioning from being childless to having children can be stressful, particularly because of the responsibilities that arise with the new status quo. The new parent has to take care of the new child from various social and moral perspectives, apart from meeting the financial expenses.

ORDER A PLAGIARISM-FREE PAPER HERE

We’ll write everything from scratch

Question

Comparing the Financial Stress of Two Families with Children

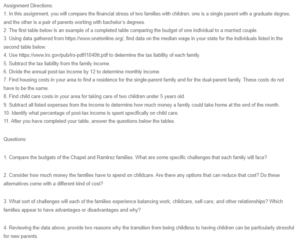

Assignment Directions:

1. In this assignment, you will compare the financial stress of two families with children; one is a single parent with a graduate degree, and the other is a pair of parents working with bachelor’s degrees.

2. The first table below is an example of a completed table comparing the budget of one individual to a married couple.

3. Using data gathered from https://www.onetonline.org/, find data on the median wage in your state for the individuals listed in the second table below.

4. Use https://www.irs.gov/pub/irs-pdf/i1040tt.pdf to determine the tax liability of each family.

5. Subtract the tax liability from the family income.

6. Divide the annual post-tax income by 12 to determine monthly income.

7. Find housing costs in your area to find a residence for the single-parent family and for the dual-parent family. These costs do not have to be the same.

8. Find child care costs in your area for taking care of two children under 5 years old.

9. Subtract all listed expenses from the income to determine how much money a family could take home at the end of the month.

10. Identify what percentage of post-tax income is spent specifically on child care.

11. After you have completed your table, answer the questions below the tables.

Questions:

1. Compare the budgets of the Chapel and Ramirez families. What are some specific challenges that each family will face?

2. Consider how much money the families have to spend on childcare. Are there any options that can reduce that cost? Do these alternatives come with a different kind of cost?

3. What sort of challenges will each of the families experience balancing work, childcare, self-care, and other relationships? Which families appear to have advantages or disadvantages and why?

4. Reviewing the data above, provide two reasons why the transition from being childless to having children can be particularly stressful for new parents.