Footnote Disclosure -Sony, Samsung and Huawei

Location of IFRS and US GAAP Accounting Standards Codification Disclosure

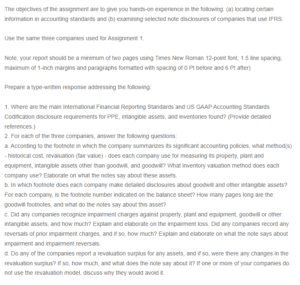

| Particular | Location for IFRS codification disclosure | ||

| PPE disclosure requirements | Intangible assets disclosure requirements | Inventories disclosure requirements | |

| Sony | Notes to PPE disclosure requirements are provided as the seventh item on page F-20 of the annual report filed to SEC (Sony F-20) | Intangible assets disclosure requirements are provided as the ninth item on page F-21 of the annual report filed to the SEC (Sony F-21) | Notes to inventories are provided as the sixth item on page F-20 of the annual report filed to SEC (Sony F-20) |

| Samsung | PPE disclosure requirements are provided under 2.9 on page 33 of the 2021 annual report (Samsung 33) | Intangible assets disclosure requirements are provided under the 2.11 item of notes to the consolidated financial statements on page 34 (Samsung 34) | Inventories disclosure requirements are provided as footnotes under 2.8 of the considered 2021 annual report on page 33 (Samsung 33) |

| Huawei | PPE disclosure requirements are provided under item (g) of notes to consolidated financial statements on page 105 of the annual report (Huawei 105) | Intangible assets disclosure requirements can be found on page 106 of the 2021 annual report under item (h) of goodwill and intangible assets (Huawei 106) | Inventory disclosure requirements are provided as item (k) on page 109 of the 2021 annual report (Huawei 109) |

Valuation Methods Used By Each Company

Sony uses a fair value approach to evaluate its plant, property, and equipment. Footnotes to consolidated financial statements provide a cost approach whereby plant, property, and equipment are stated at a cost less any accumulated depreciation and impairment losses. The company uses a cost model for intangible assets, including goodwill, which states costs less accumulated amortization and impairment losses. As indicated in the footnotes to the consolidated balance sheet, inventories are carried at a lower cost or net realizable value. A weighted average cost basis is used to determine the cost of inventories.

Samsung uses a historical approach to measure its plant, property, and equipment, whereby all items in the plant, property, and equipment are given at a cost less of accumulated depreciation and impairment losses. Depreciation on assets is computed using a straight-line approach. For intangible assets other than goodwill, the company uses an approach whereby the assets are recognized initially at their historical cost and carried at a cost less of impairment losses and accumulated amortization. Regarding goodwill, the company includes it in intangible assets. As indicated in the notes to the consolidated statement of financial position, inventories are given at the lower cost, and net realizable value, and the cost is calculated using the average cost approach apart from materials in transit.

Huawei uses a revaluation (fair value) approach to measure its PPE. As stated in the note to the consolidated statement of financial position, all items in plant, property, and equipment are stated at a cost that subtracts accumulated depreciation and impairment losses. For intangible assets other than goodwill, the company uses a fair value (revaluation) approach whereby costs are given at a cost less of impairment losses and accumulated amortization. Regarding goodwill, the company uses the fair value (revaluation) approach. As provided in the notes to the consolidated statement of financial position, the fair value is stated by taking the acquiree’s identifiable assets and subtracting liabilities and impairment losses as of the acquiring date. As indicated in the notes to the consolidated statement of financial position, inventories are carried at a lower cost and net realizable value.

Footnotes Where Detailed Disclosure for Goodwill Is Made

Sony discloses intangible assets and goodwill in the notes to the consolidated statement of financial position. The company indicates the footnote number for goodwill and intangible assets on the consolidated balance sheet as note 11. The notes are four pages long. They provide information regarding the measurement of goodwill and intangible assets, a detailed discussion of what they depict, and the amortization of intangible assets. For the case of Samsung, notes regarding intangible assets are provided and are one page long. The balance sheet identifies the footnote number to be 2.11. The notes provide information regarding the measurement and recognition of goodwill and intangible assets and the company’s plan regarding intangible assets and goodwill. On the other hand, Huawei discloses intangible assets and goodwill as notes to the consolidated statement of financial position in less than a page. The company indicates the footnote number to be 14 on the balance sheet. The information presented in the footnote includes what goodwill means to the company, other intangible assets, and how they are amortized.

Impairment Recognition Charges against PPE

Sony recognized impairment charges against the goodwill of $ 852,895. The charges relate to game and network services, imaging and sensing solutions, pictures, music, and electronic products and solutions. On the other hand, Samsung provides depreciation charges against PPE of $31,285,209. Additionally, it provides an impairment reversal of $151,202. Regarding intangible assets, the company makes an amortization charge of $2,962,152 and an impairment reversal of $53,127. However, no impairment charge is made against goodwill. Huawei carried charges for the amortization of intangible assets in the form of patents and royalties that totalled $5,600. The amortization charge for the year is allocated to sales, research and development expenses, and selling and administrative expenses. Additionally, the company reported a reversal to the impairment of PPE, intangible assets, and right-of-use assets of $72. The impairment charge was charged to the cost of sales.

Reporting of Revaluation Surplus for Any Asset

None of the three companies reports a revaluation surplus in the considered fiscal periods. One reason behind this is the failure to use the revaluation model instead of choosing to use the cost model. The companies could avoid using the revaluation model to avoid reporting gains on revaluation arising from valuating assets, thus increasing their company sizes (Colgan et al. 602). Using the cost model reduces the political burden that the companies have to incur in their operations.

Works Cited

Colgan, Jeff D., Jessica F. Green, and Thomas N. Hale. “Asset revaluation and the existential politics of climate change.” International Organization 75.2 (2021): 586-610.

Huawei. “2021 Annual Report.” Huawei, 2021, https://www.huawei.com/en/annual-report/2021.

Samsung. “Financial Statements│ Financial Information │ Investor Relations │ Samsung Global.” Samsung Global, 2021, https://www.samsung.com/global/ir/financial-information/audited-financial-statements/.

Sony. “Annual Report.” Sony Group Portal – Annual Report, 2022, https://www.sony.com/en/SonyInfo/IR/library/ar/Archive.html.

ORDER A PLAGIARISM-FREE PAPER HERE

We’ll write everything from scratch

Question

Footnote Disclosure -Sony, Samsung and Huawei

The objectives of the assignment are to give you hands-on experience in the following: (a) locating certain information in accounting standards and (b) examining selected note disclosures of companies that use IFRS.

Use the same three companies used for Assignment 1.

Note, your report should be a minimum of two pages using Times New Roman 12-point font, 1.5 line spacing, maximum of 1-inch margins and paragraphs formatted with spacing of 0 Pt before and 6 Pt after)

Prepare a type-written response addressing the following:

1. Where are the main International Financial Reporting Standards and US GAAP Accounting Standards Codification disclosure requirements for PPE, intangible assets, and inventories found? (Provide detailed references.)

2. For each of the three companies, answer the following questions:

a. According to the footnote in which the company summarizes its significant accounting policies, what method(s) – historical cost, revaluation (fair value) – does each company use for measuring its property, plant and equipment, intangible assets other than goodwill, and goodwill? What inventory valuation method does each company use? Elaborate on what the notes say about these assets.

b. In which footnote does each company make detailed disclosures about goodwill and other intangible assets? For each company, is the footnote number indicated on the balance sheet? How many pages long are the goodwill footnotes, and what do the notes say about this asset?

c. Did any companies recognize impairment charges against property, plant and equipment, goodwill or other intangible assets, and how much? Explain and elaborate on the impairment loss. Did any companies record any reversals of prior impairment charges, and if so, how much? Explain and elaborate on what the note says about impairment and impairment reversals.

d. Do any of the companies report a revaluation surplus for any assets, and if so, were there any changes in the revaluation surplus? If so, how much, and what does the note say about it? If one or more of your companies do not use the revaluation model, discuss why they would avoid it.