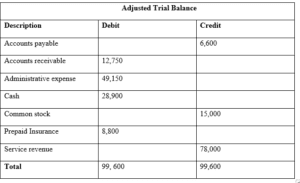

Adjusted Trial Balance

An adjusted trial balance is needed to ensure the accuracy and completeness of a company’s financial statements. It is prepared after adjusting journal entries to the accounts at the end of an accounting period (Warren, Jonick & Schneider, 2020). Errors and omissions can be identified and corrected by comparing the adjusted trial balance to the unadjusted trial balance. This aids to warrant that the monetary accounts correctly replicate the monetary situation and performance of the company, which is essential for making informed business decisions and meeting regulatory requirements (Warren, Jonick & Schneider, 2020).

Need help on an assignment ? Contact us. Our team is ready to help.

Reference

Warren, C. S., Jonick, C., & Schneider, J. (2020). Financial accounting. Cengage Learning.

ORDER A PLAGIARISM-FREE PAPER HERE

We’ll write everything from scratch

Question

Adjusted Trial Balance

Module Four Discussion Question #2

This course discussion aims to apply what you have learned after reading the chapter material and reviewing the PowerPoint.

Presentations. Keep in mind that this discussion question will help prepare you for homework and future assessments, so it is important that you understand the information and actively participate in discussions. You may also have to conduct research outside of course-provided material to supplement your learning and enhance your understanding.

Prepare an adjusted trial balance from the following adjusted account balances (assume accounts have normal balances.

Account Balances

Account payable $ 6,600

Accounts receivable 12,750

Administrative expense 49,150

Cash 28,900

Common stock 15,000

Prepaid insurance 8,800

Service revenue 78,000