Applying the Principles Used In Calculating the Price of a Bond

Question One: The Current Price of the Bond

The price of a bond is an important measure of a bond’s value. An investor considers a bond price before deciding on options in which they can invest. The discounted cash flow method is used to determine the market price of a bond. In this method, the bond receivables, including the par value and coupon, get discounted at a given market rate. Consequently, all present values of every yearly cash flow are summed together to get the current market price of the bond. Notably, newly issued bonds often sell at par value. Since the company has not had the opportunity to assess the risk associated with that particular bond sufficiently, they determine its value based on similar companies whose bonds face a similar risk. However, as time goes by, market conditions change, and a company may sell below or above par value.

The rate of risk – 1.2%

Bond Term – 10 years

Bond Yield- 3% + Risk Free rate

= 3% + 1.2% = 4.20%

Coupon rate – 5%

Face Value – $1, 000

Coupon = coupon rate × face value

= 5% × 10000

= 50

Current price = 50+ 1−(1+r)−nr + Par Value(1+r)n

= 50+1-(1+0.42)^0.42(10) + $1000/(1+0.42)^10

= $1064.25

The current market price of the bond is $1064.25.

Question Two: The Price of the Bond If the Yield Is Increased by 1.00%

The increase in bond price yields results from an increase in bond interest rates. The increase in bond yields triggers a short-term decrease in the market value of existing bonds. As a result, investors’ interest in investing in current bonds will reduce, meaning that its market value will go down. If the value of bonds is down, prices also automatically reduce. The price if the yield is increased by 1.00% is as follows;

Initial bond yield = 4.2%

Increase of yield by =1%

New bond yield = 4.2%+1%

= 5.2%

Bond price after yield increase =

Bond Term -10 years

Bond Yield – 5.2%

Coupon rate – 5%

Face Value – $1, 000

Coupon = coupon rate × face value

= 5% × 10000

= 50

Current price = 50+ 1−(1+r)−nr + Par Value(1+r)n

= 50+1-(1+0.42)^0.52(10) + $1000/(1+0.52)^10

= $984.71

Question Three: The Price of the Bond if the Yield is Decreased by 1.00%

Once bond yields fall, it leads to reduced borrowing costs for governments and corporations, leading to increased borrowing by these institutions. A decrease in the current market yield leads to an increase in the bond value. With a higher bond value comes an increase in bond price. The bond price once the yield is increased by 1.00% is as follows;

Initial bond yield = 3.2%

Decrease of yield by =1%

New bond yield = 4.2% – 1%

= 3.2%

Bond price after yield increase =

Bond Term – 10 years

Bond Yield – 3.2%

Coupon rate – 5%

Face Value-$1, 000

Coupon = coupon rate × face value

= 5% × 10000

=50

Current price = 50+ 1−(1+r)−nr + Par Value(1+r)n

= 50+1-(1+0.32)^0.32(10) + $1000/(1+0.32)^10

= $1,151.99

Question Four: Risks Associated with Bond Interest Rate Changes

According to SEC, the fundamental principle of bond investing is that bond prices and interest rates generally move in opposite directions (Securities Exchange Commission, n.d.). When interest rates rise, the prices of fixed-rate bonds often fall. The impacts of interest rates can affect any investment, but their effects in the bond market and other fixed-income securities are more pronounced and direct. Therefore, it is incumbent upon bondholders to pay attention to and monitor changes in the bond market and ensure they make effective investment decisions.

The opportunity cost concept accurately explains the risk associated with interest rate levels. For instance, when interest rates go up, the opportunity cost of holding the current bonds also increases. That means that the cost of having existing bonds and missing out on an even better investment opportunity is high (Securities Exchange Commission, n.d.). For instance, consider the example of bonds with a par value of $1,000 and earning an interest of 4.2%, as in the above case. If the interest rate rises by 1.00% to 5.20%, it becomes far less attractive to continue holding the bonds earning 4.2%, yet others are making 5.2% elsewhere. Therefore, the current bond price will decrease since people will no longer be interested in purchasing low-value bonds. The price of bonds goes down to compensate for the economic disadvantage of holding low-value bonds.

Therefore, for bonds characterized by fixed rates, when interest rates rise above the current interest rates, investors will switch to investments that reflect a higher interest rate in place of those with a lower interest rate. That means securities that may have been issued before interest rates increased will have to drop their prices to compete with new issues. However, it is worth noting that interest rate risks can be managed. Two methods to manage interest rate risks include reducing the portfolio’s duration or negating interest rate changes.

References

Securities Exchange Commission. (n.d.). Investor BulletIn Interest rate risk – When Interest rates Go up, Prices of Fixed-rate Bonds Fall The Effect of Market Interest Rates on Bond Prices and Yield. https://www.sec.gov/files/ib_interestraterisk.pdf.

ORDER A PLAGIARISM-FREE PAPER HERE

We’ll write everything from scratch

Question

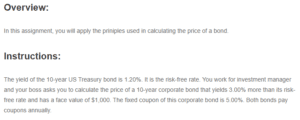

Overview:

In this assignment, you will apply the priniples used in calculating the price of a bond.

Instructions:

The yield of the 10-year US Treasury bond is 1.20%. It is the risk-free rate. You work for investment manager and your boss asks you to calculate the price of a 10-year corporate bond that yields 3.00% more than its risk-free rate and has a face value of $1,000. The fixed coupon of this corporate bond is 5.00%. Both bonds pay coupons annually.

Applying the Principles Used In Calculating the Price of a Bond

What is the current price of the corporate bond?

Calculate the price of the bond if its yield increased by 1.00%.

Calculate the price of the bond if its yield decreased by 1.00%.

Please discuss the risk associated with this change in interest rates?

Requirements:

Submit a Word document or Excel spreadsheet.

At least three pages in length, excluding the Title and Reference pages.

Be sure to read the criteria below by which your work will be evaluated before you write and again after you write.

Evaluation Rubric for Unit 7 Assignment

|

CRITERIA |

Deficient |

Needs Improvement |

Proficient |

Exemplary |

|---|---|---|---|---|

| 0 – 11 points | 12 – 15 points | 16 – 19 points | 20 points | |

|

Current price of a corporate bond |

The bond’s current price calculations are missing or incorrect. | The bond’s current price is calculated but is missing key details. | The bond price is calculated but is missing minor details. | The bond’s current price is accurate and is calculated correctly. |

|

Cost if yield increases by 1.00% |

The bond’s price calculations are missing or incorrect. | The bond’s price is calculated but is missing key details. | The bond’s price is calculated but is missing minor details. | The bond’s price is accurate and is calculated correctly. |

|

Cost if yield decreases by 1.00% |

The bond’s price calculations are missing or incorrect. | The bond’s price is calculated but is missing key details. | The bond’s price is calculated but is missing minor details. | The bond’s price is accurate and is calculated correctly. |

|

Discussion on risk and interest rates in bonds |

The discussion on risk and interest rates is missing or incorrect. | A discussion on risk and interest rates is present but missing key details. | A discussion on risk and interest rates is present but is missing minor details. | The discussion on risk and interest rates is thoughtfully and accurately addressed. |

| 0 – 5 points | 6 – 7 points | 8 – 9 points | 10 points | |

|

Paper Length |

Less than 3 pages | n/a | n/a | 3 pages or more. |

|

Clear and Professional Writing and APA Format |

Errors impede professional presentation; guidelines not followed. | Significant errors that do not impede professional presentation. | Few errors that do not impede professional presentation. | Writing and format are clear, professional, APA compliant, and error free. |