Real Estate Derivative

Derivatives are used to hedge against risk in various markets. This paper presents a derivative that can be used to hedge against risks in the real estate market (Vo et al., 2020). The design of the derivative considers the real estate market volatility. In particular, the derivative design is an option contract with call and put aspects for pricing. The derivative adopted will be a call option in terms of a contract. The call option will have real estate stock as the underlying asset. The option will give the holder the right to buy the underlying asset at a specific price before or on a certain expiration date. For the proposed call option, the buyer will consider an underlying asset that currently trades in the market for $10,000 and assume a bullish future of three months that it will trade at $10,500 as the strike price. The option will be based on three months maturity date. Notably, the three months expiration is selected considering the volatility of the real estate market, which is relatively high at 5.0%. The call option will entail a premium of $100.

For the “moneyness” of the call option, the option will be in the money if, at the expiration date, the underlying asset’s price is above $10,600. The extra covers the premium, and anything above it will be the profit for the holder. The call option will be at the money if its market price at expiration for the underlying asset will be $10,600. The option will be out of the money if, at the maturity date, the market price for the underlying asset is anything lower than $10,600. The exercise policy for the designed option will follow the American option format, whereby it can be exercised anywhere before or on the maturity date. Notably, the option will be based on physical delivery and have no margin requirements or daily settlements. The design of the option assumes a bullish condition in the market because the prices in real estate have remained relatively stable with a slight increase.

Reference

Vo, D. H., Van Nguyen, P., Nguyen, H. M., Vo, A. T., & Nguyen, T. C. (2020). Derivatives market and economic growth nexus: Policy implications for emerging markets. The North American Journal of Economics and Finance, 54, 100866.

ORDER A PLAGIARISM-FREE PAPER HERE

We’ll write everything from scratch

Question

Real Estate Derivative

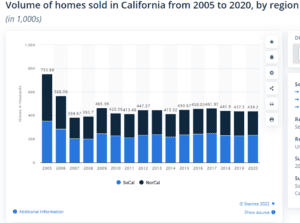

Year 2013: 446

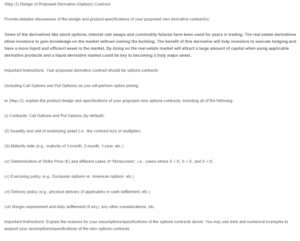

Step (3) Design of Proposed Derivative (Options) Contract

Provide detailed discussions of the design and product specifications of your proposed new derivative contract(s).

Some of the derivatives like stock options, interest rate swaps and commodity futures have been used for years in trading. The real estate derivatives allow investors to gain knowledge on the market without owning the building. The benefit of this derivative will help investors to execute hedging and have a more liquid and efficient asset in the market. By doing so the real estate market will attract a large amount of capital when using applicable derivative products and a liquid derivative market could be key to becoming a truly major asset.

Important Instructions: Your proposed derivative contract should be options contracts

(including Call Options and Put Options) as you will perform option pricing.

In Step (3), explain the product design and specifications of your proposed new options contracts, including all of the following:

(i) Contracts: Call Options and Put Options (by default);

(ii) Quantity and unit of underlying asset (i.e., the contract size or multiplier);

(iii) Maturity date (e.g., maturity of 1-month, 3-month, 1-year, etc.);

(iv) Determination of Strike Price (K) and different cases of “Moneyness”, i.e., cases where S > K, S = K, and S < K;

(v) Exercising policy (e.g., European options vs. American options, etc.);

(vi) Delivery policy (e.g., physical delivery (if applicable) or cash settlement, etc.);

(vii) Margin requirement and daily settlement (if any); any other considerations, etc.

Important Instructions: Explain the reasons for your assumptions/specifications of the options contracts above. You may use data and numerical examples to support your assumptions/specifications of the new options contracts.