Financial Market Shareholder Analysis

Political conditions refer to laws and decisions made by governments that influence business activities. Political factors influence companies in two ways. When political conditions are stable, businesses thrive, but when the conditions are unstable, businesses suffer. Politicians are at the center of law-making and can create laws that harm businesses. Examples of political factors include increased or reduced taxes and the fight against using certain technologies.

Environmental conditions related to matters surrounding the natural environment. With a rapidly changing climate, businesses are evaluated based on their responsibility toward the natural environment. Notably, this has necessitated organizations to adopt sustainable approaches that reduce all forms of pollution. One example of a negative environmental factor is the aspect of “greenwashing,” where companies use environmental protection deceitfully to win customers.

Currency conditions refer to issues arising from using different currencies in the course of doing business internationally. Notably, these factors are a major concern for businesses because they can be a source of losses. Essentially, these occur through foreign exchange risks that come along with exchanging currencies. For example, when a company transacts in the U.S. dollar, it may lose some value if payment is made to another currency that is gaining an advantage over the U.S. dollar.

Global economics refers to business situations such as GDP growth rates and demographic factors such as population growth and inflation. Such factors influence businesses that operate internationally, like Apple Inc. For example, when the GDP growth rate of a given country drops, the population’s disposable income will reduce, and a business’s sales will decline.

Government influences refer to interventions taken by governments to influence business activities. Such interventions take place through fiscal and monetary policies. The policy interventions include aspects like taxes, interest rates, and incentives. For example, an organization’s profits reduce when tax rates are set high, which can trigger the organization to leave certain markets with high tax rates.

The Federal Reserve, through the monetary policy, kept the target limit for federal funds near zero. Notably, this aimed at exceeding the inflation and employment rates of 2 over some time. Apple Inc. anticipated interest rate uncertainties and engaged in interest rate risk management. Notably, this is so because the interest rate fluctuations influence their interest income earned on cash, cash equivalents, and marketable securities.

The recovery in labor force participation was slow after the Covid-19 pandemic. Job gains averaged 540,000 per month, and the unemployment rate decreased from 6.7% in December to 5.9% in June. However, the factors leading to uneven recovery in labor force participation have a diminishing effect on labor participation. Apple Inc. had its workforce operate remotely during the Covid-19 pandemic. The reduced labor participation and slow recovery rate disrupted global suppliers and logistical networks, which led to supply shortages prompting reduced sales.

Consumer price inflation increased from 1.2% to 3.9% in May 2021. When the price of food and energy items is removed from the index, the rate moves from 1.4% to 3.4%, a difference of 2%. Apple Inc. was affected by the inflation rate rise. The Company had its products increase slightly in the period when the inflation rate increased.

Supply chain bottlenecks resulted in upward pressure on inflation. Additionally, the bottlenecks reduced the ability of U.S. manufacturers to acquire inputs needed for the production processes. The Company faced pressure on its production sites. In the fourth quarter of 2021, certain of the Company’s component suppliers faced disruptions leading to apply shortages for the Company affecting their sales.

International developments were centered on Covid-19 restrictions. Restrictions targeted at restraining covid-19 pandemic by various nations affected the nature of business. In 2021, financial conditions improved in international markets as governments worked hard to bring their economies to work again as before the pandemic. Developments in the international market increased disruption in global financial markets and caused significant volatility (Barman et al., 2021). The price of the Company’s stock fluctuated in response to the restrictions.

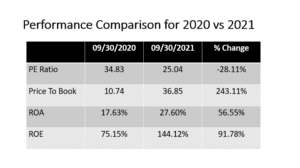

The price-earnings (PE) ratio refers to a metric that measures the valuation of a company’s stock in the market. The value for the ratio was 34.83 and 25.04 in 2020 and 2021, respectively (Macrotrends, 2022). The change across the two years represents a 28.11% reduction. The reduction indicates a decline in financial performance as it points to an overvaluation of the Company’s shares in 2020. The reduction implies a reducing growth prospect for the Company.

The price-to-book ratio is a financial metric that measures the evaluation of a business in the market compared to its book value. The value for the ratio was 10.74 and 36.85 in 2020 and 2021, respectively. Notably, this represents a 243.11% increase across the two years. The change indicates good financial performance. However, since the change is significant, it may not be good because it might mislead investors to purchase stock with no safety margin. Thus, Apple Inc. should ensure the increase is sustainable.

Return on assets refers to a metric that highlights earnings that can be attributed to assets. The value of the metric for Apple Inc. in 2020 and 2021 was 17.63% and 27.60%, respectively. Notably, this represents a 56.55% positive change. It implies that the Company’s assets gained more value across the two years.

The return on equity ratio evaluates a company’s profitability by dividing net income by shareholders’ equity. The value of the metric in 2020 and 2021 was 75.15% and 144.12%, respectively. Notably, this represents a 91.78% positive change. The higher the ROE, the better for the Company regarding the use of equity in generating revenue. The change implies good financial performance.

There are various external environment conditions that influence the performance of a company. They include political, environmental, currency, global economics and government influence. From the discussion, environmental conditions and government influence have the most impact on Apple Inc. The discussion points to economic conditions that affected Apple Inc. in 2021. They include interest rates, labor force, inflation, supply chain bottlenecks, and international development. From the analysis, the company was able to maneuver through these issues effectively in 2021. On the last part, the performance of Apple Inc. in 2020 was compared to that of 2021. the PE ratio and price to book ratios do not indicate a good financial performance due to significant undesired change across the two years. However, the company had a good financial performance regarding the ROA and ROE. The two indicate an increasing profitability for the company.

Barman, A., Das, R., & De, P. K. (2021). Impact of COVID-19 in the food supply chain: Disruptions and recovery strategy. Current Research in Behavioral Sciences, 2, 100017.

Macrotrends. (2022a). Apple PE Ratio 2010-2022 | AAPL https://www.macrotrends.net/stocks/charts/AAPL/apple/pe-ratio

Macrotrends. (2022b). Apple Price to Book Ratio 2010-2022 | AAPL https://www.macrotrends.net/stocks/charts/AAPL/apple/price-book

Macrotrends. (2022c). Apple ROA 2010-2022 | AAPL https://www.macrotrends.net/stocks/charts/AAPL/apple/roa

Macrotrends. (2022d). Apple ROE 2010-2022 | AAPL https://www.macrotrends.net/stocks/charts/AAPL/apple/roe

ORDER A PLAGIARISM-FREE PAPER HERE

We’ll write everything from scratch

Question

A company’s financial reports are used for a variety of reasons, including determining how the company is doing in the financial market. You decide to evaluate the effects of economic and market conditions on your company’s financial performance. Completing this exercise provides you with financial market research to present to your management team to inspire new KPIs and policies.

Financial Market Shareholder Analysis

Assessment Deliverable

Using the PowerPoint template above, address the following:

Evaluate economic conditions that influence company performance in general. Discuss the following five economic conditions: political, environmental, currency (money), global economics, and government influences. This is a general discussion and is not specific to Apple, but applies to any company. So, define the term and provide examples as to their affect on company performance. You need FIVE paragraphs for this discussion.

Compare market conditions from the previous year with the company’s performance for that same year. Conclude how the market conditions that year influenced the company’s performance, such as interest rates, Federal Reserve Bank monetary policy changes, or other market conditions relevant to the company you selected. This is simply a “write-up” from your Week 3 prep assignment. Make sure to use complete sentences in paragraph form comparing the Fed Monetary Policy and how it affected Apple in 2021. Make sure you take into account any grading feedback provided to you.

Analyze year-over-year performance from the past two years. Consider key metrics or ratios such as PE, price to book, return on assets, and return on equity in your conclusions. You must use Macrotrends for these figures as there are points for accuracy. Provide a discussion as to the year over year comparison. For each ratio: (1) define what the ratio measures, (2) state the 2020 & 2021 figures (use 09/30/20 & 09/30/21 dates), and (3) discuss the % change and what it implies for Apple. You need FOUR paragraphs for this discussion, one for each ratio. Links are as follows: Apple PE Ratio, Apple Price to Book Ratio, Apple ROA Ratio, and Apple ROE Ratio.

Cite references to support your assessment according to APA guidelines. Your textbook, annual report, monetary policy and Macrotrends references are already included in the template. If you use other references, please make sure to format those properly in accordance to APA guidelines.