Amazon Financial Plan

Describe the organization, including the type of business.

Amazon Inc. is an online retailer, manufacturer of electronic book readers, and web services provider that has become an iconic example of electronic commerce. Its headquarters are in Seattle, Washington. It is one of the Big Five companies in the U.S. information technology industry. The enterprise, now valued at USD 314.9 Billion, is a leader in economic growth, community investments, job creation, small businesses, and community empowerment (Robischon, N. 2017). Hire our assignment writing services in case your assignment is devastating you.

Business Case

Determine why funding is needed for the company.

The business case will determine the funding the company requires to invest in 13 African and Indian tech startups and expand its STEM Education program in select countries. The business case will also identify the sources of funding, requirements, and risks associated with each source, decide the best sources of funding, and estimate the cost of the capital for both short-term and long-term funding sources.

Determine the sources of funding. Consider self-funding, borrowing, loans, equity, venture capital, etc.

Self-funding

With self-funding, the company will assume the control associated with the investment of the funds and reap the gains in the form of financial benefits and brand expansion. Self-funding requires budgeting within the company’s operational budget and good reporting and analytics. It allows flexibility and control, transparency, and direct benefits gained by the company. The risk is that the company’s assets are exposed to any liability created by legal action against the self-funded plan.

Debt financing

This financial leverage is carried out by selling debt instruments as bank loans or bonds. The company is obliged to repay the loan and incur the cost of interest. The company pays for the huge capital expenditures required for the two projects identified above by taking debt. Amazon Inc. is a well-established enterprise with solid collateral and can easily secure debt financing. Debt financing presents the risk of not impedes reinvesting into business expansion.

Equity financing

This raises capital by selling shares of the company to public, institutional investors, or financial institutions to meet the company’s liquidity needs. Equity financing eradicates the burden of loan repayment and credit issues. It poses the risk of potential conflict if there are differences in vision and loss of control of the company (Zhengfei, L., Kangtao, Y, 2004).

Equity financing is the best source of funding for investment into startups in Africa and India. This is because potential investors would want to get a piece of the highly profitable tech industry by buying a stake in startups. Self-funding is the best source of funding for the STEM Education program as the company will have control of the program and unlimited access to the talent it produces.

Estimate the cost of capital for both short-term and long-term funding sources. Research current estimated APRs for your selected sources of funding. Create a table or chart to display this information.

Cost of Capital and Direct Costs

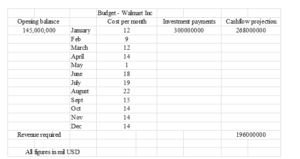

Prepare a budget that includes starting balances, monthly costs, loan/investment payments, cash flow projections, and required revenue.

Budget

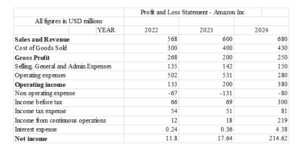

Create a profit-and-loss statement (income statement) for a 3-year period (2022, 2023, and 2024). Provide a revenue forecast, stating realistic assumptions, such as growth per year, in your projections. Refer to Table 18.1, Table 18.2, and Spreadsheet 18.1 in chapter eighteen.

Profit and Loss Statement

Conclusion

Financial planning is important for a company to monitor the use of resources. It helps in gaining investors’ confidence, prudent forecasting, and identifying funding sources. It also helps identify the strengths and weaknesses in the enterprise’s finances.

References

Carpenter, R. E., & Petersen, B. C. (2002). Capital market imperfections, high‐tech investment, and new equity financing. The Economic Journal, 112(477)

Robischon, N. (2017). Why Amazon is the world’s most innovative company of 2017. Fast Company Magazine, 2.

Zhengfei, L., & Kangtao, Y. (2004). The Puzzle of Equity Financing Preference in China’s Listed Companies [J]. Economic Research Journal, 4, 50-59.

ORDER A PLAGIARISM-FREE PAPER HERE

We’ll write everything from scratch

Question

Financial Plan (Amazon Inc)

Prepare a financial plan for Amazon Inc.

Amazon Financial Plan

Describe the organization, including the type of business.

Create the business case.

- Determine why funding is needed for the company.

- Determine the sources of funding. Consider self-funding, borrowing, loans, equity, venture capital, etc.

- Evaluate the requirements of each of the funding sources that you plan to use.

- Analyze the risks that are associated with each funding source.

- Decide which sources are the best fit for your company based on the requirements of each. Justify your decision.

- Estimate the cost of capital for both short-term and long-term funding sources. Research current estimated APRs for your selected sources of funding. Create a table or chart to display this information.

Estimate direct costs, including capital, marketing, labor, equipment, and inventory/supply costs.

Prepare a budget that includes starting balances, monthly costs, loan/investment payments, cash flow projections, and required revenue.

Create a profit-and-loss statement (income statement) for a 3-year period (2022, 2023, and 2024). Provide a revenue forecast, stating realistic assumptions, such as growth per year, in your projections. Refer to Table 18.1, Table 18.2, and Spreadsheet 18.1 in chapter eighteen.

Use the APA Template for papers or Sample PowerPoint for presentations. A standard error with presentations is not including speaker notes. Include speaker notes with each slide.

Cite references to support your assignment.

Format your citations according to APA guidelines.