Partnerships and Corporations

Do you need urgent assignment help ? Our homework help will you tons of energy and time required for your homework papers.

Question 1

- Taxes that exceed the partner’s basis in the partnership infer that the partnership has made a profit; thus, their income should be taxable (Tyson, 2013).

- Passive income exceeding 25% of gross receipts is unhealthy because S corporation will be dispensing capital in the form of passive income, thus disqualifying the election (Tyson, 2013).

- Net worth gives a true value to corporations and is also a basis that is easy to use, thus the need for US corporations to use it on companies with foreign branches when determining their gains and losses (Tyson, 2013).

- When salespersons do not approve orders, it means that they did not make sales in the state; thus, there will be no need to tax them. Rather, approving orders means that the salespersons have made sales in the state, thus the need to be subjected to taxation (Tyson, 2013).

- Decreasing debt based on shareholders is not healthy for the company because shareholders are not bound to suffer debt liability; thus, when S Corporation decreases its debt, it has to do so without doing so based on shareholders (Tyson, 2013).

- Corporations that conduct business in a state must receive 100 percent apportionment because they generate all their revenues from their sales within the state (Tyson, 2013).

- Intercompany transaction makes companies involved liable for gains or losses, such as gains or losses for a particular company, which may result in disagreements, thus the need to treat them as outside the group gains or losses (Tyson, 2013).

- Foreign income tax exclusion or the foreign tax credit for an individual who qualifies as a bona fide US citizen and meets the physical presence test eliminates instances where an individual will be subjected to double taxation (Tyson, 2013).

Question 2

(A) EFG’S partnership Taxable Income for the Year

| Title | Income/loss $ |

| Gross Revenue | 850,000 |

| Cost of sales | (650,000) |

| Gross Income | 200,000 |

| Dividend Income | 40,000 |

| Capital Loss | (21,000) |

| Charitable Contributions | (24,000) |

| Contributions to E | (100,000) |

| Taxable Income | 95000 |

(B) E’s Partnership Basis at the End of the Year

| Title | Income/loss $ |

| Outside Basis | 198,000 |

| Cash Withdrawal | (240,000) |

| Partnership Debt | 40,000 |

| Contributions to E | 100,000 |

| E’s Basis on the Partnership | 98,000 |

(C) If EFG were an S Corporation, the partners would be ordinary shareholders of the company; thus, the company would operate as a unit, and shareholders would only be involved in dividends and management.

(D) 2017 act provision introduces individual tax, thus making all the partners in the partnership taxable, unlike the 1984 tax act, which only taxed the partnership and exempted individual partners from taxation. In this case, both corporations and partnerships will be subjected to taxation as business entities as well as individuals in the case of partnership.

Question 3

(A) M Corporation’s Federal Taxable Income

| Title | Income/loss $ |

| Net Income | 185,000 |

| A Income Tax Expense | 15,000 |

| B Income Tax Expense | 5,000 |

| Federal Tax expense | 125,000 |

| Depreciation Expense | 18, 000 |

| Investment Income | (9000) |

| Bond Interest Income | (10,000) |

| Obligation Interest Income | (12, 000) |

| 5% Dividends Income | (8,000) |

| Federal Taxable Income | 309,000 |

(B) M’s 2016 Taxable Income in State A

| Title | Income/loss $ |

| Net Income | 185,000 |

| An Income Tax Expense | 15,000 |

| B Income Tax Expense | 5,000 |

| Federal Tax Expense | 125,000 |

| Depreciation Expense | 18, 000 |

| Investment Income | (9000) |

| Bond Interest Income | (10,000) |

| Obligation Interest Income | (12, 000) |

| 5% Dividends Income | (8,000) |

| Federal Taxable Income | 309,000 |

| Adjustments For State A | |

| 80% Payroll and 30% of Sales (Net Income) | 129,800 |

| Taxable Income in State A | 179, 200 |

(C) Before M expands into state N, it should assess state N tax policies first. If state N will subject M to double taxation, then M should not expand to the state because its tax obligations will increase, lowering its income.

Question 4

P’s Basis in S stock as of December 31, 2012

| Title | Amount ($) |

| S Stock as of July 1, 2010 | 12,000 |

| Accumulated Earnings and Profits on July 1, 2010 | 7,000 |

| Income Tax Incurred on July-December 31, 2010 | (2,000) |

| 2011 Earnings | 1,800 |

| Distribution | (5,000) |

| 2012 Taxable Loss | (1,300) |

| P’s Basis in S stock as of December 31, 2012 | 12,500 |

S is required to have transferred more than 50% stake to P to be in P’s Corporations US consolidated tax return.

Question 5

I agree with the ruling that overturned the decision that businesses must have a physical presence for authorities to collect sales tax because most upcoming businesses are registered online and undertake their transactions online. Because businesses are run online, sales tax can also be recovered by monitoring business transactions (Lang, Rust, & Owens, 2018). This occurrence has an economic impact of changing how states collect taxes and how businesses are run.

References

Lang, M., In Rust, A., & In Owens, J. (2018). Tax treaty case law around the globe 2017.

Tyson, E. (2013). Small business tax kit for dummies. Hoboken, New Jersey: John Wiley & Sons Wien: Linde.

ORDER A PLAGIARISM-FREE PAPER HERE

We’ll write everything from scratch

Question

Partnerships and Corporations

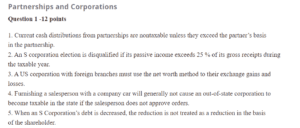

Question 1 -12 points

1. Current cash distributions from partnerships are nontaxable unless they exceed the partner’s basis

in the partnership.

2. An S corporation election is disqualified if its passive income exceeds 25 % of its gross receipts during

the taxable year.

3. A US corporation with foreign branches must use the net worth method to their exchange gains and

losses.

4. Furnishing a salesperson with a company car will generally not cause an out-of-state corporation to

become taxable in the state if the salesperson does not approve orders.

5. When an S Corporation’s debt is decreased, the reduction is not treated as a reduction in the basis

of the shareholder.

6. The sum of the apportionment percentages for the states in which a corporation conducts business

must always equal 100 percent.

7. Any gains or losses on intercompany transactions are deferred and recognized only when realized

outside the group.

8. A US citizen who qualifies as a bona fide resident and who meets the physical presence test, may

elect to claim the foreign income exclusion or the foreign tax credit.

Partnerships and Corporations

Question 2 – 12 pts

E is a 30% general partner in the EFG Partnership. EFG partnership records indicate the following:

Gross revenues $ 850,000

Cost of sales (650,000)

Dividend income 40,000

Net capital loss (21,000)

Charitable contributions (24, 000)

Guaranteed payments to E (not included above) (100,000)

E’s outside basis in the partnership at the beginning of the year was $198,000. During the year E had

cash withdrawals from the partnership of $240,000, and partnership debt decreased $40,000

A. Compute EFG’s partnership taxable income for the year.

B. Compute E’s partnership basis at the end of the year.

C. Briefly describe, in general terms, the differences and similarities that would occur if EFG were an S

Corporation.

D. Briefly summarize relevant 2017 Tax Act Provisions that would impact the choice of entity and its

operations.

Question 3 – 14 pts

M Corporation reported 2016 book net income of $185,000. The following items were included in book

income for 2016:

State A income tax expense $ 15,000

State B income tax expense $ 5,000

Federal income tax expense $125,000

Book depreciation expense $ 18,000

Other passive investment income $9,000

Municipal bond interest income $ 10,000

US government obligation interest income $ 12,000

Dividends received from 5% owned US co. $ 8,000

M Corporation computed federal tax depreciation of $26,000.

A. Based on the above, compute M’s 2016 federal taxable income.

B. M Corporation computed state tax depreciation of $20,000. M is only taxable in States A and B. All

investment income, including interest income is earned in State A. State A allows exclusion for interest

earned on federal obligations, taxes all municipal interest and disallows all deductions for state income

taxes .State A has not adopted federal depreciation methods and does not recognize the dividends

received deduction. State A apportions taxable income based on the average of three factors- payroll,

property, and sales. M Corporation has 80% of its payroll, 40% of its property, and 30 % of its sales in

State A. Based on the above information; compute M’s state 2016 taxable income in State A.

C. M Corporation is looking to expand into state N. What advice would you give M Corporation before

they begin this expansion?

Question 4 – 6 pts

On July 1, 2010, P Corporation acquired all the stock of S Corporation for $12,000 and included S

Corporation in its US Consolidated tax return. On the acquisition date, S has accumulated earnings and

profits of $7,000. During the period July1-December 31, 2010, S Corporation incurred a taxable loss of

$2,000. S Corporation had earnings of $1,800 in 2011, and made a distribution of $5,000 to P

Corporation on October 1. In 2012, S Corporation incurred a taxable loss of $1,300.

Determine P’s basis in S stock as of December 31, 2012.

What are the requirements for S to be included in P Corporation’s US consolidated tax return?

Question 5 – 6 points

On June 21, the Supreme Court overturned the long –standing precedent that a business must have a

physical presence in a state for a state to require it to collect sales tax. Do you agree with the decision

and why? Also, very briefly indicate your view of the future economic impact.