Cost Accounting

What are support departments, and why are their costs allocated to other departments? What process is used to allocate support department costs?

Support departments are those whose services are provided to the operational departments. The services that the support department provides are internal. For instance, a large bank might have a cafeteria where the employees get their meals. In the process, the bank management can have the human resource department hire the employee and keep track of their benefits towards the organization’s other departments. The services provided support the departments that interact with all the external customers that generate revenue for the bank (Okoye, 2011). Some support departments include the accounting, information system, human resources, and the marketing team.

According to the financial accounting rules, the costs incurred in the support department are treated as period expenses. Therefore, the costs in the support department are used for objectives other than accounting. That is what they are being allocated to other departments. Some organizations need to report the support department costs while engaging with outsiders (Okoye, 2011). Others will give the cost as an element of their control system. Therefore, the cost allocation will boost the belief system that will be responsible for encouraging managers from both the support and operating departments.

Six key steps are used in the allocation of costs in the support department to the operating sections. The first step is to identify the purpose of the distribution. The stage is achieved by stating the goals and objectives (Okoye, 2011). The second step is to identify the cost pool in both the support and operating departments. The third step entails allocating the cost to the respective reservoirs. In the fourth phase, there is a selection of an allocation base from each of the cost pools from the support department. The fifth step is to select the most effective method to use in the allocation process (Okoye, 2011). The last stage is allocating the operating department’s cost to the units of goods and services being provided.

How are joint costs allocated? Explain and analyze using numerical example.

Joint costs are the expenses that are incurred up to the split-off point. In most instances, organizations aim at allocating typical costs to individual products for various reasons. Some of the reasons include determining the cost of the inventory, the cost of goods sold, and the cost of goods that have been manufactured (Aruomoaghe and Agbo, 2013). Any other cost that the organization will incur after the split-off point will be a part of a particular product, and there will be no need for an allocation.

Several methods can be used in the allocation of joint costs. The most common is the average unit cost. The price is calculated by dividing the total collaborative cost of production by the unit of joint products produced. For example, a stationery company that manufactures pens of different colors will require ink of different colors. The manufacturing process of the pen is the same, but the cost of the ink is additional for each pen. The stationary company wants to manufacture 1,000,000 pens, and the allocation is as follows.

Blue pens = 200,000

Red Pens = 500,000

Green Pens = 300,000

The total joint cost before reaching the split-off point is $400,000

The first step will be to determine the average cost for each unit

Average cost for each unit = Total Joint Cost/Number of units

= 400,000/1,000,000 = $0.4 for each pen.

The second step will be to allocate the joint cost as follows

Red Pens = 200,000*0.4 = $80,000

Blue Pens = 500,000*0.4 = $200,000

Green Pens = 300,000*0.4 = $120,000

The allocation of the cost is on the body of the pens up to the split point. After the threshold has been surpassed, the price will be apportioned based on the ink that is being injected.

How are budget variances calculated and used as performance measures? Provide numerical example?

Budget variances addressed the financial discrepancies in a company. The most common example is when an organization fails to budget for its expenses effectively. There are two main reasons why there can be a variation between an organization’s actual performance and the forecasting in the budget. The two reasons are differences in the spending and the revenue activities. Budget variances are calculated by determining the per-unit variable cost, the per-unit revenue, and the total fixed cost (Aruomoaghe and Agbo, 2013). The per-unit variable cost is the expense incurred in the manufacturing of a single unit of the product. The per-unit revenue represents the amount that has been charged in the production of a single company.

For example, a company may budget to spend $250,000 in the production, marketing, and distribution activities. The company might be producing a product like a card, and the budget includes the cost of cardstock, ink, and labor. However, at the end of the process, the organization can realize that they have spent $265,000. The amount has surpassed the intended budget by $15,000. The extra amount is the adverse budget variance for the organization. The budget variance can be used in measuring the level of performance as it is effective in the decision-making process. For instance, it is possible to avoid the budget variance.

References

Aruomoaghe, J., & Agbo, S. (2013). Application of Variance Analysis for Performance Evaluation: A Cost/Benefit Approach. Research Journal of Finance and Accounting, 4(13), 111-114.

Okoye, A. (2011). Cost Accountancy: Management Operational Applications. Mindex press. Benin City. 2nd edition

ORDER A PLAGIARISM-FREE PAPER HERE

We’ll write everything from scratch

Question

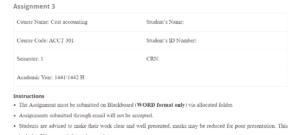

Assignment 3

| Course Name: Cost accounting | Student’s Name: |

| Course Code: ACCT 301 | Student’s ID Number: |

| Semester: 1 | CRN: |

| Academic Year: 1441/1442 H | |

Instructions

Cost Accounting

- The Assignment must be submitted on Blackboard (WORD format only) via allocated folder.

- Assignments submitted through email will not be accepted.

- Students are advised to make their work clear and well presented, marks may be reduced for poor presentation. This includes filling your information on the cover page.

- Students must mention question number clearly in their answer.

- Late submission will NOT be accepted.

- Avoid plagiarism, the work should be in your own words, copying from students or other resources without proper referencing will result in ZERO marks. No exceptions.

- All answered must be typed using Times New Roman (size 12, double-spaced) No pictures containing text will be accepted and will be considered plagiarism).

- Submissions without this cover page will NOT be accepted.

Q1 What are support departments, and why are their costs allocated to other departments? What process is used to allocate support department costs?

(1.5 Marks, week 10 materials

Q2 How are joint costs allocated? Explain and analyze using numerical example.

(1.5 Marks, week 11 materials)

Q 3 How are budget variances calculated and used as performance measures? Provide numerical example?

(2 Marks, week 12 materials)