Tax Problems

Problem 1:

Individual A paid $10,000 to B. What is the federal income tax effect on A?

If individual A paid $10000 to B as a payment during A’s business or as a means of earning an income, then the amount should be deducted from his income to determine taxable income. However, when the payment is unrelated to the pursuit of income but generally paid as a donation or for charity, or as a gift, then it will not be deducted from the taxable income.

If the $10000 A paid to B is a bonus, then the IRS can allow B to use the numerous methods available to withhold tax from the bonus because it is considered a bonus.

Do you need an original copy of “Tax Problems”? Contact us.

Problem 2

To what extent may J.P. deduct his net $50,000 loss from the office building?

For most taxpayers, rental activities are assumed to be passive activities, and losses from passive activities are not generally deductible against non-passive income such as wages earned from work (Townsend, 2017). However, a special provision allows taxpayers to deduct up to $25000 of the losses from the rental property they actively participate in. Remember that the $25000 deduction will be phased out when the taxpayer’s modified adjusted gross income ranges from $100000 to $150000, resulting in no deduction for people making more than $150000 and filing returns jointly with their spouses. Since Jim is passively involved in the office building and adjacent property operations, the $50000 loss will not be deducted.

In part (a), what would be the tax consequence in Year 1 if J.P. also owned a second rental property that produced $40,000 of income net of all expenses, including interest and depreciation?

Perhaps, the rental loss from that property can be used to offset income earned from another property. In general, annual income and loss from all the properties are combined to determine whether the taxpayer has income or loss from all the rental activities for the year.

Refer to (a). On the first day of the second year, J.P. sold the property. Because the property’s value exactly equaled the $1,980,000 debt on the property, the buyer took the property subject to the mortgage, and J.P. received no other consideration. What are the tax consequences of the sale to J.P. in Year 2?

Passive losses are only realized in the year of the sale; hence, the $50000 can only be used to offset the gains on another passive income of the year.

Refer to (c). Assume that instead of selling the property, J.P. receives in the second year $320,000 of rental income net of all expenses except for interest and depreciation. J.P. pays $22,000 of recourse loan principal, $200,000 of interest on both loans, and depreciation is again $60,000. J.P.’s salary and dividend income are the same as in the first year. What are the tax consequences of J.P.’s investment in the property in Year 2?

In year 2, J.P. investment earned an income of $120000 net of depreciation reported at $60000. Remember that depreciation refers to the loss in the value of a property over the years because of different factors. Depreciation will allow J.P. Investments to write off the property. It is an expense that is used as a write-off on the taxes. It reduces reportable income and hence affects taxable income. The net rental income should be reported to the tax in the year earned (year 2), and the taxpayer can use it to offset other passive losses made.

Problem 3

Receivables were known to be worthless in February.

Receivable known to be worthless in February of the current year was income earned last year and will be reported as bad debt. To assist businesses, the tax man often allows businesses to report bad debt expenses as a deduction when filing tax returns.

Prepaid rent of January, check received, but not deposited.

Prepaid rent is taxable in the previous year and will not be considered in the current year.

Dividend declared to shareholders of record as of December 30; check not received.

Dividends should not be recorded as income until they have been received.

- Payment for supplies ordered the previous year.

Payments for supplies ordered last year were accrued in the year and hence had no consequence on the current tax year.

Increase in unpaid accounts payable.

Increases in unpaid accounts payable can only be considered an expense accrued; hence, it cannot affect tax in the current tax year.

Sale of securities at a loss at the end of December, settlement date January 4.

The losses on the disposal of securities are deductible in the current year.

Same as (f), but at a gain.

The disposal of securities can be considered a gain at the end of the year, with the completed transaction happening in the following year, and is subject to taxation in the first year.

Prepayment for services to be rendered this year, check cashed by the payee in December.

Prepayments for services to be done in the current year cannot be deductible until the services have been done.

Problem 4

a) Provision 1 Response:

Consider § 1041, where transactions can have practical consequences between spouses, such as tax-free transfers between former spouses or spouses (Townsend, 2017). Even though most transfers between spouses and ex-spouses within the context of a divorce are not taxable, there are certain exceptions to the rule (Patel & McClelland, 2017). For instance, it does not apply when the recipient spouse is a non-resident.

b) Provision 2 Response:

- 1239 provides that a whole gain realized on a transfer to a related party should be considered ordinary income (Townsend, 2017). This is to avert the transfer of low-basis property to a related party in which the purchases uses depreciation deductions against ordinary income, and the seller obtains capital gains treatment.

Other Related: Create a Budget and Financial Plan for a Vacation Trip

References

Patel, E., & McClelland, J. (2017). What Would a Cash-Flow Tax Look Like for U.S. Companies? Lessons from a Historical Panel. Office of Tax Analysis Working Paper, 116.

Townsend, J. A. (2017). Federal Tax Procedure (2017 Practitioner Ed.).

ORDER A PLAGIARISM-FREE PAPER HERE

We’ll write everything from scratch

Question

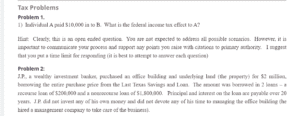

Tax Problems

Problem 1.

1) Individual A paid $10,000 to B. What is the federal income tax effect on A?

Tax Problems

Hint: Clearly, this is an open-ended question. You are not expected to address all possible scenarios. However, it is important to communicate your process and support any points you raise with citations to primary authority. I suggest that you put a time limit for responding (it is best to attempt to answer each question)

Problem 2:

J.P., a wealthy investment banker, purchased an office building and underlying land (the property) for $2 million, borrowing the full purchase price from the Last Texas Savings and Loan. The amount was borrowed in 2 loans – a recourse loan of $200,000 and a nonrecourse loan of $1,800,000. Principal and interest on the loan are payable over 20 years. J.P. did not invest his own money or devote any of his time to managing the office building (he hired a management company to take care of the business).

In the first year of operations, the results for J.P. are as follows:

| Rental income | $270,000 |

| Interest paid | $210,000 |

| Operating expenses | $50,000 |

| Depreciation | $60,000 |

In addition to the interest payment, J.P. made a $20,000 principal payment on the recourse note. J.P. has $800,000 in salary from his investment banking job and $80,000 in dividend income from portfolio investments. J.P.’s depreciation was not accelerated.

List the authorities relied upon in your responses:

(a) To what extent may J.P. deduct his net $50,000 loss from the office building?

(b) In part (a), what would be the tax consequence in Year 1 if J.P. also owned a second rental property that produced $40,000 of income net of all expenses, including interest and depreciation?

(c) Refer to (a). On the first day of the second year, J.P. sold the property. Because the property’s value exactly equaled the $1,980,000 debt on the property, the buyer simply took thrty subject to the mortgage, and J.P. received no other consideration. What are the tax consequences of the sale to J.P. in Year 2?

(d) Refer to (c). Assume that instead of selling the property, J.P. receives in the second year $320,000 of rental income net of all expenses except for interest and depreciation. J.P. pays $22,000 of recourse loan principal, $200,000 of interest on both loans, and depreciation is again $60,000. J.P.’s salary and dividend income are the same as in the first year. What are the tax consequences of J.P.’s investment in the property in Year 2?

Problem 3

Space Funerals, Inc. is a calendar year accrual basis taxpayer. What is the tax status of each of the following items from the company’s current year (provide citations and a brief discussion/conclusion)?

- Receivables were known to be worthless in February.

- Prepaid rent of January, check received, but not deposited.

- Dividend declared to shareholders of record as of December 30; check not received.

- Payment for supplies ordered the previous year.

- Increase in unpaid accounts payable.

- Sale of securities at a loss at the end of December, settlement date January 4.

- Same as (f), but at a gain.

- Prepayment for services to be rendered this year, check cashed by the payee in December.

Problem 4

Numerous provisions in the Code treat transactions between related parties differently than those between unrelated parties. Note two provisions that would alter the tax consequences of transactions based on relationships. Briefly describe how each provision works and what parties are affected.

Identify and discuss the authorities within the body of the response itself.

a) Provision 1 Response:

b) Provision 2 Response: