Create a Budget and Financial Plan for a Vacation Trip

Introduction

One day many years ago, I was reflecting, sitting by the porch on the rented Sunset Beach house to spend a family vacation; the sundown was almost over, and the sky was overtaken by a surreal, magical color combination of yellow, red, blue, orange and white, when the image of an old Chinese man came to me very visible inviting me to make a trip from Los Angeles to Honk Kong, spend seven days there, then fly to Beijing to spend another seven days, find him in a tumultuous market area near the so famous Chinese Wall, that he would be wearing a white hat sitting by a corner of a small shop, to approach him because he was going to give me some information, and then, travel back to Los Angeles. Hire our assignment writing services in case your assignment is devastating you.

That moment was when I decided that this vision would come true and would be my last trip to a section of the world I had never been to. Due to my preference for travelling first class and staying in five-star hotels, I planned a savings budget to make it a reality. Now at my current age, having saved sufficiently, I decided to begin the vacation during summer.

Traveling expenses

A round-trip ticket business class will cost US $13,472.00 per person on Hong Kong Airlines as of May 17, 2018. As a solo traveller, that amount would be the only traveling expense, a round trip from Los Angeles – Hong Kong (with a stop in Beijing) – Los Angeles.

Lodging expenses

For the Hong Kong destination hotel, I selected the Hilton Garden Inn, where a King guest room on a high floor would cost US $1,000.00 per night. The considerations that led to the choice of this hotel were because it is a world-class hotel and has all international support services, including support language and international cuisines, it has other facilities like WIFI, a restaurant, fitness center, tennis court, meeting rooms, pools, near the beach and sea ports, the Langham Place, and free parking for guests. After landing at the airport, I will board a limousine that will charge me US $100.00 per trip to the hotel and return to the airport for a total of US $200.00. Accommodation expenses will be US $1,000 daily for a total of US $7,000.00.

Food and beverage

There will be two meals every day which are estimated to cost as follows:

Breakfast = Free – Included with the cost of the suite.

Lunch = $40.00 a day.

Dinner = $15.00 per day; eating very light and early in the evenings.

Total food expenses will be US $55.00 daily, for a total of US $385.00

Other expenses

Apart from food, travel and accommodation, I will be renting a car with a chauffeur for four days out of the seven days of my stay, at US $145.00 per day for a total of US $650.00, including a tip of US $70.00.

Financial plan

From the estimates made, it can be established that the amount of money is quite high, but I consider it as my last indulgence. This is to say that for one to qualify to make the trip, proper prior planning was required. Instead of waiting and doing all the financing once the time for the trip comes close, it is possible to look at the trip through the lens of future value. The future value in finance means looking at the trip as an expected future outflow.

According to Arnold (2013), future outflows are adjusted for such items as inflation and interest accumulation. The assumption here is that the amount of money, if invested today, will yield a certain percentage of interest over time. This is what makes it wiser to plan for future outflows prior to the period when they will be needed. In order to come up with the future value, the first step will be to determine the total financial obligation and then look at the total amount of future value that will be required. This amount will then be discounted to get the total amount that will be required at present. This is referred to as a present value.

Total financial requirement:

Travel expenses = $13,472

Lodging expenses = $ 7,000

Food and beverage = $ 385

Hotel – airport limo = $ 200

Car rental w/chauffeur = $ 650

Total $21,707

The expected future value before adjustment for inflation will be $21,707. After adjusting for inflation, the amount will be $22,249. This is the future value that will be required for the trip. In order to come up with the present value of the trip, we shall discount the amount using a discount rate of 10 per cent, which is the nominal rate of return. This will be done as follows:

PV = C1/(1 +r)n

= 22,249/(1.1)10

= $8,578.21

This is the amount that should be invested at present to earn a future value of $22,249. If this amount is to be contributed monthly, it follows that the amount that will be invested every month will be calculated as follows

Monthly PV = C1 x [1 – (1 + r)]/r

= $109.61 monthly

In a situation where the trip is delayed for another 5 years, the present value will be:

22,249/(1.1)15

= $5,326.233

And the monthly payment = $66.87

What the calculations above mean is that when the trip is to be made in 10 years’ time, the amount to be paid monthly will be higher than when the trip is to be made in 15 years’ time. This is because the amount at 15 years will have 5 more annual interests. There will be 5 more years to accumulate the amount compared to 10 years. The more the number of years, the lesser the payments made to arrive at the future value.

References

Arnold, S (2013) Fundamentals of financial planning; present value, future value and discounting; London: Taylor and Francis publishers

ORDER A PLAGIARISM-FREE PAPER HERE

We’ll write everything from scratch

Question

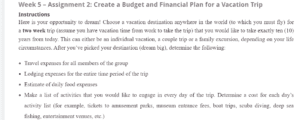

Week 5 – Assignment 2: Create a Budget and Financial Plan for a Vacation Trip

Instructions

Here is your opportunity to dream! Choose a vacation destination anywhere in the world (to which you must fly) for a two week trip (assume you have vacation time from work to take the trip) that you would like to take exactly ten (10) years from today. This can either be an individual vacation, a couple trip or a family excursion, depending on your life circumstances. After you’ve picked your destination (dream big), determine the following:

: Create a Budget and Financial Plan for a Vacation Trip

- Travel expenses for all members of the group

- Lodging expenses for the entire time period of the trip

- Estimate of daily food expenses

- Make a list of activities that you would like to engage in every day of the trip. Determine a cost for each day’s activity list (for example, tickets to amusement parks, museum entrance fees, boat trips, scuba diving, deep sea fishing, entertainment venues, etc.)

- Make a list and associated cost estimate of any other expenses that you believe should be included in a total cost estimate for your vacation (e.g., pet boarding, house sitting, airport parking fees, etc.)

- Would only someone who makes a high income be able to afford this trip? Or would someone who makes the minimum wage be able to afford this trip?

NOTE: You must research all aspects of your list to substantiate your cost estimates; that is, you must demonstrate and/or document how you derived each cost estimate in the list.

After gathering and organizing all collected data, prepare a document describing your destination (including your reason for choosing that location), listing (and substantiating) all costs of the trip (this can be done in a table or bullet point format, but it must be clear and provide sufficient detail so that the reader understands your interest and passion for your vacation), and determining a total cost of your dream vacation from the time you leave to the time you return.

Assuming that your estimated total cost will grow by 2.5 percent per year (due to inflation), demonstrate how you would compute the expected future cost of your dream vacation.

Suppose that you can invest money every month into a fee free mutual fund and that this fund is expected to have a 10 percent nominal annual rate of return. Using your estimated future cost (including inflation) as a future value, determine the amount of money you must save each month for the next 10 years (i.e., 120 months) to achieve your goal. Then determine the monthly amount you must save if you delay your trip for an additional five years (that is, you will take the trip 15 years from today = 180 months) instead of 10 years from today (note: be sure to add 5 additional years of inflation to the estimated future cost). Write an explanation for your calculations so the reader is completely clear on how you derived your required monthly deposits.

Based on this numerical representation of your dream vacation, write a well contemplated critical analysis of your trip. For example, explore questions such as: is this something that you think is worth saving for, have you changed your mind after seeing the reality of the required sacrifice, are you rethinking the location or luxury level of your accommodations or daily outings, and so on.

Note that you must properly cite all reference sites that you used to collect data to estimate your costs value, etc.

Length: 4-5 pages not including title page and references

Your response should demonstrate thoughtful consideration of the ideas and concepts presented in the course and provide new thoughts and insights relating directly to this topic. Your response should reflect scholarly writing and current APA standards.