WACC Calculation

| WACC Calculation | ||

| Cost of Equity | 13.00% | |

| Cost of Debt | 8.50% | |

| Capital Structure | ||

| Weight of Equity | 50.00% | |

| Weight of Debt | 50.00% | |

| Tax Rate | ||

| Tax Rate | 35.00% | |

| WACC | 9.26% | |

For this calculation, the tax rate has been assumed to be 35%

Are you looking to acquire an initial version of “WACC Calculation assignment”? Get in touch with us.

Calculating the Weighted Average Cost of Capital (WACC)

The Weighted Cost of Capital is the average rate a company is expected to pay all its security holders to finance its assets.

The WACC is calculated as follows:

WACC=(Cost ofEquity×Weight of Equity)+(Cost of Debt×Weight of Debt)(1-Tax Rate)

To calculate the WACC using the model:

- Enter the percentage Cost of Equity in cell D4

- Enter the percentage Cost of Debt in cell D5

- Enter the percentage Weight of Equity in cell D8

- Enter the percentage Weight of Debt in cell D9

- Enter the Tax Rate in cell D12

- The WACC will be displayed in cell D14

Similar Post: MATH 111 – Week 5 – Oblique Triangles and the Law of Sines and Cosines Exam

ORDER A PLAGIARISM-FREE PAPER HERE

We’ll write everything from scratch

Question

WACC Calculation

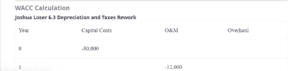

Joshua Loser 6.3 Depreciation and Taxes Rework

| Year | Capital Costs | O&M | Overhaul |

| 0 | -80,000 | ||

| 1 | -12,000 | ||

| 2 | -12,000 | ||

| 3 | -12,000 | -25,000 | |

| 4 | -12,000 | ||

| 5 | -12,000 | ||

| 6 | -12,000 | ||

| 7 | -12,000 | ||

| 8 | -12,000 | ||

| 9 | -12,000 | ||

| 10 | 10,000 | -12,000 |

WACC Calculation

| Year | Capital Costs | Overhaul | Revenue | PW |

| 0 | -$90,000.00 | |||

| 1 | $0.00 | $30,000.00 | $27,272.73 | |

| 2 | $0.00 | $30,000.00 | $24,793.39 | |

| 3 | -$10,000.00 | $20,000.00 | $15,026.30 | |

| 4 | $0.00 | $30,000.00 | $20,490.40 | |

| 5 | $0.00 | $30,000.00 | $18,627.64 | |

| 6 | -$15,000.00 | $15,000.00 | $8,467.11 | |

| $114,677.56 | ||||

| Future Worth = Sum of revenue | $155,000.00 | |||

| Present Worth Calculation | Future Worth Calculation | |||

| PW= | $87,493.46 | FW= | $155,000.00 | |

| Future Worth | 155,000 | Present Worth | 87,493.46 | |

| Interest Rate r | 0.1 | Interest Rate r | 0.1 | |

| Years (t) | 6 | Years (t) | 6 | |

| Initial Cost | $100,000 | |||

| Annual Cash Flows | $30,000 | |||

| Year 3 Overhaul | $10,000 | |||

| Year 6 Clean-up Costs | $15,000 | |||

| Equipment Salvage Value | $10,000 | |||

| r (not provided in Module 2) | 0.1 | |||

| Net Annual Cash Flow | Annual Cost | Year 3 Overhaul | Year 6 Clean-up Cost | Salvage Value | Depreciation | Equipment Sold For | Tax Rate |

| $81,155 | $20,000 | $15,000 | 35% | ||||

| $81,155 | $20,000 | $15,000 | 35% | ||||

| $81,155 | $20,000 | -$15,390 | $15,000 | 35% | |||

| $81,155 | $20,000 | $15,000 | 35% | ||||

| $81,155 | $20,000 | $15,000 | 35% | ||||

| $81,155 | $20,000 | -$17,690 | $10,000 | $15,000 | $20,000 | 35% | |