Strategy Implementation and Strategic Controls

Introduction

The first product is W1, which, regarding its performance, the customers are never worried. For the past 3 years, it has been in the market. In its category, W1 is the most expensive tablet compared to other tablets. In the past year, based on the module 3 simulation, W1 was in the development period of the life phase of its product. Research and development expenditure is always needed the minute a good is in its growing period of the product’s life cycle. The quality of the product should be maintained, and support services and additional features added. Until W1 remains in its growing stage, the pricing strategy will continue, yet in the present year, W1 might have reached the maturity stage of product progression. As a result of the situation, the value may well have to be reduced so that the market stake can be maintained. Research and development are also needed for the identification of the present phase of W1 product development. In turn, it will help determine the delivery strategy of W1 and the expenditure sustained during the promotion.

The other merchandise is a W2 tablet. It is the tablet that has been on the market for the past two years. Since W1 and W2 are from the same industry, it can be depicted that W2 is similar in the stage of growth of product development. The loyal consumers of W2 are requesting an improvement in its performance. Based on the customer’s needs, it is seen that they are not price-sensitive as long as the performance is improved. The customer’s behavior is also elaborated by the default prices. The price of W1 is $285, while W2 is $430. To satisfy the needs of W2 customers, R&D expenditure is needed so that the performance of W2 can be improved. Since the consumers are requesting quality, the high prices of W2 should be maintained since it is without doubt in the growing stage, and moreover, its consumers are not sensitive to price. More so, research and development expenditures are needed to improve the delivery of W2, and advertising is needed to familiarize the product with sensitive customers. CEO Smothers enjoys W2 because the tablet’s performance is better than that of the other tablets in the same group.

The other product is W3. Compared to the other products, it is the newly introduced. Hence, the W3 tablet is in its starter stage of product maturation. The original price tag of W3 is $ 195, which correspondingly reflects its point in the lifespan of the product. In the midst of the three products, W1, W2, and W3, they have the lowest prices. By running, W3 with its default values, the profitability that is obtained is -73% for 2012. Since it is in the introduction stage, the CEO must experience expenditures to set the levels of performance and product branding. The price of W2 is like penetration pricing, which has been made so that it can build the market share. Alternatively, some firms maintain a high glance at setting a price in order to recover the development costs. Moreover, substantial costs are incurred in the efforts of reaching out to early adopters and innovators. The costs of promotion for W3 are likely to be higher than the other products since it is in the introduction stage. In general, W3 is more prospective to stay unbeneficial for a significant period.

CVP Analysis

CVP Analysis is a good tool for evaluating the influence of setting a price and additional charges on the profits incurred by a company by putting into consideration the least level of trades required to evade incurring losses. The firm has 3 products that are required to be assessed for valuing and R&D strategy so that the general productivity of the company can be improved. As seen in the introduction, both W1 and W2 are in their growing phase, which indicates that there is a requirement to increase the R&D expenditures to boost the added features in the tablets so that there can be a rise in demand in the marketplace. The approach grounded on the CVP analysis is forthright that the R&D expenditure should be increased with respect to W1 and W2 for the year 2013 only. If the demand increases, there will be more growth in the upcoming periods. The approach used in 2013 concerning the product price will be unlike for both the W1 and W2. There is a growth in the price of W1, while on the other hand, the price of W2 increases since its customers are not price sensitive.

During the year 2013, it is expected that there will be a surge in the R&D expenses for the two products, W1 and W2, since the two products are in the growth phase. As a result, their demand will increase since additional features will be added due to the clients need. The plan to be used for 2013, 2014, 2015, and 2016 will depend on the outcomes of both W1 and W2 products in terms of their total returns. There will be a small improvement in the price of W2, whereas the price of W1 will not change due to its sensitivity in price which means that an increase in price results in reducing the general returns of the company. W3 needs to be established in 2013 since for the product to be profitable to the company, it will take significant time. During the year 2013, the R&D expenses and price strategy for W3 are eliminated.

The year 2013

The price of W1 is $285 since there is no significant variation in the value of the tablet as a result of its customer’s sensitivity to price, hence affecting the demand. The price of W2 increases and its price during the year 2013 is $ 470. The R&D charge increases by 46% of the value so that the existing specifications of both W1 and W2 can be improved. There is no strategy concerning W3 since it has been overlooked for this year because it has resulted in a loss of profitability for the firm. Since the demand for W2 is not subtle in price, the demand for tablet W2 can increase without being affected by an increase in price. The demand for W1 will also increase due to the added features and improvement in performance with the motive of attracting more customers. in the year 2013, the strategy is implemented and the pricing of W1 is $285.

Regarding the implementation of the strategy explained above concerning products W1 and W2. There is an expectation that the general returns will rise because of the increase in the number of clients for the two products. The R&D expenditures for the two products enhance the spread of the product to various sections of the market, and more buyers will be associated with the company.

Strategy grounded on CVP Analysis: 2013

| Product | Price | R&D |

| W1 | 285 | 50% |

| W2 | 470 | 50% |

| W3 | – | – |

Strategy grounded Simulation: 2013

| Product | Price | R&D | Results | W1 | W2 | W3 |

| W1 | 285 | 45% | Market | 2,064,017 | 1,059,527 | – |

| W2 | 470 | 45% | Finance | 557,284,699 | 487,382,302 | – |

| W3 | – | – | Advisory comments | W1 performance relates positively with others. | W2 in the growing phase, there are clients who have not subscribed it. | Total Score:

389,765,674 |

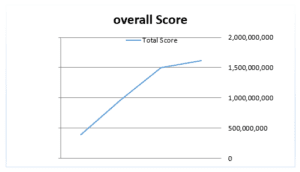

Based on the CVP analysis, the simulation strategy is developed. When the R&D expenses and price are inputted from the CVP analysis, the outcomes for W1, W2, and W3 are obtained, though W3 has been withdrawn. The consequence is that the entire score after the year 2013 is improved than the other scores. This validates the approach chosen. Both W1 and W2 have improved, elaborating that they are in the product development stage. Moreover, by observing the remarks of the advisor, the strategy is supported. One of the comments associated with the high feature of W3 in comparison to that of the contenders, and the other comment elaborated that W2 is in the growing phase. This justifies the rise in prices of both W1 and W2.

The year 2014

Regarding the 2013 results, the approach for 2014 is as well a rise in the R&D expenditure for the 3 products: W1, W2, and W3. A price rise of W2 causes an improvement in the general profitability of the business. The extra expenses of the company over the R&D will help to increase the number of different consumers in order to boost the profits of the company. The price approach taken by the company will see W1 have no variation in the price while increasing the R&D expenditure by $ 20 will see the value rise up to $490. The price of W1 will stay at $ 285.

By continuing with the simulation strategy, the value of W1 remains at $285. We also do not have an idea the minute W1 will reach the maturity stage of the product development. The price of W2 increases to 490$ hence the total revenues of the company is increases.

Policy-based on CVP Analysis: 2014

| Product | Price | R&D |

| W1 | 285 | 25% |

| W2 | 490 | 40% |

| W3 | 195 | 30% |

Strategy-based Simulation: 2014

| Product | Price | R&D | Results | W1 | W2 | W3 |

| W1 | 285 | 25% | Market | 2,992,727 | 1,854,592 | – |

| W2 | 490 | 40% | Finance | 805,292,162 | 872,258,409 | – |

| W3 | 195 | 30 | Advisor Comments | W1 is in the shakeout stage. | Consumers are prepared to pay extra for W2. | Total Score:

977,914,367 |

Based on the current year’s outcomes, it also shows that the overall score that has been made based on this simulation strategy is still better than the original company performance. Moreover, the comments of the advisor match the arguments brought forth by the strategy. The price of W1 had not been improved, apprehending that the phase of maturity would be attained. The advisor’s comments also argue that W1 is in the shakeout stage.

The year 2015

During this year, the strategy changes concerning the R&D expenses in the case of W1 and W2 since a decision has been made that the R&D expenses will not be increased until there is an indication that there is a downfall in the product’s revenues at the expiration of the year. Despite this, the R&D expenditure of W3 increases to boost its market situation by $50000. Moreover, there is a transformation concerning the strategy of pricing in 2014 since the value of W1 has to be deducted by $20, and for W2, the value is to be deducted by $30.

Strategy based CVP Analysis, 2015

| Product | Price | R&D |

| W1 | 260 | 20% |

| W2 | 460 | 40% |

| W3 | 195 | 30% |

| Units of sale | 1,120,500 | 295,000 | 450,000 |

| Contribution margin | 83,350,000 | 42,425,000 | 37,500,000 |

| Less: Fixed costs | $76,350,000 | $37,760,000 | $37,695,000 |

| Income | $8,100,000 | $3,865,000 | ($196,100) |

| Total income | $11,570,000 |

By using the above CVP analysis, the simulation strategy can be obtained

Strategy based Simulation 2015

| Product | Price | R&D | Results | W1 | W2 | W3 |

| W1 | 260 | 20% | Market | 1,308,512 | 3,529,907 | – |

| W2 | 460 | 40% | Finance | 321,255,782 | 1,484,889,911 | – |

| W3 | 195 | 30% | Advisor comments | Consumers pay similar prices for company products. | W2 has gotten to the shakeout stage. | Total Score:

1,512,028,840 |

For this current year, the performance of the approach is much enhanced than for the CVP analysis. This year, a sharp reduction in the sales and sales revenue of W1 is observed. It is evident that W1 has reached its decline stage. The advisor indicates that the prices of W1 should be comparable with the price of the other competitors. Moreover, the advisor warns that W2 has reached its shakeout phase.

The year 2016

The strategy for W1 and W2 for 2016 is reducing the prices and more so to protect the market share. From the previous year, based on the simulation strategy, W2 has reached its shakeout price, and therefore, its price should be deducted to $ 420. Moreover, the value of W1 should be deducted to $ 250. The rivals of W1 will also incur great fixed charges, so they may have difficulty cutting down their prices and hence will have an advantage, hence the demand for the product increase.

The R&D expenses for W1, W2 and W3 will go on at 20%, 40% and 40% respectively. The motive of R&D expenses and pricing is protecting the market share of W1 and W2.

Strategy-based Simulation: 2016

| Product | Price | R&D | Results | W1 | W2 | W3 |

| W1 | 250 | 20% | Market | 775,659 | 1,289,284 | – |

| W2 | 420 | 40% | Finance | 174,671,364 | 489,499,335 | – |

| W3 | 195 | 40% | Advisor comments | Consumers pay a similar price for Company products as they normally do for other goods. | Total Score:

1,712,297,539 |

The results of the final year indicate using the simulation strategy improves the results from what was achieved by CVP analysis. The default of the company was $1,613,237,527, while the score attained by using the strategy is $1,712,297,539. This indicates that there has been an improvement in the performance. W1 shows that there is an improvement in profitability. Despite this, W2 has not improved in terms of profitability. The greatest improvement is in W3 which gives a good sign that the company will achieve further profit improvement in the near future. Additional R&D expenses should be implemented in the case of W2 and W3 to boost profitability.

References

Amaldoss, W., Desai, P. S., & Shin, W. (2015). Keyword search advertising and first-page bid estimates: A strategic analysis. Management Science, 61(3), 507-519.

Segura, E., Morales, R., & Somolinos, J. A. (2018). A strategic analysis of tidal current energy conversion systems in the European Union. Applied Energy, 212, 527-551.

Subrahmanyam, K. (2018). Indian Nuclear Policy—1964–98 (A Personal Recollection). Strategic Analysis, 42(3), 293-311.

Tan, Y. R., & Carrillo, J. E. (2017). Strategic analysis of the agency model for digital goods. Production and Operations Management, 26(4), 724-741.

ORDER A PLAGIARISM-FREE PAPER HERE

We’ll write everything from scratch

Question

Strategy Implementation and Strategic Controls

Module 4 – SLP

Strategy Implementation and Strategic Controls

Simulation

In Module 4, you will continue with the CVP analysis you completed in the Module 3 SLP.

Scenario Continuation:

It is still January 2, 2013. You have just completed your revised SLP3 strategy using CVP analysis and are eager to implement your decisions for 2013 through 2016.

Using the CVP analysis from SLP3, run the simulation for a final time. Again, be sure to take notes about your analysis and document the reasoning behind your decisions.

Finalize your report showing the strategy you have used.

Assignment Overview

Using the strategy that you developed in SLP3, run the simulation. Document your results as you did previously. Review and analyze these results and develop a final strategy.

Please turn in a 6- to 8-page paper, not including cover and reference pages.

Keys to the Assignment

The key aspects of this assignment that should be covered and taken into account in preparing your paper include:

The revised strategy consists of the Prices, R&D Allocation %, and any product discontinuations for the W1, W2, and W3 tablets for each of the four years: 2013, 2014, 2015, and 2016.

You must present a rational justification for this strategy. In other words, you must provide support for your proposed strategy using financial analysis and relevant theories.

Use the CVP Calculator and review the PowerPoint that explains CVP and provides some examples.

You will need to crunch some numbers (CVP Analysis) to help you determine your prices and R&D allocations.

Make sure your proposed changes in strategy are firmly based on this analysis of financial and market data and sound business principles. Your goal is to practice using CVP and get better at it.

Present your analysis professionally, making strategic use of tables, charts, and graphs.

Time Line Summary:

SLP1

2016: Hired on December 31, 2016.

Turned in the first report to CEO Smothers.

SLP2

You are returned – via Time Warp – to January 1, 2013.

You make decisions for 2013 – 2016.

December 31, 2016 – You have revised all four years, and you write up your summary report.

SLP3

Apparently, your SLP2 decisions were not “good enough,” as you have again been returned to January 1, 2013.

Once again, on January 1, 2013, you decided to use CVP analysis to develop a revised four-year plan for your strategy. You analyze the results of your first decisions from SLP2, taking notes and documenting your decision-making process. You use the CVP Calculator to help you develop your strategy. Your notes explain the logic behind your decisions.

SLP4

It is still January 1, 2013. Using your CVP analysis from SLP3, you run the simulation, implementing your revised four-year plan. You keep track of your financial and marketing results year over year.

You submit your final 6- to 8-page report, which includes your Final Total Score.

You compare – and report – your results with previous results.