Reeby Sports Case Study

Help Jenny forecast dividend payments for Reeby Sports and estimate the stock’s value.

In this case, it “support” financial logic to value the shares concerning George’s forecasts. As he suggests, the key determinant of the company’s growth and future value is profitability (ROE) and the ability to reinvest the retained earnings. The dividend payout provides the basis for determining the retained earnings. Based on the spreadsheet, between the years 2008 and 2013, the company had a 15% ROE. If, by chance, Reeby Sports losses a competitive edge by 2011, it won’t be easy to continue running below the cost of capital, which is 10%. With this, starting in 2011, ROE was reduced to 10%.

We can get the stock value by setting ROE= 0.1 for 2008-2010 and 2011-2012. ROE × (1 – dividend payout ratio) = .10 × (1 – .30) = .07.

The PV = $13.17

The present value for Growth Opportunity (PVGO) = ROE-R

PVGO = 16.82-13.71 = $3.11 per share invested in 2008 and later years.

Alternatively, considering the presence of “comparable” factors, which are competitors, we can use the P/E ratio of 13.1 to get the horizon value in 2010 and PV

PVH =13.1 ×2.37 =$31.05

PV =3.43 +

=$20.96

31.07

(1.10)6

The comparable P/E, the value of the company, say 2016, can also be calculated directly from 2017 EPS PV = 13.1 x 2.03 = $26.59

How much of your estimate of the value of Reedy’s stock comes from the present value of growth opportunities?

To calculate share value, we have to estimate a horizon value in 2010 and add its PV to dividends from 2008 to 2017. Using the constant-growth DCF formula,

PVH = 0.71/ (0.80-0) = 0.8875

The PV of dividends from 2009 to 2017is $3.43 in 2008, so the share value in 2008 is

PV = 3.43 + 23.72 = $16.82

(1.1)6

The spreadsheet shows the PV of dividends through 2017 and the horizon value this year. Just a note, the PV in 2008 remains at $16.82. This seems to make sense as the firm’s value is not dependent on the investment horizon selected for valuation.

What would be the company’s value if we had used the multiples of the comparable companies?

In this case, George can use the comparable P/E ratio to calculate the company’s 2008 value directly from 2009 EPS.

PV = 13.17 x 3.1 = $40.83

ORDER A PLAGIARISM-FREE PAPER HERE

We’ll write everything from scratch

Question

Reeby Sports case study

*Find the full case study in the attachment*

Reeby Sports Case Study

Questions:

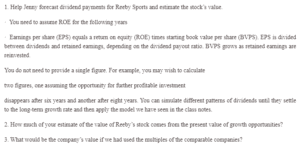

1. Help Jenny forecast dividend payments for Reeby Sports and estimate the stock’s value.

· You need to assume ROE for the following years

· Earnings per share (EPS) equals a return on equity (ROE) times starting book value per share (BVPS). EPS is divided between dividends and retained earnings, depending on the dividend payout ratio. BVPS grows as retained earnings are reinvested.

You do not need to provide a single figure. For example, you may wish to calculate

two figures, one assuming the opportunity for further profitable investment

disappears after six years and another after eight years. You can simulate different patterns of dividends until they settle to the long-term growth rate and then apply the model we have seen in the class notes.

2. How much of your estimate of the value of Reeby’s stock comes from the present value of growth opportunities?

3. What would be the company’s value if we had used the multiples of the comparable companies?