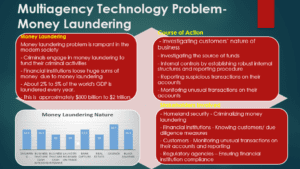

Multi-Agency Technology Problem – Money Laundering

Money laundering has become a big challenge to homeland security in the modern day. Criminals are using technology to hack into financial business systems to carry out unauthorized transactions and get the funds to fund their criminal activities. To prevent money laundering, all stakeholders, including financial institutions such as banks, customers, and the Department of Homeland Security, need to work collaboratively to counter this criminal activity. Banks are responsible for carrying out due diligence to know their customers. Banks should know what the customers do and what their source of finance is. Customers are responsible for reporting any suspicious transaction on their accounts to banks or Homeland Security. Homeland security has the responsibility of investigating suspected individuals’ nature of business and their source of money.

Cox, D (2014). Handbook of Anti-money Laundering. John Wiley & Sons.

IFC. (2019). Anti-Money-Laundering (AML) & Countering Financing of Terrorism (CFT) Risk Management in Emerging Market Banks. https://www.ifc.org/wps/wcm/connect/e7e10e94-3cd8-4f4c-b6f8-1e14ea9eff80/45464_IFC_AML_Report.pdf?MOD=AJPERES&CVID=mKKNshy

ORDER A PLAGIARISM-FREE PAPER HERE

We’ll write everything from scratch

Question

Multi-Agency Technology Problem – Money Laundering

For this assignment, complete the following:

Develop a quad chart that outlines potential courses of action (COA) to address a pressing multijurisdiction or multiagency problem that deals with technology, vulnerability assessment and protection, intelligence, or policy issues.

The COA must employ at least 1 technique or process from the contrarian approach methodology.

The quad chart must include the stakeholders who are affected by each COA.