Litigation, Censures, and Fines

Explain the Importance of Ethics in Accounting

Upholding the code of ethics in the accounting profession safeguards a company’s reputation. The business community expects companies to give accurate, timely, and transparent financial statement reports. Accountants safeguard a company’s reputation by abiding by the rules and regulations of the relevant governing body (Jaijairam, 2017). A false representation of a company’s financial position taints its reputation, thereby affecting its trustworthiness. If an audit report reveals that false reporting was deliberately done, it may lead to legal troubles for the company and individual accountants.

Besides, accounting ethics is important in ensuring companies pay taxes proportionate to their profits. Businesses have the legal obligation to file true financial statements in tax forms. Some companies cheat the taxman by underreporting their revenue with the hope of paying less tax. In some instances, companies over-report their financials to enhance their investment stakes. However, the code of ethics prevents both instances since those caught can be fined or prosecuted (Duska et al., 2018). The code of ethics in accounting encourages the presentation of true information.

A company’s plans also depend on the accounting process. Managers expect accountants to make accurate and timely financial statements to help them make critical decisions regarding an organization’s future. If the financial statements presented are inaccurate, the company may miss important business opportunities or incur higher costs (Duska et al., 2018). Therefore, the code of ethics ensures there is no misrepresentation of numbers in the financial statements presented to stakeholders.

The code of ethics in accounting also helps companies to comply with universal accounting regulations. For instance, multinational corporations are expected to comply with generally accepted accounting principles (GAAP) when preparing financial statements (Jaijairam, 2017). Strict adherence to GAAP principles saves companies unnecessary legal hitches when auditors undertake strict checks to ensure adherence.

Apart from helping the organization, the code of ethics in accounting also instills ethical and moral standing among accounting professionals. Professional bodies that enroll practicing accountants monitor their conduct. For instance, in the UK, the Institute of Chartered Accountants in England and Wales (ICAEW) monitors individual conduct by accountants (Jaijairam, 2017). Among other functions, the body ensures the information provided to the financial market is reliable. The body also ensures accounting behavior boosts a firm’s financial standing.

Apply Ethical Principles and Professionalism to the Case at ACC KarParts

ACC KarParts supervisor’s request reflects income smoothing used for the wrong reasons. The main purpose of income smoothing is to spread net income fluctuation from one period to the next in the company’s interest (Chong, 2006). As long as accountants undertaking the process abide by the generally accepted accounting principles (GAAP), they can undertake income smoothing. GAAP principles prohibit companies and their accountants from issuing creative financial statements in the name of income smoothing (Chong, 2006). Quinn’s proposal would be acceptable if it were to benefit the company. A smoothing strategy used to benefit a group of stakeholders, including the management, contravenes GAAP principles and can raise a red flag during auditing.

Another ethical failure in Quinn’s proposal is the suggestion that the rest of the company stakeholders be kept in the dark. An income smoothing process ought to be documented and reported sufficiently to all relevant stakeholders. The report should include the reasons for undertaking income smoothing, the benefits from the specific strategies, and the actions geared towards avoiding future problems (Chong, 2006). If accountants fail to abide by these basic principles, it may raise and red flag and subsequent media and investor backlash.

Income smoothing is not an unethical accounting practice per se as long as it is used for the right purpose. The process is a logical and flexible strategy that helps organizations achieve their financial goals. However, overstating profits as 30% instead of 28% to get bonuses amounts to creating artificial account entries, an unethical accounting practice.

Based on Generally Accepted Accounting Principles, Recommend at Least Three Acceptable Legal Alternatives to Meet Company Goals.

A company may be forced to smooth its income to achieve its financial forecasts. The failure to meet forecasts may signal that the business is on the verge of failure (Chong, 2006). Such false signals can potentially lead to the reduction of a company’s stock price. The management is at liberty to smooth out earnings to meet expectations.

Also, smoothing can be used to avoid violating debt repayment plans. Failing to pay commercial loans on time has many repercussions for companies, including higher interest rates and possible demand for immediate repayment (Chong, 2006). In this case, a company can smooth out income to reflect lower earnings for the current year.

Also, smoothing out loss provisions can help a company reduce the tax burden. If a company makes less income today but can manage taxes, it can overstate income to avoid a huge tax burden in the future. Overstating income today also happens if a company wishes to implement big projects in the future that may cause financial burdens.

References

Chong, G. (2006). Is income smoothing ethical? Journal of Corporate Accounting & Finance, 18(1), 41–44. https://doi.org/10.1002/jcaf.20261

Duska, R. F., Brenda Shay Duska, & Kenneth Wm Kury. (2018). Accounting ethics. Wiley Blackwell.

Jaijairam, P. (2017). Ethics in Accounting. Journal of Finance and Accountancy, 23, 1-13

ORDER A PLAGIARISM-FREE PAPER HERE

We’ll write everything from scratch

Question

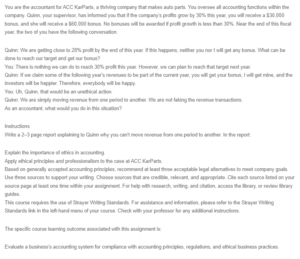

You are the accountant for ACC KarParts, a thriving company that makes auto parts. You oversee all accounting functions within the company. Quinn, your supervisor, has informed you that if the company’s profits grow by 30% this year, you will receive a $30,000 bonus, and she will receive a $60,000 bonus. No bonuses will be awarded if profit growth is less than 30%. Near the end of this fiscal year, the two of you have the following conversation:

Litigation, Censures, and Fines

Quinn: We are getting close to 28% profit by the end of this year. If this happens, neither you nor I will get any bonus. What can be done to reach our target and get our bonus?

You: There is nothing we can do to reach 30% profit this year. However, we can plan to reach that target next year.

Quinn: If we claim some of the following year’s revenues to be part of the current year, you will get your bonus, I will get mine, and the investors will be happier. Therefore, everybody will be happy.

You: Uh, Quinn, that would be an unethical action.

Quinn: We are simply moving revenue from one period to another. We are not faking the revenue transactions.

As an accountant, what would you do in this situation?

Instructions

Write a 2–3 page report explaining to Quinn why you can’t move revenue from one period to another. In the report:

Explain the importance of ethics in accounting.

Apply ethical principles and professionalism to the case at ACC KarParts.

Based on generally accepted accounting principles, recommend at least three acceptable legal alternatives to meet company goals.

Use three sources to support your writing. Choose sources that are credible, relevant, and appropriate. Cite each source listed on your source page at least one time within your assignment. For help with research, writing, and citation, access the library, or review library guides.

This course requires the use of Strayer Writing Standards. For assistance and information, please refer to the Strayer Writing Standards link in the left-hand menu of your course. Check with your professor for any additional instructions.

The specific course learning outcome associated with this assignment is:

Evaluate a business’s accounting system for compliance with accounting principles, regulations, and ethical business practices.