Life Cycle Costing

Executive Summary

The purpose of this report is to evaluate the better vehicle to purchase and own for five years for family travel. For this evaluation, two cars with the same capacity have been chosen; the two are a 2018 Hyundai Kona and a 2018 Toyota CHR. The selected car will be sold out at the end of the 5-year period with a resale price identified after deducting all the depreciation over the same period. Hire our assignment writing services in case your assignment is devastating you. We offer assignment help with high professionalism.

Two vehicles have been chosen and assessed in this report. Both vehicles are within a similar price range and performance, while there are both execution and specification varieties in the cars, they are, fundamentally, the same model. The motor vehicle is additionally expressed to be for 100% private purpose, and all things considered does exclude any recompense for potential imposition of any duty.

To differentiate the costs between the two models, a lifecycle costing strategy has been used to consider all the factors – from the buy cost to related working expenses, lastly to the resale net cost. Utilizing Present Value Factors (PVF) because of a discount rate from the opportunity cost of buying it, the expenses related have been adjusted, also, totaled to Net Present Value with a specific end goal to demonstrate a solitary figure to decide the contrast between choices.

By face value, the 2018 Hyundai Kona is more expensive, as the capital expense is lower than that of the comparable 2018 Toyota CHR model. Be that as it may, continuous running expenses of the two vehicles show the advantage inclines the contrary route, with the Hyundai Kona being the costlier choice to run.

On the commencement of a 5-year proprietorship and activity of another vehicle, which will then be sold at the end of this 5-year term, the 2018 Toyota CHR is more economically viable according to cost to operate than the 2018 Hyundai Kona type. However, this is by a little edge, and should distinctive lengths of lifecycles be considered; the Hyundai Kona model may turn into the lower cost elective on the premise of the initial capital cost required to obtain as given by this lifecycle costing model.

2. Introduction

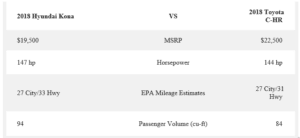

As the crossover segment becomes more popular and more competitive, a driver’s buying decision can get even more robust. This side-by-side comparison of the 2018 Hyundai Kona vs. 2018 Toyota C-HR will offer you a closer look at two of the top new models and inform you as to how they differ from each other. With the detailed information you’ll learn, you should have no problem choosing the right one.

From the start, you can easily see one of the most glaring differences between the 2018 Hyundai Kona and 2018 Toyota C-HR in this comparison. The 2018 Hyundai Kona has a much lower MSRP price than the 2018 Toyota C-HR. With such a big difference in price and an advantage in many other aspects, including horsepower, fuel efficiency, and cargo space, the 2018 Hyundai Kona takes an early lead over the 2018 Toyota C-HR crossover.

Both the 2018 Hyundai Kona and 2018 Toyota C-HR have a lot to offer to crossover SUV shoppers who are looking for excellent versatility. However, the new 2018 Hyundai Kona has a larger interior than the 2018 Toyota C-HR and gives you more passenger volume and increased comfort thanks to its spacious design. The new Kona also gives you more cargo space than the new C-HR. The differences in this comparison between the 2018 Hyundai Kona and the 2018 Toyota C-HR don’t stop there. The new Hyundai Kona also offers you a higher fuel economy rating than the new C-HR crossover. If you want the best crossover and one that can give you the most for your money, the new 2018 Hyundai Kona is a perfect choice as it handily beats the new 2018 Toyota C-HR.

This report gives data concerning capital cost, progressing expenses, and resale estimations of 2 proportional vehicles, one Hyundai Kona and one Toyota CHR both 2018 models. This data has been retrieved from openly accessible sources on the web and included as a reference. This report tries to feature the real qualities and shortcomings of the two models.

This report will detail, with verification where fundamental, any presumptions made in the portrayal of any costs related to the purchase and running of an SUV. These assumptions are made to describe the regions assessed or not reviewed by the expenses gathered and are planned to treat the two models also. The technique utilized for surveying the two vehicles is that of Lifecycle Costing, using the Net Present Value (NPV) procedure. The car is to be obtained with saving reserves, which suggests the markdown rate used is based off the potential open-entryway cost related to the purchase, rather than the cost of capital that would be accessible should the vehicle be financed. The markdown and expansion rates rely upon market benchmarks and are believed to be steady for the required existence of the cars. Working costs of the car reliant on the required family use (and sometimes towing breaking point) have been consolidated and studied to ensure that a relevant degree of value is assessed over the proposed 5-year term for the vehicle.

The primary income incorporated into this report is that of the resale of the vehicle toward the finish of the 5-year time assignment. This surveyed resale value has been established on the assessed deals income of proportionate cars at five years of age and considering the main sticker price that would be depended upon to be recouped in the resale of a car. Finally, in light of the data accumulated, the purpose behind this report is to figure out which one among the cars is more affordable over the communicated 5-year ownership period, taking both purchase costs, running costs, and resale values into a record.

3. Assumptions

In this report, the following assumptions have been incorporated in calculating all the life-cycle costs for both vehicles

- The tow bar has to be fitted separately since a new vehicle doesn’t come with it, and it will be added to the capital expenditure of the car.

- Registration will be considered in Y0 only, insurance and maintenance will be paid on purchase (Y0) and over the entire period of 5 years and also will be considered when finding out the resale value.

- Assuming all other inputs remain constant, the insurance premium will vary for the Hyundai Kona and will be constant for the Toyota CHR

- Market values will be used to calculate insurance premiums, unlike the set-up costs.

- Comprehensive insurance coverage will be taken.

- All the drivers will be legally approved to drive such vehicles.

- There would be no accident incident over the entire period,

- There would be no additional wear and tear to the vehicle as all the enlisted drivers are experienced and qualified.

- The fuel prices will remain constant over the entire period.

- Over the whole period, the vehicles would not require tire change.

11 The car will travel 13,000 kilometers for each year, based on the normal separation

As by Western Australian Drivers. The announced figure has been adjusted down, as this figure likewise writes about business use vehicles, and the average individual uses are lower than this normal.

- A 3-year standard warranty is obtained from both the cars.

- Servicing will be conducted as per the manufacturer’s guidance on purchase.

- Servicing costs are expected to remain constant.

- There would be no extreme mechanical problem beyond the servicing period.

- Registration costs are done only once during purchase.

- There would be a constant inflation rate at 1.6% P/A for the reviewed timeframe.

- The usage of the vehicle is for 100% private family use, and hence there would not be any tax implications considered

- The car to be resold at the end of the period would be in good condition.

4. Discount Rate

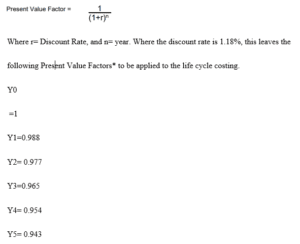

The discount rate utilized in this report is sourced from the average opportunity cost related to the buy of a vehicle. This is the income lost from investment funds being used as opposed to contributing, rather than the potential expense of capital if the purchase was financed through an auto credit. The arrival on a savings maximizer account (ING 2018) is that of 2.8% intrigue per annum. The 2.8% is a nominal rate of return, which incorporates Inflation. With the end goal of this life cycle costing, inflation will be expelled, and a real rate of return will be purposed as the discount rate for further estimations.

Keeping in mind the end goal in calculating this change, it is essential to recognize the present inflation rate. For a reason for this life-cycle cost, inflation is set at 1.6% P.A. This depends on finding the middle value of valuable information throughout the previous three years, and the subsequent rate is relied upon to stay steady all things considered over the accompanying five years.

The real rate of return would then be able to be calculated at 1.18%, as pursues. This real rate of return is that what can be in this way utilized as the discount rate to decide the present esteem factors required for the lifecycle costing.

Real rate of return = [(1 + 0.028) /(1 + 0.016)] – 1

5. Present Value Factor

Determination of NPV is given as below.

6. List of Costs

1. Capital Cost of Vehicles

The cost of the two vehicles (at RRP) are:

Hyundai Kona: $19,500

Toyota CHR: $22,500

2. Tow Bar cost

The tow bar cost for both vehicles is the same, calculated at $ 483.08 for the Hyundai Kona and $503.95 for the Toyota CHR, plus labor of $200. This results in a total cost of $765.

3. Registration Cost

Registration cost for the two vehicles is the equivalent, as registration depends on the motor limit and weight, as opposed to fuel sources. Introductory enrollment will be $577, and no yearly registration expenses will be charged.

4. Insurance Cost

To thoroughly ensure the vehicle has a good insurance cover, three bases are used, on a fundamental ‘market value’ arrangement with an abundance will cost:

Inclusion comprises three distinct cutoff points, substantial damage for every individual, real damage for the whole mischance, and the utmost for property harm. You usually observe estimations of 50/100/50 which remain for $50,000 in inclusion for every individual’s wounds, a point of confinement of $100,000 in damage security per mishap, and a cutoff of $50,000 paid for the harmed property.

5. other total costs

Total initial costs

| Capital Cost of Car | $19,500 |

| Tow Bar | $ 483.08 |

| Registration | $577 |

| Destination costs | $200 |

| Total initial costs | $20,760.08 |

| PVF | 1 | 0.988 | 0.977 | 0.965 | 0.954 | 0.943 |

| TOTAL COSTS | $20,760.08 | 8470 | 4664 | 4317 | 4390 | 5309 |

| PV | $20,760.08 | 8368.36 | 4556.728 | 4165.905 | 4188.06 | 5006.387 |

Total PV =47,045.52

The Toyota C-HR may be the only vehicle in the local Toyota lineup to boast a sophisticated turbocharged petrol engine, but thanks to a generous 12-month/15,000km maintenance interval and a five-year fixed-price servicing scheme. The C-HR’s scheduled servicing plan works out to be cheaper than anything else in the Toyota stable if you’re the type who holds onto a car for five years

Under Toyota’s capped-price servicing scheme for the C-HR, each service costs $195, but the lower frequency of them means you pay much less over time. The C-HR will only need to make half the number of workshop visits over a three-year period compared to the Corolla and will cost $585 after three years/45,000km of motoring.

| Year 1

|

Year 2 | Year 3

|

Year 4

|

Year 5

|

|

| · Depreciation

|

$1208.6 | $1208.6 | $1208.6 | $1208.6 | $1208.6 |

| · Taxes & Fees

|

$1,400 | $95 | $95 | $95 | $95 |

| · Financing

|

$843.75 | $843.75 | $843.75 | $843.75 | $843.75 |

| · Fuel

|

$1,270 | $1,270 | $1,270 | $1,270 | $1,270 |

| · Insurance

|

$500 | $500 | $500 | $500 | $500 |

| · Maintenance

|

$195 | $195 | $195 | $195 | $195 |

| · Repairs

|

0 | 0 | $500 | 0 | 0 |

| Tax Credit

|

0 | 0 | 0 | 0 | 0 |

| True Cost to Own | 5417.35 | 4112.35 | 4612.35 | 4112.35 | 4112.35 |

| Capital Cost of Car | $22,500 |

| Tow Bar | $503.95 |

| Registration | $577 |

| Destination costs | $200 |

| Total initial costs | 23780.08 |

| PVF | 1 | 0.988 | 0.977 | 0.965 | 0.954 | 0.943 |

| TOTAL COSTS | 23760.08 | 5417.35 | 4112.35 | 4612.35 | 4112.35 | 4112.35 |

| PV | 3210.08 | 5352.34 | 4017.77 | 4450.92 | 3923.35 | 3877.95 |

Total net present value figure = $24832.41

TOTAL COSTS

3.75% interest payment.

Resale value, $14,996 initial cost $22,500

Depreciation cost flat rate of 20% assumed.

Financed through a car loan. Finance cost annually assumed value $375 per month for 60 months,

Finance cost gives 375 x 60 = $22500 monthly interest pay is (3.75% x 22500) = $843.75

Insurance paid is normal for the cars of group 14, for 20% tax bracket owner, (assumed the owner will be within 20% tax bracket for both vehicles.)

9. Conclusion

The initial capital costs required for owning these two vehicles, proofs that Toyota C-HR is more expensive to purchase, it costs $23,780.08. However, Hyundai Kona is cheaper coming with the initial costs of $20,760.08. The costs of owning the two vehicles were within a similar range for the two cars but with Hyundai Kona 2018 model having slightly higher running costs.

Taking consideration of the resale value, Toyota CHR performs better with lower annual maintenance costs as compared to Hyundai CHR, its annual maintenance costs of $195 annually unlike. While this is to some extent down to the higher initial value, and expected lifespan of the Toyota CHR, there is additionally market inclination as to the second-hand buy of Hyundai Kona which prompts an infla1ted level of ini1tial cost recovered in the resale.

Lifecycle costing at that point takes the majority of the above into thought. By gathering the average costs, and applying the present value factors ascertained, the aggregate of the expenses, and also the resale income, can be taken back to a solitary net present esteem figure. For the Hyundai Kona, this is an expense of $47,045.52, and the Toyota C-HR $24832.41. The distinction in the existence cycle cost of the two vehicles is $22,213.11, a little more than an extra half of the estimation of the Toyota C-HR to buy and run the Hyundai Kona over a 5-year term.

At last, the Toyota C-HR show scrapes in ahead in this costing model, anyway, it is worth noticing that the genuine cost differences between the two models were fundamentally lower than initially shown by the buy costs. Should the vehicle be kept for a more drawn out time of time before resale, it is sensible to expect that the Hyundai Kona model would then outflank the Toyota CHR? In that capacity, the critical factor in primary leadership between the Hyundai Kona and Toyota C-HR is the average time that the vehicle will be held for.

References

https://www.autoblog.com/2018/04/10/2018-hyundai-kona-vs-other-small-crossovers-compare/

https://www.carbuyer.co.uk/reviews/hyundai/kona/suv/mpg

https://www.asburyauto.com/compare/2018-hyundai-kona-vs-2018-toyota-c-hr/151620

https://www.auto123.com/en/news/2018-hyundai-kona-pricing/64415/

https://www.teamhyundaimd.com/models/hyundai-kona-lexington-park-md.htm

ORDER A PLAGIARISM-FREE PAPER HERE

We’ll write everything from scratch

Question

You are contemplating the purchase of a new car for family use including holidays. You are to choose two brand-new vehicles that have similar specifications and purchase prices and perform a Life Cycle Costing calculation using the Net Present Value method to determine their life cycle costs, over a period of 5 years. The vehicle is to be purchased using a car loan from a lending institution. As the vehicle is for private use only, you must ignore any tax implications in your life cycle costing but must consider the resale value.

Life Cycle Costing

As a minimum you must provide the following information for both vehicles:

- a detailed description of ALL your assumptions

- a detailed explanation and breakdown of all costs and values used in your costing (do NOT use published all-inclusive rates per kilometre for running expenses)

- sources for ALL the data used (with sources proven by screenshots).

- a comprehensive explanation (with sources, proven by screenshots) for your choice of discount rate and method for handling inflation

- a single A4 spreadsheet per LCC which shows all the relevant costs and values for the full life cycle as well as the discounting calculations. The spreadsheets are to be in landscape layout, titled, and use the following general layout for information: