Healthcare Budget Request – Telehealth-Based Post-Discharge Follow-Up Program

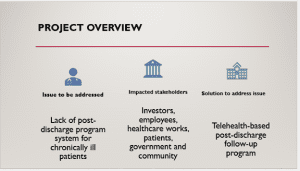

The information provided in this executive summary relates to a project aimed at introducing a new telehealth-based post-discharge program in the HealthWays Clinic. The executive summary covers various aspects relating to this project, including a discussion of the healthcare issue, affected stakeholder groups, stakeholder groups to play a role in implementation, and the proposed solution, as given in the next subsection.

Healthcare Issue/Opportunity

The healthcare budget request relates to a business case for HealthWays Clinic that has been evaluated keenly. Specifically, the business case entails a gap in the HealthWays Clinic in which it was established that there is no formal post-discharge follow-up system for chronically ill patients. Patients with heart failure and diabetes are some of the examples. From the evaluation, it was established that the patients would end up being readmitted to our hospital within 30 days after their discharge. Notably, this is largely attributable to a lack of proper post-discharge care coordination. It is apparent that if this continues, HealthWays Clinic will suffer reputational damage and incur losses. There is a need to avoid direct and indirect costs through innovative solutions (Waxman & Massarweh, 2018). Therefore, a solution is necessary to address this issue. According to López-Luiz et al. (2024), the issue is detrimental to patient outcomes and contributes to hospital readmissions, which trigger financial penalties under value-based care reimbursement models.

Impacted Stakeholder Groups

Implementing the system will impact various groups of stakeholders. Patients will be the first group of stakeholders to be impacted. As the primary stakeholders, they will experience better care from the hospital after their discharge. The subsequent group of stakeholders to be affected will be healthcare personnel, who will be responsible for using the healthcare system daily. Consistently, the hospital management and government will form a group of secondary stakeholders. Notably, this group of stakeholders is crucial for the implementation of the system from the policy front.

Stakeholders Responsible for Implementation

Essentially, this group of stakeholders will be responsible for assisting to address the issue. For example, the management will have to approve the implementation of the system and offer fiscal support. Therefore, the hospital management will play a crucial role in implementing the project. Further, implementation of the project will entail health workers assigned to ensure the system is installed. Essentially, this group of stakeholders will work under the guidance of a project manager selected from HealthWays Clinic’s management team. The government, on the other hand, must ensure that the surrounding environment is favorable by providing security.

Proposed Solution

Based on the identified issue, a solution that entails a telehealth-based post-discharge follow-up program is recommended. The system will aid in tracking the health status of patients post-discharge. Essentially, the project applies to HealthWays Clinic by making it easier to follow the patient’s recovery process post-discharge period, which in turn will make the patient’s recovery success rate grow. Following this, acquiring or developing this system will necessitate funds that are not currently available; therefore, a budget request is being made to ensure that the project begins and is completed successfully.

Conclusion

HealthWays Clinic faces a problem that could be turned into an opportunity through a carefully implemented strategy. As provided, the level of post-discharge readmission is high and could be turned into an opportunity using the proposed solution of a telehealth system that will aid in alienating the issue. It is crucial to note that all stakeholders must collaborate for maximum gain.

References

López-Luis, N., Rodríguez-Álvarez, C., Arias, A., & Aguirre-Jaime, A. (2024). Discharge follow-up of patients in primary care does not meet their care needs: Results of a longitudinal multicentre study. Nursing Reports, 14(3), 2430–2442. https://doi.org/10.3390/nursrep14030180

Waxman, K., & Massarweh, L. J. (2018). Talking the talk: Financial skills for nurse leaders. Nurse Leader, 16(2), 101–106. https://doi.org/10.1016/j.mnl.2017.12.008

W4A3 Projected Expenses and Revenues (Five Year)

Analysis

The information in this analysis offers insight into the projected expenses, revenues, and the return on investment for the project. The costs are not accurate as they present a forecast. However, the basis for their estimations is provided, which attempts to make them as realistic as possible. Notably, this discussion is given below:

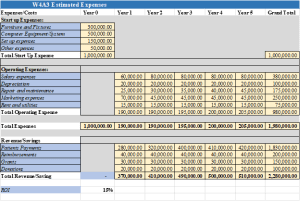

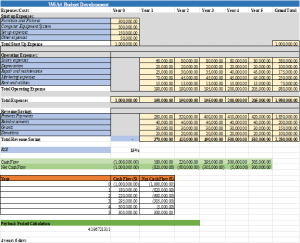

Start-Up Expenses Analysis

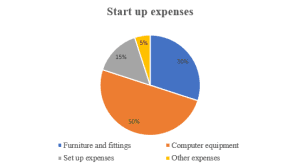

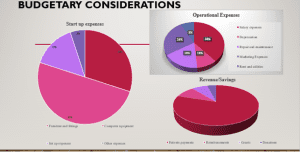

The projected start-up expenses are provided in the schedule above, imported from the budget Excel sheet. The project is expected to cost $1,000,000. The breakdown of this amount is informed by Smith’s (2025) evaluation of healthcare project costs. Notably, this cost will entail furniture and fittings for the set-up of the department to run the project, which will cost $300,000. The start-up cost includes a computer program and accessories that will be used to run the intended project, costing $500,000. The start-up cost also includes set-up expenses that include payments to experts setting up the system, and training for first-time users, which will cost $150,000. Lastly, start-up costs are allocated $50,000 to cater for any unforeseen needs that may arise during set-up.

Operating Expenses Analysis

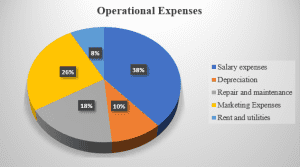

Regarding operating expenses, the organization will incur salary expenses that entail remuneration to staff. Notably, this cost will be incurred monthly and will remain constant across the years, other than the first year, as no more staff will be hired unless reviewed so by the management. The project manager will be paid an annual salary of $25,000, and the team members will share the remaining $55,000 within the industry remuneration standards (Leon et al., 2024). Essentially, there will be a 33% increase in salary due to addition of a worker to enhance the workforce capability. A depreciation cost based on a straight-line method of $20,000 will be incurred every year. Notably, this cost relates to the wear and tear of computers, furniture, and fittings. A forecast of repair and maintenance for the systems, computers, and fittings is estimated to keep rising across the five years from $25,000 to $50,000. The project will also entail marketing costs to reach target consumers. Notably, a constant budget of $45,000 is set up. Lastly, rent and utilities of $15,000 every month will be incurred.

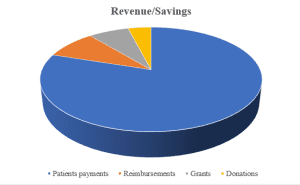

Revenues Analysis

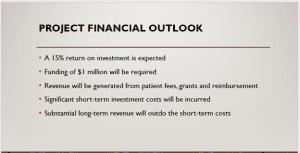

Regarding revenues, the organization will generate its revenue from patient payments, reimbursements, grants, and donations. The organization expects to raise a major part of its revenue from patients’ payments. It is estimated that the hospital will serve between 80 and 100 patients per month charging each of them $300 for the service. Other revenue streams available for hospitals that are anticipated include reimbursements, grants, and donations which are expected to raise $90,000 every year (Smith, 2023). When comparing the revenue versus the costs to be incurred in the project, a positive return on investment is realized. Notably, a 15% positive return on investment is envisioned, which makes the project an attractive venture for prospective investors. The ROI must be realizable across the five years; therefore, the investors must be willing to commit throughout this period to gain a return on investment.

Conclusion

The costs and revenue model for HealthWays Clinic are provided above. The information regarding the two is informed by scholarly work and industry insights. The revenue exceeds the costs, indicating profitability. However, there is a need to conduct a cost analysis for the effective delivery of the set budget.

References

Leon, G., Carbonel, C., Rampuria, A., Rajpoot, R. S., Joshi, P., & Kanavos, P. (2024). An assessment of the implications of distribution remuneration and taxation policies on the final prices of prescription medicines: Evidence from 35 countries. The European Journal of Health Economics, 26(3), 513–536. https://doi.org/10.1007/s10198-024-01706-x

Smith, T. (2025, January 23). How much EHR costs and how to set your budget. EHR in Practice. https://www.ehrinpractice.com/ehr-cost-and-budget-guide.html

W6A4 Projected Budget (Five Year)

Analysis

A budget is a crucial tool for managing the resources of a firm. Upon budgetary process completion, there can be a budget deficit or budget surplus. Notably, this is the objective of this analysis, whereby the budget of HealthWays Clinic is reviewed to determine whether a surplus or deficit is achieved. Further, budgetary risks and percentage allocations are evaluated.

Budget Surplus/Deficit Evaluation

Over the five years of the budget, a budget surplus is established. The budget surplus is equivalent to the profit that HealthWays Clinic is likely to generate after adopting the new project. However, it is important to note that the surplus is realized in the fifth year. A budget deficit is evident across the first four years. From the payback period that is calculated, the clinic will take five years to fully recover the capital investment made into the project. In the end, the budget surplus will make the project worth consideration for investors. The budget surplus is representative of the return on investment (ROI) of 15% that is reported.

Percentage Budget Allocations

Various percentages of the budget are dedicated to various categories. Starting with the start-up costs, 30% of the budget is allocated to furniture and fixtures, 50% to computer equipment/system, 15% to set-up expenses, and 5% to other expenses that may be unforeseen at the start of the project. Essentially, this is so because, without unforeseen cost allocation, projects are likely to fail (Baker, 2022). Regarding operating expenses, the allocation of expenses as a percentage varies yearly. The following chart gives an insight into operational expense allocation.

However, there are some costs whose budgeting allocates them to constant amounts. Notably, these entail rent and utilities, depreciation, and salary expenses. For revenue allocation, the following chart gives an allocation of the percentages.

Budgetary Risks That Can Lead to Variances

Repair and maintenance costs and marketing expenses will vary based on the needs of each year across the five years. The budgeting anticipates some risks. According to Okeke et al. (2024), risks are inherent in any budgeting process. For the subject budgeting process, unforeseen risks in a rise in interest rates are expected. Essentially, this can make the prices of commodities go higher than anticipated. Second, risk in government policy changes is expected to influence the costs in the market unfavorably. As a measure to mitigate the risks, the budget allocates $50,000 to other expenses, which will be used to cater for any risks that may occur unexpectedly. The budget means survival for HealthWays Clinic. Notably, this is so because the challenge that is addressed by the budget has unintended consequences of tarnishing the organization’s reputation. Consequently, the organization may lose even the current revenue streams by not addressing the subject issue. Therefore, the budget is crucial for the long-term survival of the organization. ROI

Conclusion

The budget for HealthWays Clinic indicates that a budget surplus is attained. Notably, this indicates that the project is worthwhile. Further, this is supported by the payback period that is calculated. However, there is a need to implement risk mitigation measures for the outcomes to be realized.

References

Baker, F. A. (2022). Budgeting for Success: Management and Resource Planning. In Leadership and Management of Clinical Trials in Creative Arts Therapy (pp. 107-120). Cham: Springer International Publishing. https://doi.org/10.1007/978-3-031-18085-9_5

Okeke, N. I., Bakare, O. A., & Achumie, G. O. (2024). Forecasting financial stability in SMEs: A comprehensive analysis of strategic budgeting and revenue management. Open Access Research Journal of Multidisciplinary Studies, 8(1), 139-149. https://doi.org/10.53022/oarjms.2024.8.1.0055

W10/11A6 Organizational Statement Analyses

The organizational statement analysis is provided in this section. It offers an insight into the company’s performance, which offers crucial information to various decision-making groups. The statement analysis takes a horizontal approach, whereby performance is compared across two years (Welc, 2022). The comparisons are made in relation to the income statement numbers, balances, expenses, operating revenue, operating margin and days cash on hand. The analysis is based on the assumption that the economic conditions will remain stable and, thus, no drastic changes will occur in supply prices.

Income Statement

The income statement gives an insight into the organization’s generation of income. Healthways generated a net income of $3,758 and $-1307 in the years 2018 and 2019, respectively. It is an excellent improvement across the two years in financial performance.

Balances

The balances for total operating revenues were $650,937 and $627,842 across the two years under consideration. The balances for operating expenses were $647,179 and $629,148 across the two years. The expense balance increases just like in the case of revenues.

Expense per Encounter

When total expenses are divided by the total number of encounters registered, the expense per encounter is realized. For the year 2018, the expense per encounter was $175.91, while it was $180.22 in 2017. The change across the two years indicates a positive financial performance for the company.

Total Operating Revenue per Encounter

The total operating revenue per encounter is achieved by dividing total operating expenses with the total number of encounters. The total operating revenue per encounter was $176.93 in 2018 and $179.85 in 2017. Essentially, this is a positive improvement across the two years because it shows an enhanced operational efficiency.

Operating Margin

The operating margin indicates the organization’s profitability resulting from operating activities. 0.58% profit margin indicates a relatively good financial performance in 2018. However, the same cannot be said for the year 2017, as a negative operating margin of -0.21% is reported. It reflects a poor financial performance. Essentially, this could be due to operational inefficiencies that resulted in more expenses as compared to revenues generated.

Days Cash On Hand

The days cash on hand indicates the amount of cash that the firm requires per day to run its operations efficiently. The cash at hand ensures that the company maintains liquidity at levels where it can meet its maturing obligations as and when they fall due (Décamps & Villeneuve, 2022). The days cash on hand for 2018 was 3.2 in 2018 and 7.0 in 2017. The change across the two years is positive, indicating improvement in the company’s ability to manage cash efficiently.

Conclusion

There has been significant improvement in performance across 2017 and 2018. As analyzed, Healthways Clinic attained better performance in 2018, which can be associated with better efficiency in managing operational costs. Essentially, this offers investors confidence to entrust their funds to the organization’s project.

References

Décamps, J. P., & Villeneuve, S. (2022). Learning about profitability and dynamic cash management. Journal of Economic Theory, 205, 105522. https://doi.org/10.1016/j.jet.2022.105522

Welc, J. (2022). Financial statement analysis. In Evaluating Corporate Financial Performance: Tools and Applications (pp. 131-212). Cham: Springer International Publishing. https://doi.org/10.1007/978-3-030-97582-1_3

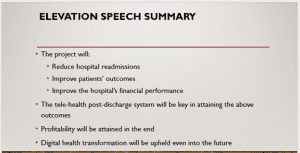

W10/11A6 Summary/Elevator Speech (PPT slides)

ORDER A PLAGIARISM-FREE PAPER HERE

We’ll write everything from scratch

Question

Healthcare Budget Request – Telehealth-Based Post-Discharge Follow-Up Program

W10/11A6 Final Healthcare Budget Request

Once an idea has matured to the point that there is a clear understanding about the organizational and financial impact, there is typically a need to request resources to bring the idea to reality. This is typically done by submitting a budget request in the hopes of getting the idea on the budget, meaning there is organizational commitment to move forward with the idea by planning to allocate necessary resources. This commitment implies that the expenditure aligns with organizational objectives and the financial position of the organization.

In this Assignment, you will analyze financial statements to determine the financial health of an organization. You will use this assessment as part of a final healthcare budget request.

Healthcare Budget Request – Telehealth-Based Post-Discharge Follow-Up Program

Resources

Be sure to review the Learning Resources before completing this activity.

Click the weekly resources link to access the resources.

WEEKLY RESOURCES

To Prepare

Reflect on the previous Healthcare Budget Request assignment submissions, including your executive summary, your Expense/Revenue/ROI Analysis, your estimated budget, and your ratio analysis.

Review the Excel Assignment Workbook, W10/11A6 HealthWays Financials tab. These are sample financial statements.

Reflect on the information conveyed by these statements.

If possible, secure copies of your healthcare organization’s income statement, balance sheet, and statement of cash flows. Consult with your internal financial counselor on this, as needed.

The Assignment

Finalize your Healthcare Budget Request by completing the following:

Part 1: Financial Statement Calculations and Analysis:

Open your Excel Assignment Workbook and navigate to the “W10/11A6 Financials” worksheet.

You have 2 Options for completing this Assignment as noted in the Excel Assignment Workbook.

Using the Healthcare Budget Request Guide for guidance, conduct analyses as directed on either your organization’s financial statements or those provided in the HealthWays Financial Statements worksheet. Your analysis will include spreadsheet calculation of financial statement ratios.

Part 2: Summary of Analyses and Interpretation of Results:

Create a brief (1- to 2-page) description of your analyses. Be sure to address the following in your summary:

Describe the results of each statement analysis. What do the results of each analysis mean?

What does your complete financial statement analysis suggest about the financial health of the organization?

If using your current organization’s data, does your analysis help describe any observed organizational behaviors or actions? Explain.

What assumptions have you made in your analyses?

What implications do these analyses have for your proposed healthcare product or service?

Part 3: Summary of Work and Final Healthcare Budget Request

Compile and summarize your work in previous assignments. Place your final work on the Healthcare Budget Request template. Your final Healthcare Budget Request should include:

A final version of your Executive Summary

A final version of your projected expenses and revenues

A product/service budget for the launch and the first 5 years

A summary of financial and SWOT analyses that you conducted, including your interpretation of the results

A 3- to 5-slide PowerPoint presentation containing the final version of your elevator speech, incorporating selling points from your analyses that you believe make the business case for nurse entrepreneurship and leadership’s commitment to your proposed healthcare product or service.

By Day 2 of Week 11

Submit your Assignment.

*NOTE: You will need to submit three documents: a Word Document,an Excel Spreadsheet, and your PowerPoint for your Assignment submission. Please be sure to only submit your Assignment once you have uploaded these three components of your W11A6 Assignment.

submission information

Before submitting your final assignment, you can check your draft for authenticity. To check your draft, access the Turnitin Drafts from the Start Here area.