Gross Domestic Product

Part 1

| Nominal GDP & Its Components | Real GDP (chained 2012 dollars) | |

| GDP | 23,992.4 | 19,806.0 |

| Expenditures of personal consumption | 16,347.8 | 13,842.7 |

| Investment of Gross private domestic | 4,478.7 | 3,868.9 |

| Goods and services Net exports | -962.6 | -1338 |

| Gross investment and expenditures of government consumption | 4,128.4 | 3,356.8 |

Table 1: Gross Domestic Product: Degree and Switch from Preceding Period

Do you need urgent assignment help ? Get in touch with us at eminencepapers.com. We endeavor to provide you with excellent service.

Percentage of each Category in Real GDP and Nominal GDP

| Nominal GDP & Its Components (Percentage of GDP) | Real GDP [chained 2012 dollars] (Percentage of GDP) | |

| Expenditures of personal consumption | 68.1% | 69.9% |

| Investment of gross private domestic | 18.7% | 19.5% |

| Goods and services of Net Exports | -4.0% | -6.8% |

| Gross investment of Government consumption expenditures | 17.2% | 16.9% |

Table 2: Percentage of each Category in Nominal GDP and Real GDP

Why Nominal GDP was higher than Real GDP

NGD Products considers all the merits of services and goods made in a country by increasing all the benefits and interests produced with the market costs. Nonetheless, the actual gross domestic product decides a country’s output by looking at the country’s investment, exports, and spending. Additionally, RGDP considers the deflation and inflation of the prices of the different goods and services based on a year (Argandoña, 2016). The base year of the above exercise is 2012. In the above case, nominal GDP is higher than real GDP because the country’s net exports of goods and services show a deficit of 962.6, reducing the real GDP by 2480.4.

GDP Categories

The Gross Domestic Product comprises fixed investment, inventory change, net exports, government expenditure or consumption, and private consumption (Beckerman, 2017). Private or personal utilization is the most significant component of Gross Domestic Product, and Net Exports are the minor component of the GDP.

Explanation of Gross Domestic Investment (GDPI)

GDPI refers to manufacturing every investment product to replace structures, equipment, and machinery used in the current year with any net capital earnings in the economy. Its investment majors on both capital earnings and reimbursement. GDPI acts in the place of all expenditures with the primary objective of creating new capital advantages or products that generate income. The mentioned is usually the cost of buying investment products (Guirguis, 2018). Investment products are capital goods such as industrial buildings, equipment, machinery, and construction goods such as roads and houses. Generally, the investment costs in the private sector have a structure, such as the final buying of capital products, the cost of construction, and changes in the investment products of stocks. The government plays a vital role in ensuring that the investment expenditure is seen in government expenditure for procuring services and goods. GPDI continuously measures the expenses of the private business section of a state to develop a specific year.

Goods and Services Net Exports

Net Exports evaluate a country’s trade. It analyzes the imports of services and goods and deducts them from the exports of services and goods. In a situation where Net Export is positive, it usually means more goods were exported than the number of goods imported. Where the value of Net Export is negative, it shows that imports’ value was higher than exports. The Net Export is negative (BEA, 2021). This indicates that import value was higher than exports, creating a trade deficit and imbalance in trade.

Calculating National Defense Percentage out of GDP

The expenditure on “National defense” was 909.1 in the last quarter. At the same time, Government Consumption Expenditure and Gross Investment were 4,128.4. Hence, to find the national defense percentage concerning government utilization and gross investment;

909.1/4128.4*100

=22.02%

The GDP was 23,992.4, around the same quarter.

Then;

909.1/23,992.4*100

=3.79%

Significance of the Data for this Exercise

The data used in the above exercise is concurrent; hence, it shows the actual state of the economy.

What I Have Learned

The exercise has been of great help to me since I now understand the different components and categories of GDP and the effect of each element. Furthermore, I appreciate the difference between Nominal and Real GDP since I can now tell the difference.

Part 2

| Category | Amount |

| GDP | 23,992.4 |

| GNP | 23,470 |

| Net National Product | 19,462.8 |

| National Income | 20,175.4 |

| Personal Income | 20,904.1 |

| Personal Disposable Income | 18,188.2 |

| Personal Savings | 1342.6 |

Table 3

Difference between GDP and GNP

GDP refers to the actual value of services and goods created by a stateless value of goods and services consumed in production. It is measured by adding net exports of services and goods, personal utilization expenditure, gross private domestic investment, gross investment, and government consumption expenditure (BEA, 2021). On the other hand, GDP is the whole worth of all produced services and goods manufactured by the people of a state in a financial year, regardless of geographical location. GDP considers the output of foreign states in a country, while GNP does not believe that.

The Calculation to Determine GNP from GDP

To ascertain GNP from GDP, one has to add the income generated by the country’s citizens in foreign states with the income payment of aliens living within the same country.

National Income

National Income is the value of economic output, which means the measure of services and goods created in a state in a financial year. It measures a country’s net economic businesses in a financial year. The value of National Income is in terms of money.

Between GNP and NI, Which was Higher

In the above case, GDP was higher at 23,992.4 than NI, 20,175.4. The difference between the two was 3817.

Determining NI from GNP

One must reduce fixed capital’s statistical discrepancy and consumption to ascertain NI from GNP.

National Income Categories

The National Income has several categories, including taxes on productions, proprietor’s income inventory valuation, salaries and wages and its supplement, government enterprises’ current surplus, enterprises’ current transfer payments, compensation of employees, and rental income of a person with capital consumption. In the above categories, the balance of employees remains the largest, and the current surplus of government enterprises is the lowest.

Determining Personal Income from National Income

To ascertain personal income from national income, one has to add income earned with income received to the national income.

Determining Disposable Personal Income and Personal Savings

To get Personal Disposable Income, one has to subtract current personal taxes from personal income. On the other hand, to determine Personal Savings, one has to deduct personal outlays from disposable income.

Importance of the Data Given

The data above provides information on a fundamental economic case as it is accurate and provable.

Reflection on the Exercise

The exercise has taught me different concepts, such as the difference between GNP and GDP. I have learned how National Income is generated from GNP and ascertaining Personal Income through NI.

References

Argandoña, A. (2016). Gross Domestic Product (GDP) and Gross National Product (GNP). Encyclopedia of Business Ethics and Society, Forthcoming, IESE Business School Working Paper, (1153-E).

BEA (2021). Gross Domestic Product (Second Estimate) Corporate Profits (Preliminary Estimate) First Quarter 2021: New Release. Retrieved: gdpniwd@bea.gov.

Beckerman, W. (2017). GDP and Friends. In Economics as Applied Ethics (pp. 119-133). Palgrave Macmillan, Cham.

Guirguis, M. (2018). Application of a Principal Component Analysis (PCA), Based on the Macroeconomic Factors, Namely, Personal Consumption Expenditures, Gross Private Domestic Investment, Net Export of Goods and Services, and Government Consumption Expenditures and Gross Investment that Constitute The US GDP. Based on the Macroeconomic Factors, Namely, Personal Consumption Expenditures, Gross Private Domestic Investment, Net Export of Goods and Services and Government Consumption Expenditures and Gross Investment that Constitute The US GDP. (September 21, 2018).

ORDER A PLAGIARISM-FREE PAPER HERE

We’ll write everything from scratch

Question

Gross Domestic Product

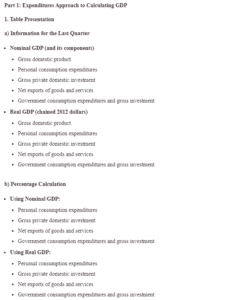

Part 1: Expenditures Approach to Calculating GDP

1. Table Presentation

a) Information for the Last Quarter

- Nominal GDP (and its components)

- Gross domestic product

- Personal consumption expenditures

- Gross private domestic investment

- Net exports of goods and services

- Government consumption expenditures and gross investment

- Real GDP (chained 2012 dollars)

- Gross domestic product

- Personal consumption expenditures

- Gross private domestic investment

- Net exports of goods and services

- Government consumption expenditures and gross investment

b) Percentage Calculation

- Using Nominal GDP:

- Personal consumption expenditures

- Gross private domestic investment

- Net exports of goods and services

- Government consumption expenditures and gross investment

- Using Real GDP:

- Personal consumption expenditures

- Gross private domestic investment

- Net exports of goods and services

- Government consumption expenditures and gross investment

2. Report Analysis (2 pages double-spaced)

- Significance of Nominal GDP over Real GDP

- Composition of GDP by Categories

- Most significant portion

- Least significant portion

- Definition and Significance of “Gross Private Domestic Investment”

- Understanding “Net Exports of Goods and Services” and Its Implications

- Analysis of National Defense Expenditures

- Overall Significance and Reflection on the Data Exercise

Part 2: Income Approach to Calculating GDP

1. Table Presentation

- Information for the Last Quarter

- Gross domestic product

- Gross national product

- Net national development (calculated)

- National income

- Personal income

- Personal Disposable Income

- Personal Savings

2. Report Analysis (2 pages double-spaced)

- Difference Between GDP and GNP

- What GDP Measures Compared to GNP

- Calculations for Determining GNP from GDP

- Definition and Significance of “National Income (NI)”

- Comparison of GNP and NI

- Calculations for Determining NI from GNP

- Composition of National Income (NI)

- Most significant portion

- Calculations for Determining Personal Income from National Income

- Calculations for Determining Personal Disposable Income and Personal Savings

- Overall Significance and Reflection on the Data Exercise