Financial Situation

Introduction

Ascena Retail Group, Inc. is a US national retailer specializing in offering women’s apparel, shoes, and accessories. The retailer’s collective brands include LOFT, Lane Bryant, Cacique, Ann Taylor, and Lou & Grey. The brands serve women across all generations and identities. As of August 2020, Ascena operates e-commerce websites and approximately 1,500 stores throughout the United States through its retail brands. Ascena Retail became one of the retailers that fell during the COVID-19 pandemic. In July 2020, 1,600 of Ascena’s 2,800 stores closed shop, dealing a big blow to shopping malls and to the retailers’ revenues. This was part of a Chapter 11 restructuring to pay off $1 billion of its $1.1 billion in debt. The United States Bankruptcy Court granted the restructuring approval for the Eastern District of Virginia (“Owner of Ann Taylor and Lane Bryant Files for Bankruptcy,” 2021).

Ascena Retail sold two of its brands, Justice and Catherines, early in 2020 and closed all the brand stores, although Catherines continues to operate online. The biggest brands, Anne Taylor, Lou & Grey, and Loft, were sold to private equity firm Sycamore Partners later in December 2020. Ascena Retail Group filed for bankruptcy in July 2020, falling to the economic impacts of the COVID-19 pandemic that has already had a huge negative impact on other giant retail enterprises (Tucker, H. 2020). The company’s sales were already dragging, and the pandemic only made the situation worse. Ascena’s top line fell 4.3 percent in the fourth quarter, and its operating loss widened by 120% (“Owner of Ann Taylor and Lane Bryant Files for Bankruptcy,” 2021). The retailer also exhausted its $230 million credit facility as it sought financial flexibility during the closure of the stores. The Listing Qualifications Department at Nasdaq notified Ascena Retail Group through a letter dated July 24, 2020, of the suspension of trading of its common stock on Nasdaq due to the Chapter 11 Cases. The common stock began trading on the OTC Pink Marketplace under the symbol “ASNAQ.” Mahwah Bergen Retail Group, Inc. is the debtor in possession of the Ascena Retail Group.

Evaluation of Ascena Retail Group Financial Plan

The retail group seeks to meet its potential and known obligations as a result of the Chapter 11 process. The liabilities subject to compromise amounted to $2,0796 million as of October 21, 2020. The retailer ceased recording on the term loans by the time the contractual interest expense was approximately $18.3 million for the three months ending October 21, 2020.

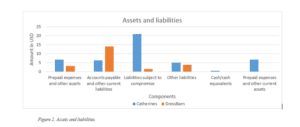

The sale of the original DressBarn line incurred cumulative costs of approximately $50 million, with just $8 million of the income being reflected during the first quarter of the financial year 2020-2021 as no-cash lease-related accruals for terminated lease of stores was reversed following the Chapter 11 proceedings. The discontinued operations of DressBarn resulted in a loss of income of $7.8 million in the first quarter of FY 2020-2021, ending October 21, 2020. The discontinued operations of Catherines incurred cumulative costs of approximately $21.5 million. Income from discontinued operations of the two lines is reflected in Fig. 1. The major components of Dressbarn and Catherines assets and liabilities related to discontinued operations are reflected in Fig. 2. The data has been retrieved from the United States Securities and Exchange Commission (2021), and figures quoted in millions. For the three months ending October 31, 2020, the debtor-in-possession of Ascena Retail Group recognized revenue of approximately $10 million associated with gift card redemptions and breakage. Of these amounts, approximately $2 million was recorded within income from discontinued operations. The reduction in income from gift cards during the three months ended October 31, 2020, due to the significant decline in store traffic reflecting the continued impact of COVID-19 compared to the prior year.

Figure 1. Costs of discontinued operations

Cost of Capital and Direct Costs

Figure 2. Assets and liabilities

Assets and liabilities

One of the most effective solutions for the ailing retailer is focusing on core activities or cutting the marketing spend and reducing costs to give the business the finance it requires to clear debts with suppliers and other creditors.

Determine strategies for achieving a sustainable competitive advantage in the marketplace and increasing financial performance.

The retailer must embark on rigorous market research that would enable it to close in on profitable niches not currently well-serviced by competitors. Understanding the market and its segments will give the enterprise a competitive advantage to make a comeback and run profitably. The company should establish new and sustainable markets that will identify uniquely with the brand. This should also integrate an understanding of the customer needs and create value that would earn customer loyalty. Establishing support for the value in terms of quality, pricing, and branding will give the retailer a competitive advantage in the market. This can be innovatively built on the retailer’s past strengths and core competencies. According to the target market, strategic pricing effectively cuts a niche in the larger segments. Good pricing will ensure cost-effectiveness in producing and distributing the retailer’s products. With changing ways of doing business, the company should optimize its technological competitiveness and move most of its business online. This streamlines operations cost-effectively. The retailer should also be more adaptable to changing markets and trade factors, expanding and dynamic niches and be willing to leverage the information age to capture trends and create products that appeal to the markets.

Reduction of expenses is one sure strategy to improve the organization’s financial performance. This can be achieved by getting a better deal when it comes to insurance and supplies, streamlining production methods to integrate low-cost means such as renewable energy, and only buying stock when the cash flow is high. Given its good asset standing, the retailer should consider leasing off some of the main assets and selling the ones that attract unnecessary maintenance and insurance costs. Finance performance can also be improved by investing in research and development for the purpose of finding new ways to streamline the organization’s financial operations. The retailer should also consolidate its data and use the means with the lowest interest to refinance. This will help the company cut down on the costs of financing debts.

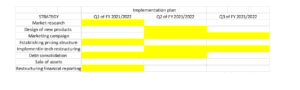

Strategy Implementation Plan

Implementation Plan

References

Owner of Ann Taylor and Lane Bryant Files for Bankruptcy. Nytimes.com. (2021). Retrieved May 19, 2021, from https://www.nytimes.com/2020/07/23/business/ascena-bankruptcy-ann-taylor-lane-bryant.html.

Tucker, H. (2020). Coronavirus bankruptcy tracker: These major companies are failing amid the shutdown. Forbes https://www.forbes.com/sites/hanktucker/2020/05/03/ coronavirus-bankruptcy-tracker-these-major-companies-are-failing-amid-theshutdown/#5649f95d3425

Ascenaretailgroupinc.gcs-web.com. (2021). Retrieved May 19 2021, from https://ascenaretailgroupinc.gcs-web.com/static-files/2b272764-1c13-4f80-9228-ef53c0295edb.

ORDER A PLAGIARISM-FREE PAPER HERE

We’ll write everything from scratch

Question

Financial Situation

Select and research a company that is having financial difficulties or is on the brink of bankruptcy.

Financial Situation

Review “Where Can I Find a Company’s Annual Report and Its SEC Filings?” from Investopedia.You can also access specific information about a variety of businesses in the University Library by searching the following databases:

- University Library > Databases > B > Business Source Complete

- University Library > Databases > E > EDGAR

- University Library > Databases > H > Hoovers

- University Library > Databases > P > Plunkett Research Online

Conduct a strategic analysis of the company’s current financial operations. Determine strategies for achieving a sustainable competitive advantage in the marketplace and increasing financial performance.

Write a 1,050- to 1,400-word analysis. When writing your analysis, complete the following:

- Evaluate the company’s current financial plan, including charts and/or graphs showing financial data from the struggling company, and make recommendations for improvement.

- Determine strategies for achieving a sustainable competitive advantage in the marketplace and increasing financial performance.

- Create a plan to implement the strategies you selected.

Include APA-formatted, in-text citations, and a reference page with at least 3 sources.