Case Study Analysis – Dalton Convention Center

Question One

Fixed costs include salaries for full-time employees, maintenance for the center’s equipment costs, insurance premiums for the center, depreciation for the machinery operated in the center, payroll taxes, and benefits paid to full-time employees. Generally, fixed costs remain constant irrespective of work output (Savelli & Morstyn, 2021). On the other hand, variables change with a change in activity level (Liu & Tyagi, 2017). For this case, variable costs include supplies, cost of goods sold, bills for electricity and gas, payment for rented equipment, water bill, payment for non-fulltime employees, and remuneration benefits based on performance and linens used for events. For the semi-variable costs, there are salaries for workers working on a fixed-term contract and wages for non-fulltime workers. The contribution margin statement is given below.

Table 1

Dalton Convention Center Contribution Margin Income Statement

| Dalton Convention Center Contribution Margin Income Statement For the Year Ended December 31, 2017 | ||

| Revenues | ||

| Food and beverage | ||

| Catering | $528,198 | |

| Concessions | 162,304 | |

| Room rental fees | 567,411 | |

| Others | 11,747 | |

| Total Revenue | 1,269,660 | |

| Less: Variable Expenses | ||

| Costs Cost of Goods Sold | 134,328 | |

| Building supplies

Data processing |

40,105

18,102 |

|

| Building supplies | 40,105 | |

| Water and waste | 16,145 129,661 | |

| Gas | 18,777 | |

| Electricity | 129,661 | |

| Equipment rental | 4,371 | |

| Linens (for events) | 13,978 | |

| Benefits (wages) | 30,419 | |

| Insurance – Workers Comp (wages) | 1,462 | |

| Payroll taxes (wages) | 16,776 | |

| Part-time wages (25%) | 254,438 | |

| Total Variable Costs | 678,562 | |

| Contribution Margin | 591,098 | |

| Less: Fixed Costs | ||

| Full-time salaries (75%) | 746,923 | |

| Equipment maintenance | 24,035 | |

| Insurance – Non- workers comp | 34,792 | |

| Depreciation | 561,805 | |

| Benefits (related to salaries) | 91,257 | |

| Insurance – Workers Comp (salaries) | 4,388 | |

| Payroll taxes (salaries) | 50,329 | |

| Other G&A | 99,236 | |

| Total Fixed Costs | 1,612,765 | |

| Operating Loss | ($1,021,667) | |

The analysis indicates that the center operates at a loss. However, other considerations are worth evaluating before entirely discarding the institution’s significance. Dalton Center should establish strategies that will assist in improving income to ensure a positive operating and net income. One approach for evaluating the significance and use of the center is to conduct frequent analysis of the contribution margin. A contribution margin, like the one for the year under analysis, that is insufficient to pay fixed costs, indicates that the center’s operations must be essential to the community.

Question Two

The current continuing funding needed by the county and city for operating the center can be equated to the total of fixed and variable costs, which amount to $2,291,327. Notably, these amounts are significant compared to when the center is shut down. When shut down, the costs would run to almost zero. However, this should not mean closing the center is a better option. For instance, the 2014 publication by the Dalton Chamber of Commerce titled “Northwest Georgia Trade and Convention Center Economic Impact for Dalton” offers insight into the center’s benefits. According to the publication, the Convention Center’s presence in the town in 2017 contributed almost $5 million. The city would have much less financial flow if the Convention Center’s activities were suspended, meaning reduced tax money for the county and city. The county and the city first constructed the Convention Center to host events about the then-dominant carpet business. The center contributes socially to employees and workers, creating business opportunities for community members. Thus, this analysis suggests that the center is crucial, and profits should not be the only consideration in deciding whether to close or continue its operations.

Question Three

There are benefits and drawbacks to using the Dalton Convention Center’s economic effect to justify operations. An enhanced understanding of the community around the Dalton Convention Center is one advantage of doing an economic impact analysis. The company’s beneficial economic effect extends to the surrounding neighborhood. It considers the effects of a successful business and the potential for development and financial stability for the society at large. Notably, this approach stands out in the business and financial spheres since many organizations are self-centered and self-sufficient, with little consideration for the communities in which they operate. This relates to corporate social responsibility and how a company affects the local economy in its locations. There may be a problem with using economic gain as a very subjective defense for keeping the Dalton Convention Center open. It is not easy to pinpoint the company’s exact economic impact on the community. Notably, this approach relies heavily on the viewpoint of the individual making the financial decisions. The sphere of influence that determines the prosperity of an economy needs to be clarified. It is not easy to comprehend the components that determine economic effect. It does not seem as though there is a clear limit to its economic power. It is challenging to make reliable fiscal decisions when dealing with subjective facts. The Dalton Convention Center would have to at least break even financially. An operational loss (cost) of $1,021,667 for the current year shown in the financial statements would be covered by an economic impact of $5,000,000.

Question Four

The Dalton Convention Center was first built to house the expanding and well-established carpet business and provide economic flow for the local community through higher tax revenues, tourism from the center’s events, and center operations. The local economy and developments in the carpet business prevented the center from producing the expected amount of money. Nonetheless, the center continues to be a net contributor to the community regarding finances. The income statement identified above demonstrates that the center’s overall assets have declined 71%, although overall liabilities have dropped to 37.94%, a far more significant decrease. This indicates that although net assets are rising, the center’s obligations and debt are falling. The Expenses, Statement of Revenues, and Changes in Fund Net Position show that, for the year ended December 31, 2017, operational operations resulted in a net loss of $1,021,667. The income from non-operating activities, which totaled $1,246,599 in 2017, balances this net loss. Net income of $224,932 results from the operating loss and non-operating income. Notably, this suggests that, despite the center’s earnings falling short of initial projections, the center is still a net contribution to the community.

It is simpler to see the concrete advantages of having the center in the community than the ethereal advantages. A convention center that can host athletic events, political speeches, concerts, guest lecturers, and other activities is undoubtedly a helpful resource for the community (García-Muiña et al., 2019). Having a location for the city’s activities is advantageous from the perspective of the local governments associated with the institution. For instance, it is not generally addressed or considered until the requirement for such an event space emerges that the center be prepared to provide assistance and relief to the community’s residents in the event of severe weather. The linkages between convention centers and improved financial flow throughout the community are among the intangible advantages that are harder to pinpoint. As previously established, an estimated $5,000,000 would be the projected economic gain for 2017 alone. By itself, this increase in tax income exceeds the costs that Whitfield County and the City of Dalton pay for operating losses. If the center is regarded as a long-term investment, it will be simpler to comprehend its intangible rewards. Whitfield County and the City of Dalton funded a community center with net assets of $10,390,873 and less than $500,000 in liabilities.

Question Five

Having a conference center in the area gives more chances to make money. The five markets on which the city and county have concentrated their center-related efforts are business events, association events, consumer exhibitions, social events, and religious events. Entering new markets is one of the best strategies to boost sales. The center’s monthly activities were reviewed, and it was found that the least profitable months were January, June, and July. During these months, focus should be placed on finding possible applications for the center while avoiding interfering with ongoing activities. Providing childcare services in the form of sports camps or summer camps in June and July is one way to do this. If given to participants as part of a flat rate fee, this activity might generate extra revenue from food and beverages without requiring any significant capital increases. Organizing food and toy drives in January after the holidays is an idea. After the holidays, it is normal for families to have excess food or outdated toys lying around. It will be good if they make donations to the center. Reducing some variable expenses associated with part-time pay might be accomplished by having community people and businesses volunteer.

References

García-Muiña, F. E., Fuentes-Moraleda, L., Vacas-Guerrero, T., & Rienda-Gómez, J. J. (2019). Understanding open innovation in small and medium-sized museums and exhibition halls: An analysis model. International Journal of Contemporary Hospitality Management, 31(11), 4357-4379.

Liu, Y., & Tyagi, R. K. (2017). Outsourcing to convert fixed costs into variable costs: A competitive analysis. International Journal of Research in Marketing, 34(1), 252-264.

Savelli, I., & Morstyn, T. (2021). Electricity prices and tariffs to keep everyone happy: A framework for fixed and nodal prices coexistence in distribution grids with optimal tariffs for investment cost recovery. Omega, 103, 102450.

ORDER A PLAGIARISM-FREE PAPER HERE

We’ll write everything from scratch

Question

Case Study Analysis – Dalton Convention Center

The following questions should be addressed in the case study assignment. You should use APA formatting and use outside scholarly resources.

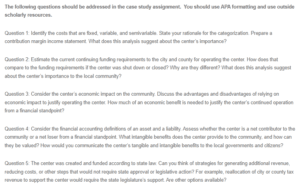

Question 1: Identify the costs that are fixed, variable, and semivariable. State your rationale for the categorization. Prepare a contribution margin income statement. What does this analysis suggest about the center’s importance?

Question 2: Estimate the current continuing funding requirements to the city and county for operating the center. How does that compare to the funding requirements if the center was shut down or closed? Why are they different? What does this analysis suggest about the center’s importance to the local community?

Question 3: Consider the center’s economic impact on the community. Discuss the advantages and disadvantages of relying on economic impact to justify operating the center. How much of an economic benefit is needed to justify the center’s continued operation from a financial standpoint?

Question 4: Consider the financial accounting definitions of an asset and a liability. Assess whether the center is a net contributor to the community or a net loser from a financial standpoint. What intangible benefits does the center provide to the community, and how can they be valued? How would you communicate the center’s tangible and intangible benefits to the local governments and citizens?

Question 5: The center was created and funded according to state law. Can you think of strategies for generating additional revenue, reducing costs, or other steps that would not require state approval or legislative action? For example, reallocation of city or county tax revenue to support the center would require the state legislature’s support. Are other options available?