Case on Budgeting

An Explanation of the Budgeted Income Statement

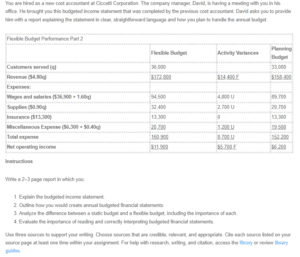

The budgeted income statement is a framework developed by an organization to exhibit the amount of revenue, expenses, and operating profit expected from operations. In the case of Mr. David, there is a need to understand that budgeted income statement figures are estimates and not the company’s actual performance. The given budgeted income statement indicates that the company planned to serve 33,000 customers, which could result in a revenue of $158,400. However, the company managed to serve 36,000 customers in reality and raised revenue of $172,800. Notably, this indicates a positive difference referred to as sales volume variance. A favorable sales volume variance demonstrates good financial performance (Hill et al., 2021). Further, the budget shows that the company incurred more expenses than it planned for, resulting from serving more customers than anticipated. Despite the higher expenses incurred, the actual net operating income, as shown in the flexible budget, is higher than planned and indicates a favorable financial performance by Ciccetti Corporation. Do you need help with your assignment ? Contact us at eminencepapers.com.

Creating Annual Budgeted Financial Statements

Creating annual budgeted financial statements is a process that involves various steps. First, creating annual budgeted financial statements will entail gathering the financial data from previous years to help as a baseline for forecasting the future. Second, I will consider the dates the organization’s fiscal year runs through. Budgeted statements need to reflect the fiscal periods that the company will operate without necessarily being from January to December (Arimany-Serrat et al., 2022). Third, I will create a budgeted income statement highlighting the expected values for revenue and expenses and the operating income. Fourth, I will prepare a budgeted balance sheet to indicate the company’s projected assets, liabilities, and equity. Fifth, I will create a budgeted cash flow statement highlighting cash inflows and outflows during the fiscal year. Lastly, I will revise the prepared budget statements to ensure they are as accurate and realistic as possible.

A Static Budget versus a Flexible Budget

A static budget is an economic plan that remains constant regardless of the company’s activity. It is usually created at the start of the budget period and does not consider volume or activity changes. On the other hand, a flexible budget is often updated to reflect actual performance and can be adjusted to variations in activity or volume (Hiromoto, 2019). Each budget type’s significance varies depending on the nature of the firm and how it operates. A static budget may be helpful in industries with known costs and consistent demand, where there is little change in activity levels. However, a flexible budget is more suited for industries with fluctuating costs or demand since it enables revisions depending on actual performance. A flexible budget also gives decision-makers more precise and pertinent information because it adapts to business activity and volume changes. Managers can then decide where performance can be enhanced and where resources should be allocated wisely.

An Evaluation of the Significance of Reading and Correctly Interpreting Budgeted Financial Statements

Reading and correctly analyzing budgeted financial statements is crucial for efficient financial planning and decision-making. These financial statements give an overview of the financial health of a business and point out any areas that need to be adjusted to reach specific financial objectives. Financial statements that have been budgeted can be correctly interpreted to assist in spotting possible problems before they become serious ones. It can also ensure that a company’s financial resources are utilized effectively and efficiently and that its financial objectives are reached. Making educated decisions on resource allocation, investment opportunities, and financial strategy is possible with the use of this information. Further, budgeted financial statements can serve as a foundation for forecasting and future projections, which is a crucial component of strategic planning. These forecasts can be used to foresee possible hazards and opportunities, which can then be utilized to inform corporate planning.

References

Arimany-Serrat, N., Farreras-Noguer, M., & Coenders, G. (2022). New developments in financial statement analysis. Liquidity in the winery sector. Accounting, 8(3), 355-366.

Hill, G., Johnson, S., & Neil, C. (2021). Sales Forecasting and Budgeting-Outcomes of Variance Analysis. International Journal on Economics, Finance and Sustainable Development, 2(2), 26-32.

Hiromoto, T. (2019). Restoring the relevance of management accounting. In Management Control Theory (pp. 273-288). Routledge.

ORDER A PLAGIARISM-FREE PAPER HERE

We’ll write everything from scratch

Question

Case on Budgeting

You are hired as a new cost accountant at Ciccetti Corporation. The company manager, David, is having a meeting with you in his office. He brought you this budgeted income statement that was completed by the previous cost accountant. David asks you to provide him with a report explaining the statement in clear, straightforward language and how you plan to handle the annual budget.

| Flexible Budget Performance Part 2 | |||

| Flexible Budget | Activity Variances | Planning Budget | |

| Customers served (q) | 36,000 | 33,000 | |

| Revenue ($4.80q) | $172,800 | $14,400 F | $158,400 |

| Expenses: | |||

| Wages and salaries ($36,900 + 1.60q) | 94,500 | 4,800 U | 89,700 |

| Supplies ($0.90q) | 32,400 | 2,700 U | 29,700 |

| Insurance ($13,300) | 13,300 | 0 | 13,300 |

| Miscellaneous Expense ($6,300 + $0.40q) | 20,700 | 1,200 U | 19,500 |

| Total expense | 160,900 | 8,700 U | 152,200 |

| Net operating income | $11,900 | $5,700 F | $6,200 |

Instructions

Write a 2–3 page report in which you:

- Explain the budgeted income statement.

- Outline how you would create annual budgeted financial statements.

- Analyze the difference between a static budget and a flexible budget, including the importance of each.

- Evaluate the importance of reading and correctly interpreting budgeted financial statements.

Use three sources to support your writing. Choose sources that are credible, relevant, and appropriate. Cite each source listed on your source page at least one time within your assignment. For help with research, writing, and citation, access the library or review library guides.