Calculating Prices Case Study

Part (a)

Initial Mark Up (IMU) for the stainless pot = Retail price – Cost of Pots

- IMU = (12× $42) – (12 × $20)

- IMU = ($264/504) × 100 = 52.38%

The minimum initial retail price for the new pots = IMU + Cost Price. But the Cost Price is given by given P × $32, where P is the number of pots initially bought. Meanwhile, the last quarter’s average performances are:

- Expenses averaged = $14, 625 (0.35 × $325,000)

- Markdowns averaged = $39,000 (0.12 × $325,000)

- Profit averaged = $113,750 (0.045 × $325,000)

From these, Sales = Profit + Total Expenses

- Sales = $113,750 + $14, 625 = $128,375

Since profits must be equal, we have

- (P × 32) = $264

- P = 8.25

Minimum initial retail price = $32 + 8.825. Therefore, the minimum initial retail price must be $ 40.825 for the profits to be equal.

Part (b)

IMU2 must be greater than IMU1 for the company to make higher profits than the previous quarter.

- IMU 2 > IMU 1

- 30 × X > $38, where X is a constant value.

- X ≥ 1.27 + $38

The actual retail price should be at least $39.27 for the store to realize a higher profit than the previous quarter of the financial year.

Part (c)

Average margin percentage = ( ) × 100

Items

- of stainless steel = 24 (cost price = $20 each; retail price = $42)

- Wooden Ladles = 18 (cost price = $18 each; retail price = $38 each)

- Planned net sales of the year = $325,000

- Net retail price = (24 × $42) + (18 × $ 38) + (X Pot-hanging racks)

- Net retail price = $1008 + $628 + X Pot-hanging racks

Cost of Goods Sold

- (24 × $20) + (18 × $ 18) + (Y Pot-hanging racks)

- $480 +$324 + (Y Pot-hanging racks)

Therefore, Average margin percentage = ($325,000 – $480 +$324 + (Y Pot-hanging racks)/ $325,000

Average margin percentage = {$324196 + (Y Pot-hanging racks)}/$ 325,000

- Y Pot-hanging racks = $804

Therefore, grouping of pots = ($325,000 – $480)/325,000 × 100 =99.85%

- Grouping for Pot-hanging racks = ($325,000 – $324)/ $325,000 = 99.90%

- Grouping for Wooden Ladles = ($325,000 – $804)/$325,000 = 99.97%

Part (d)

- $480 + $324 + $804 = $1, 608

- ($1, 608 × $51.6)/100 = $829,927

Samantha should suggest bringing the retail prices of all groupings to an acceptable minimum to realize a 51.6% profit target.

Part (e)

Margin calculation can tell more about a company’s sales power by indicating whether the cost of goods is too high to be sold or too low to bear losses (Smith & Hittinger, 2018). For example, if someone deposits $5,000 in a margin account and puts up 50% of the purchase price, it means the account has $10,000 worth of buying power. If the account is used to purchase goods worth $ $2,000, it has $ 8,000 in buying power remaining. There is enough cash to cover the transaction without tapping into the margin. Borrowing money can only happen when the account purchases goods worth more than $5,000.

References

Smith, C., & Hittinger, E. (2018). Using marginal emission factors to improve estimates of emission benefits from appliance efficiency upgrades. Energy Efficiency, 12(3), 585-600. https://doi.org/10.1007/s12053-018-9654-4

ORDER A PLAGIARISM-FREE PAPER HERE

We’ll write everything from scratch

Question

Business Case Scenario

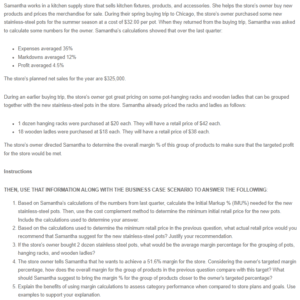

Samantha works in a kitchen supply store that sells kitchen fixtures, products, and accessories. She helps the store’s owner buy new products and prices the merchandise for sale. During their spring buying trip to Chicago, the store’s owner purchased some new stainless-steel pots for the summer season at a cost of $32.00 per pot. When they returned from the buying trip, Samantha was asked to calculate some numbers for the owner. Samantha’s calculations showed that over the last quarter:

Calculating Prices Case Study

- Expenses averaged 35%

- Markdowns averaged 12%

- Profit averaged 4.5%

The store’s planned net sales for the year are $325,000.

During an earlier buying trip, the store’s owner got great pricing on some pot-hanging racks and wooden ladles that can be grouped together with the new stainless-steel pots in the store. Samantha already priced the racks and ladles as follows:

- 1 dozen hanging racks were purchased at $20 each. They will have a retail price of $42 each.

- 18 wooden ladles were purchased at $18 each. They will have a retail price of $38 each.

The store’s owner directed Samantha to determine the overall margin % of this group of products to make sure that the targeted profit for the store would be met.

Instructions

THEN, USE THAT INFORMATION ALONG WITH THE BUSINESS CASE SCENARIO TO ANSWER THE FOLLOWING:

- Based on Samantha’s calculations of the numbers from last quarter, calculate the Initial Markup % (IMU%) needed for the new stainless-steel pots. Then, use the cost complement method to determine the minimum initial retail price for the new pots. Include the calculations used to determine your answer.

- Based on the calculations used to determine the minimum retail price in the previous question, what actual retail price would you recommend that Samantha suggest for the new stainless-steel pots? Justify your recommendation.

- If the store’s owner bought 2 dozen stainless steel pots, what would be the average margin percentage for the grouping of pots, hanging racks, and wooden ladles?

- The store owner tells Samantha that he wants to achieve a 51.6% margin for the store. Considering the owner’s targeted margin percentage, how does the overall margin for the group of products in the previous question compare with this target? What should Samantha suggest to bring the margin % for the group of products closer to the owner’s targeted percentage?

- Explain the benefits of using margin calculations to assess category performance when compared to store plans and goals. Use examples to support your explanation.