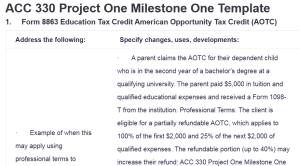

ACC 330 Project One Milestone One Template

1. Form 8863 Education Tax Credit American Opportunity Tax Credit (AOTC)

| Address the following: | Specify changes, uses, developments: |

| · Example of when this may apply using professional terms to describe clients

· Changes to the form from year A to year B · Changes to areas to consider from year to year · Possible new developments and why they may occur

|

· A parent claims the AOTC for their dependent child who is in the second year of a bachelor’s degree at a qualifying university. The parent paid $5,000 in tuition and qualified educational expenses and received a Form 1098-T from the institution. Professional Terms: The client is eligible for a partially refundable AOTC, which applies to 100% of the first $2,000 and 25% of the next $2,000 of qualified expenses. The refundable portion (up to 40%) may increase their refund: ACC 330 Project One Milestone One Template.

· The maximum MAGI thresholds remain $180,000 for joint filers and $90,000 for single filers. Additionally, Form 1098-T is mandatory for claiming the AOTC unless specific exceptions apply. The major structural changes were identified, but users must verify whether updated MAGI limits or Form 1098-T requirements apply. · Verification of TINs for both filer and student by the return’s due date. Ensuring the educational institution’s EIN is included on the form. Proper substantiation of tuition expenses, such as receipts or Form 1098-T. · The increased scrutiny of improper claims suggests tighter reporting and documentation requirements. These changes aim to minimize fraud, particularly regarding eligibility and qualified expenses. |

| Documentation if applicable (statements from taxpayer(s), other substantiating proof, official IRS tax forms provided to the taxpayer(s), etc.) | · Form 1098-T

· Receipts for tuition and course materials · Proof of enrollment (if applicable) · Statements for scholarships or employer-provided assistance. |

| Citations – Include related IRS publications, IRS articles, tax forms for each year used for comparison, and any other supporting research | · IRS Instructions for Form 8863 (2024) https://www.irs.gov/pub/irs-pdf/i8863.pdf

· IRS Publication 970 (Tax Benefits for Education). https://www.irs.gov/publications/p970 |

2. Form 8863 Lifetime Learning Credit (LLC)

| Address the following: | Specify changes, uses, developments |

| · Example of when this may apply using professional terms to describe clients

· Changes to the form from year A to year B · Changes to areas to consider from year to year · Possible new developments and why they may occur

|

· An independent contractor takes a professional certification course costing $3,000 to enhance their skills. The LLC allows them to claim 20% of the cost, resulting in a credit of $600. Unlike the AOTC, the LLC does not require the student to be enrolled in a degree program or attend at least half-time, making it more flexible for continuing education.

· The LLC remains nonrefundable, and the MAGI limits are consistent with those of the AOTC. No major changes in calculation or eligibility. Taxpayers should monitor any adjustments to income phase-out ranges. · Claiming either the LLC or AOTC but not both for the same student in the same year. Accurate reporting of tuition payments, especially when using funds from scholarships or employer assistance. · Increased emphasis on MAGI thresholds and updated IRS publications for nuanced eligibility requirements. Future changes may expand accessibility to include broader types of professional training. |

| Documentation if applicable (statements from taxpayer(s), other substantiating proof, official IRS tax forms provided to the taxpayer(s), etc.) | · Form 1098-T

· Receipts for tuition and course materials · Proof of enrollment (if applicable) · Statements for scholarships or employer-provided assistance |

| Citations – Include related IRS publications, IRS articles, tax forms for each year used for comparison, and any other supporting research | · IRS Instructions for Form 8863 (2024) https://www.irs.gov/pub/irs-pdf/i8863.pdf

· IRS Publication 970 (Tax Benefits for Education). https://www.irs.gov/publications/p970 |

3. Form 8812 Child Tax Credit

| Address the following: | Specify changes, uses, developments: |

| · Example of when this may apply using professional terms to describe clients

· Changes to the form from year A to year B · Changes to areas to consider from year to year · Possible new developments and why they may occur

|

· A single parent supporting two children aged 10 and 14 who meet all qualifying criteria. Filing Status: Head of Household. MAGI: $70,000 (below phase-out thresholds). Credit Calculation: $2,000 per child = $4,000 total credit. Refundable portion (up to $1,600 per child) = $3,200. Nonrefundable portion = $800.

· No significant changes to the CTC structure were observed from 2023 to 2024. Income thresholds and credit limits remain consistent. · Ensure valid Social Security Numbers (SSNs) are provided for each child before the tax return deadline. Non-citizen children with ITINs are not eligible for the CTC but may qualify for the Other Dependent Credit (ODC). · Potential policy adjustments could expand refundable portions or modify phase-out thresholds, reflecting changes in economic conditions. |

| Documentation if applicable (statements from taxpayer(s), other substantiating proof, official IRS tax forms provided to the taxpayer(s), etc.) | · SSNs for each child.

· Residency documentation (e.g., school or medical records showing the child’s address). · Proof of taxpayer’s support, such as tax statements or payment records. |

| Citations – Include related IRS publications, IRS articles, tax forms for each year used for comparison, and any other supporting research | · IRS Form 8812 Instructions (2024): https://www.irs.gov/pub/irs-dft/i1040s8–dft.pdf

· IRS Publication 972 (Child Tax Credit): https://www.irs.gov/credits-deductions/individuals/child-tax-credit · IRS Website – Child Tax Credit: https://www.usa.gov/child-tax-credit |

4. Form 8812 Other Dependent Credit

| Address the following: | Specify changes, uses, developments: |

| · Example of when this may apply using professional terms to describe clients

· Changes to the form from year A to year B · Changes to areas to consider from year to year · Possible new developments and why they may occur

|

· Taxpayer supporting their 20-year-old college student dependent who does not qualify for the Child Tax Credit. The dependent lived with the taxpayer for over six months, and the taxpayer provided over half of their support. Offset tax liability for supporting dependents ineligible for the Child Tax Credit.

· The maximum credit remains $500 per qualifying dependent. No changes to income thresholds; phase-out begins at $200,000 (single) and $400,000 (joint). · Proposals could expand the ODC to dependents attending college or caregiving for elderly family members, reflecting broader caregiving trends. |

| Documentation if applicable (statements from taxpayer(s), other substantiating proof, official IRS tax forms provided to the taxpayer(s), etc.) | · Proof of dependency (e.g., birth certificates, college enrollment records, etc.).

· Evidence of financial support provided (e.g., bank statements, receipts). |

| Citations – Include related IRS publications, IRS articles, tax forms for each year used for comparison, and any other supporting research | · IRS Form 8863 Instructions (2024)https://www.irs.gov/pub/irs-pdf/i8863.pdf

· IRS Form 8812 Instructions https://www.irs.gov/credits-deductions/individuals/dependents · IRS Publication 501: Dependency eligibility rules. https://www.irs.gov/publications/p501 |

5. Form 2441 Child and Dependent Care Credit

| Address the following: | Specify changes, uses, developments: |

| · Example of when this may apply using professional terms to describe clients

· Changes to the form from year A to year B · Changes to areas to consider from year to year · Possible new developments and why they may occur |

· The credit is limited to $3,000 for one qualifying person and $6,000 for two or more. Taxpayers must also input their earned income, and if married, their spouse’s earned income. For the example, the single parent enters $6,000 as the maximum allowed expenses for two children and their earned income of $50,000.

The form calculates the credit based on income thresholds using a percentage (up to 35%) applied to the qualifying expenses. The final credit for the taxpayer would be $1,800 (30% of $6,000). · From 2021 to 2023, the enhanced credit percentage (50% under the American Rescue Plan) reverted to a maximum of 35%. The refundable credit feature was also removed, making it nonrefundable in 2023. The expense limits of $3,000 (one child) and $6,000 (two or more) remain unchanged for 2023. · Taxpayers must retain proof of payment, including receipts and invoices from the care provider. Ensure proper documentation for the care provider, including their identifying number (EIN or SSN). Earned income limits and filing status (e.g., married filing separately) significantly impact eligibility and credit amount. · Future policy changes could reintroduce a refundable credit or increase the maximum expense limits to align with rising childcare costs. |

| Documentation if applicable (statements from taxpayer(s), other substantiating proof, official IRS tax forms provided to the taxpayer(s), etc.) | · Payment for childcare expenses (receipts, canceled checks, etc.).

· Care provider details (name, address, EIN/SSN). · Evidence of earned income (Form W-2 or 1099). · Qualifying dependent information (Social Security Numbers). |

| Citations – Include related IRS publications, IRS articles, tax forms for each year used for comparison, and any other supporting research | · Form 2441 Instructions (2023) https://www.irs.gov/pub/irs-pdf/i2441.pdf

· IRS Publication 503 (Child and Dependent Care Expenses): https://www.irs.gov/publications/p503 · IRS Website: Current tax law updates related to childcare credits. https://www.irs.gov/taxtopics/tc602 |

ORDER A PLAGIARISM-FREE PAPER HERE

We’ll write everything from scratch

Question

ACC 330 Project One Milestone One Guidelines and Rubric

Overview

Each year the Internal Revenue Service (IRS) updates the tax code and makes changes to standard documentation. Tax professionals can see sweeping changes over their career. An area such as the application of tax credits can have drastic changes over a five-year period.

Some of the most common tax credits relate to children, other dependents, childcare expenses, low-to-moderate income workers, and education. It’s important to stay current with tax codes, laws, and regulations, and to update your knowledge each year with what might have changed since the last time you put together a tax return.

Directions

For this assignment you will be investigating the changes in several tax credits, forms, and schedules over time. (The form or schedule number will remain constant, but the form or schedule title may change based on changes to tax credits and what is required to be reported.) In your research you will be comparing these forms from different tax years to find any significant changes. Evaluating tax credits and supplemental forms requires an ability to search proficiently.

Compare Tax Credits and Corresponding Forms

Please follow this process for each of the forms and schedules required in this assignment:

- Follow the example provided for Earned Income Tax Credit (EITC) in the Project One Milestone One template.

- Pull up the form you are investigating from both the current and previous tax years (for instance, 2021 and 2020).

- Search for any IRS publications that discuss changes in this tax credit.

- Note any changes mentioned in the publication that impact the current year or may impact future years. It takes attention to detail to uncover these changes.

- Compare the current tax year with the prior tax year.

- Research the forms required for the respective tax years using the search terms below in the Supporting Materials section.

- Complete the table for each type of tax credit.

- Add a list of documentation and citations to the template provided.

This is the process a paid professional tax preparer uses each year as part of due diligence. As a professional tax preparer you will be responsible for knowing and applying changes from year to year. Consider what needs to be reviewed every tax year for each tax credit category. Check other qualifications or requirements for the credit. Consider how things might change in the future that impact tax planning.

Hint: Changes in requirement and parameter may include the following areas: amount of credit, income thresholds, qualified dependents, and/or filing status.

Specifically, you must address the following rubric criteria:

- Form 8863 Education Tax Credit – American Opportunity Tax Credit (AOTC): Specify changes past, present, and future if applicable to this form.

- Example of when this AOTC tax credit may apply using professional terms to describe client’s scenario

- Changes to the form from year A to year B

- Changes to areas to consider from year to year

- Possible new developments and why they may occur

- Form 8863 Education Tax Credit – Lifetime Learning Credit (LLC): Specify changes past, present, and future if applicable to this form.

- Example of when this LLC tax credit may apply using professional terms to describe client’s scenario

- Changes to the form from year A to year B

- Changes to areas to consider from year to year

- Possible new developments and why they may occur

- Schedule 8812 Child Tax Credit: Specify changes past, present future if applicable to this form.

- Example of when this child tax credit may apply using professional terms to describe client’s scenario

- Changes to the form from year A to year B

- Changes to areas to consider from year to year

- Possible new developments and why they may occur

- Schedule 8812 Other Dependent Credit: Specify changes past, present future if applicable to this form.

- Example of when this other dependent credit may apply using professional terms to describe client’s scenario

- Changes to the form from year A to year B

- Changes to areas to consider from year to year

- Possible new developments and why they may occur

- Form 2441 Child and Dependent Care Credit: Specify changes past, present future if applicable to this form.

- Example of when this Child and Dependent Care Credit may apply using professional terms to describe client’s scenario

- Changes to the form from year A to year B

- Changes to areas to consider from year to year

- Possible new developments and why they may occur

- Identify applicable documentation for each of the tax credit categories.

- Document retention is part of form 8867 for due diligence

- Different types of forms or documents depend on the type of tax credit

ACC 330 Project One Milestone One Template

What to Submit

Submit a completed Project One Milestone One template. Sources should be cited and linked according to APA style.

Supporting Materials

The following resources support your work on the project:

Resource: Tax Research Guide

Forms and Documents:

Note: Ensure you are working in the proper year when performing research. The following links are for the current tax year.

- Form 8863 – Education Credits

- About Form 8863 – Education Credits (American Opportunity and Lifetime Learning Credits)

- Schedule 8812 – Credits for Qualifying Children and Other Dependents

- Tax Credits and Deductions USA.gov

- Form 2441 – Child and Dependent Care Expenses

Search Terms:

Note: Direct links change from year-to-year. Use the following to search these topics.

- Publication 503 – Child and Dependent Care Expenses

- Publication 970 – Tax Benefits for Education

- Publication 972 – Child Tax Credit and Credit for Other Dependents