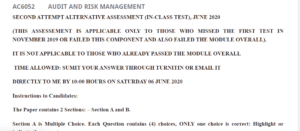

AC6052 AUDIT AND RISK MANAGEMENT

SECOND ATTEMPT ALTERNATIVE ASSESSMENT (IN-CLASS TEST), JUNE 2020

(THIS ASSESSMENT IS APPLICABLE ONLY TO THOSE WHO MISSED THE FIRST TEST IN NOVEMBER 2019 OR FAILED THIS COMPONENT AND THE MODULE OVERALL).

IT IS NOT APPLICABLE TO THOSE WHO HAVE ALREADY PASSED THE MODULE OVERALL

TIME ALLOWED: SUMIT YOUR ANSWER THROUGH TURNITIN OR EMAIL IT

DIRECTLY TO ME BY 10:00 HOURS ON SATURDAY, 06 JUNE 2020

Do you need an initial copy of “AC6052 AUDIT AND RISK MANAGEMENT”?Reach out to us.

Instructions to Candidates:

The Paper contains 2 Sections: – Section A and B.

Section A is Multiple Choice. Each Question contains (4) choices; ONLY one choice is correct: Highlight or indicate the correct answer.

Section A: 20 Questions of 4 marks each (Total marks = 80)

Section B: Discursive Questions (Total marks = 20)

STUDENT NAME: ………………………………………………………..

STUDENT IDENTIFICATION NUMBER: ………………………………………..

SECTION A

Circle or indicate the correct answer

- Which of the following is a correct statement regarding audit evidence?

A) A large sample of evidence an independent party provides is always considered persuasive evidence.

B) A small sample of only one or two pieces of highly appropriate evidence is always considered persuasive.

C) The auditor must obtain sufficient relevant and reliable evidence to form an opinion on the fairness of the financial statements.

D) Evidence is usually more reliable for balance sheet accounts when obtained within six months of the balance sheet date.

- Evidence is generally considered appropriate when:

A) it has been obtained by random selection.

B) there is enough of it to afford a reasonable basis for an opinion on financial statements.

C) it is relevant to the audit objective being tested.

D) it consists of written statements made by managers of the company under audit.

- Audit documents:

A) are kept by the client for easy reference for their accounting staff.

B) should be considered a substitute for the client’s accounting records.

C) are designed to facilitate the review and supervision of the work performed by the audit team by a reviewing partner.

D) prepared during the engagement are the client’s property once the audit bill is paid.

- Internal controls:

A) are implemented by and are the responsibility of the auditors.

B) consist of policies and procedures to ensure the company reasonably achieves its objectives and goals.

C) guarantee that the company complies with all laws and regulations.

D) only apply to listed companies.

- Which of the following statements about internal controls is least likely to be correct?

A) No person should be responsible for the custodial and recording responsibilities for an asset.

B) Transactions must be properly authorized before such transactions are processed.

C) Because of the cost-benefit relationship, a client may apply controls on a test basis.

D) Control procedures reasonably ensure that cooperation among employees cannot occur.

- As acceptable audit risk decreases, the likely audit cost increases.

A) True

B) False

- Control available in a small company, which may be necessitated because of a lack of competent personnel, is:

A) wider segregation of duties.

B) a voucher system.

C) fewer transactions to process.

D) the owner-managers direct involvement in the control process.

- The permanent files included as part of audit documentation do not normally include the following:

A) a copy of the current and prior years’ audit programs.

B) copies of articles of incorporation, bylaws, and contracts.

C) information related to the understanding of internal control.

D) results of analytical procedures from prior years.

- Audit evidence regarding the separation of duties is normally best obtained by:

A) preparing flowcharts of operational processes.

B) preparing narratives of operational processes.

C) observation of employees applying control activities.

D) inquiries of employees applying control activities.

- The concept of reasonable assurance indicates that the auditor is:

A) not a guarantor of the correctness of the financial statements.

B) not responsible for the fairness of the financial statements.

C) responsible only for issuing an opinion on the financial statements.

D) responsible for finding all misstatements.

- An auditor is likely to use four types of procedures to support the operating effectiveness of internal controls. Which of the following would generally not be used?

A) Make inquiries of appropriate client personnel

B) Examine documents, records, and reports

C) Reperform client procedures

D) Inspect design documents

- To promote operational efficiency, the internal audit department would ideally report to the following:

A) line management.

B) Professional Oversight Board.

C) Chief Accounting Officer.

D) Audit Committee.

- External financial statement auditors must obtain evidence regarding what attributes of an internal audit (IA) department if the external auditors intend to rely on IA’s work.

A) Integrity

B) Objectivity

C) Competence

D) All of the above

- Narratives, flowcharts, and internal control questionnaires are three common methods:

A) testing the internal controls.

B) documenting the auditor’s understanding of internal controls.

C) designing the audit manual and procedures.

D) documenting the auditor’s understanding of a client’s organizational structure.

- The employee in charge of authorizing payment to the company’s suppliers does not fully understand the company’s purchasing system. This lack of knowledge would constitute:

A) a deficiency in the operation of internal controls.

B) a deficiency in the design of internal controls.

C) a deficiency of management.

D) not constitute a deficiency.

- A measure of the auditor’s assessment of the likelihood that there are material misstatements in an account before considering the effectiveness of the client’s internal control is called:

A) control risk.

B) acceptable audit risk.

C) statistical risk.

D) inherent risk.

- The auditors determine which disclosures must be presented in the financial statements.

A) True

B) False

- The auditor’s best defense when material misstatements are not uncovered is to have conducted the audit:

A) by generally accepted auditing standards.

B) as effectively as reasonably possible.

C) promptly.

D) only after an adequate investigation of the management team.

- Which of the following statements is usually true?

A) Materiality is easy to quantify.

B) Fraudulent financial statements are often easy for the auditor to detect, especially when there is a collaboration among management.

C) Reasonable assurance is a low assurance that the financial statements are free from material misstatement.

D) An item is considered material if it would likely have changed or influenced the decisions of a reasonable person using the statements.

- A written understanding detailing what the auditors will do in determining if the financial statements are fair representations of the company’s financial statements and what the auditor expects from the client in performing an audit will normally be expressed in the:

A) management letter requested by the auditor.

B) engagement letter.

C) Audit Plan.

D) Audit Strategy for the client.

(Total marks for Section A = 80)

SECTION B

The audit risk model requires the auditor to understand the entity and its environment to assess the risks of the audit of the financial statements of an entity.

Required:

- Explain the components of the audit risk model and how they combine to result in the level of detection risk. How does this impact the level of assurance sought and the planned substantive testing?

Audit risk refers to the auditor offering an incorrect opinion on a company’s financial statements. This situation occurs due to issuing an unqualified audit report whose qualification is justified, expressing a qualified audit opinion that does not require qualification, failing to highlight matters of importance in the report, and expressing an opinion in circumstances whereby the audit performance is limited.

Inherent risk

This type of risk arises due to misstatement of the financial statements resulting from an error of omission etc. It is the most challenging to mitigate in the audit risk model. Even with the implementation of the appropriate controls and with the best intentions, the audit may lack some information and may not shed light on some challenges experienced. This imprecision arises from the complex nature of businesses. In some cases, the auditors may offer recommendations rendered obsolete at the time of the report’s publication.

Detection Risk

This risk arises from the failure of auditors to identify material misstatements in the financial statements. During the audit procedure, the auditors may fail to identify major challenges in financial reporting and may end up painting a good picture of the firm’s financial performance, which is not the case. There isn’t a surefire way to determine that an audit has uncovered all the company’s major financial challenges. Auditors tend to miss out on major problems and, in some cases, only identify the tip rather than the iceberg itself.

Control Risk

Control risk refers to the misstatement or omission in the financial statements due to the ineffectiveness of the implemented internal control in the company. In most cases, companies have implemented weak control in managing data, more so that related to the firm’s financial performance. This challenge is addressed by restructuring the company’s internal controls to enhance its effectiveness.

The audit risk model evaluates the inherent and control risk regarding an audit engagement in enhancing the understandability of the business environment. Afterward, the detection risk is implemented after incorporating both the inherent and control risks. Low detection risk is achieved by increasing the sample size for testing. If the auditor estimates high inherent and control risks, the detection risk is set lower in maintaining the audit risk at a reasonable level. (15 marks)

- Discuss how the current Covid 19 pandemic would impact the components of the audit risk model.

Notably, the Covid-19 pandemic would adversely affect each component of the audit risk model. The inherent risk would be multiplied by a great fold due to the rampant changes in the business environment. This type of risk arises from the complexity of the business environment, which the epidemic would enhance. Moreover, a significant portion of the companies is struggling to remain on their feet. Furthermore, the recommendations offered by the auditors before the pandemic would no longer be useful in the post covid business world. Detection risk would also increase since the epidemic has resulted in some underlying issues in the company’s financial performance that are yet to be known. Hence, auditors may take longer to detect these issues in imprecise reports. Lastly, control risk would be brought about by the company’s attempt to cover its poor financial performance, which would be detrimental to its relationship with key stakeholders, e.g., investors. Therefore, the epidemic escalates the three audit risk to increased complexities in both the internal and external business environment. (5 marks)

(Total marks for Section B = 20)

Similar Post: Jeffrey Immelt and GE

ORDER A PLAGIARISM-FREE PAPER HERE

We’ll write everything from scratch

Question

AC6052 AUDIT AND RISK MANAGEMENT

SECOND ATTEMPT ALTERNATIVE ASSESSMENT (IN-CLASS TEST), JUNE 2020

AUDIT AND RISK MANAGEMENT

(THIS ASSESSMENT IS APPLICABLE ONLY TO THOSE WHO MISSED THE FIRST TEST IN NOVEMBER 2019 OR FAILED THIS COMPONENT AND THE MODULE OVERALL).

IT IS NOT APPLICABLE TO THOSE WHO HAVE ALREADY PASSED THE MODULE OVERALL

TIME ALLOWED: SUMIT YOUR ANSWER THROUGH TURNITIN OR EMAIL IT

DIRECTLY TO ME BY 10:00 HOURS ON SATURDAY, 06 JUNE 2020

Instructions to Candidates:

The Paper contains 2 Sections: – Section A and B.

Section A is Multiple Choice. Each Question contains (4) choices; ONLY one choice is correct: Highlight or indicate the correct answer.

Section A: 20 Questions of 4 marks each (Total marks = 80)

Section B: Discursive Questions (Total marks = 20)

STUDENT NAME: ………………………………………………………..

STUDENT IDENTIFICATION NUMBER: ………………………………………..

SECTION A

Circle or indicate the correct answer

- Which of the following is a correct statement regarding audit evidence?

A) A large sample of evidence an independent party provides is always considered persuasive evidence.

B) A small sample of only one or two pieces of highly appropriate evidence is always considered persuasive.

C) The auditor must obtain sufficient relevant and reliable evidence to form an opinion on the fairness of the financial statements.

D) Evidence is usually more reliable for balance sheet accounts when obtained within six months of the balance sheet date.

- Evidence is generally considered appropriate when:

A) it has been obtained by random selection.

B) there is enough of it to afford a reasonable basis for an opinion on financial statements.

C) it is relevant to the audit objective being tested.

D) it consists of written statements made by managers of the company under audit.

- Audit documents:

A) are kept by the client for easy reference for their accounting staff.

B) should be considered a substitute for the client’s accounting records.

C) are designed to facilitate the review and supervision of the work performed by the audit team by a reviewing partner.

D) prepared during the engagement are the client’s property once the audit bill is paid.

- Internal controls:

A) are implemented by and are the responsibility of the auditors.

B) consist of policies and procedures to ensure the company reasonably achieves its objectives and goals.

C) guarantee that the company complies with all laws and regulations.

D) only apply to listed companies.

- Which of the following statements about internal controls is least likely to be correct?

A) No person should be responsible for the custodial and recording responsibilities for an asset.

B) Transactions must be properly authorized before such transactions are processed.

C) Because of the cost-benefit relationship, a client may apply controls on a test basis.

D) Control procedures reasonably ensure that cooperation among employees cannot occur.

- As acceptable audit risk decreases, the likely audit cost increases.

A) True

B) False

- Control available in a small company, which may be necessitated because of a lack of competent personnel, is:

A) wider segregation of duties.

B) a voucher system.

C) fewer transactions to process.

D) the owner-managers direct involvement in the control process.

- The permanent files included as part of audit documentation do not normally include the following:

A) a copy of the current and prior years’ audit programs.

B) copies of articles of incorporation, bylaws, and contracts.

C) information related to the understanding of internal control.

D) results of analytical procedures from prior years.

- Audit evidence regarding the separation of duties is normally best obtained by:

A) preparing flowcharts of operational processes.

B) preparing narratives of operational processes.

C) observation of employees applying control activities.

D) inquiries of employees applying control activities.

- The concept of reasonable assurance indicates that the auditor is:

A) not a guarantor of the correctness of the financial statements.

B) not responsible for the fairness of the financial statements.

C) responsible only for issuing an opinion on the financial statements.

D) responsible for finding all misstatements.

- An auditor is likely to use four types of procedures to support the operating effectiveness of internal controls. Which of the following would generally not be used?

A) Make inquiries of appropriate client personnel

B) Examine documents, records, and reports

C) Reperform client procedures

D) Inspect design documents

- To promote operational efficiency, the internal audit department would ideally report to the following:

A) line management.

B) Professional Oversight Board.

C) Chief Accounting Officer.

D) Audit Committee.

- External financial statement auditors must obtain evidence regarding what attributes of an internal audit (IA) department if the external auditors intend to rely on IA’s work.

A) Integrity

B) Objectivity

C) Competence

D) All of the above

- Narratives, flowcharts, and internal control questionnaires are three common methods:

A) testing the internal controls.

B) documenting the auditor’s understanding of internal controls.

C) designing the audit manual and procedures.

D) documenting the auditor’s understanding of a client’s organizational structure.

- The employee in charge of authorizing payment to the company’s suppliers does not fully understand the company’s purchasing system. This lack of knowledge would constitute:

A) a deficiency in the operation of internal controls.

B) a deficiency in the design of internal controls.

C) a deficiency of management.

D) not constitute a deficiency.

- A measure of the auditor’s assessment of the likelihood that there are material misstatements in an account before considering the effectiveness of the client’s internal control is called:

A) control risk.

B) acceptable audit risk.

C) statistical risk.

D) inherent risk.

- The auditors determine which disclosures must be presented in the financial statements.

A) True

B) False

- The auditor’s best defense when material misstatements are not uncovered is to have conducted the audit:

A) by generally accepted auditing standards.

B) as effectively as reasonably possible.

C) promptly.

D) only after an adequate investigation of the management team.

- Which of the following statements is usually true?

A) Materiality is easy to quantify.

B) Fraudulent financial statements are often easy for the auditor to detect, especially when there is a collaboration among management.

C) Reasonable assurance is a low assurance that the financial statements are free from material misstatement.

D) An item is considered material if it would likely have changed or influenced the decisions of a reasonable person using the statements.

- A written understanding detailing what the auditors will do in determining if the financial statements are fair representations of the company’s financial statements and what the auditor expects from the client in performing an audit will normally be expressed in the:

A) management letter requested by the auditor.

B) engagement letter.

C) Audit Plan.

D) Audit Strategy for the client.

(Total marks for Section A = 80)

SECTION B

The audit risk model requires the auditor to understand the entity and its environment to assess the risks of the audit of the financial statements of an entity.

Required:

- Explain the components of the audit risk model and how they combine to result in the level of detection risk. How does this impact the level of assurance sought and the planned substantive testing? (15 marks)

- Discuss how the current Covid 19 pandemic would impact the components of the audit risk model.